As a seasoned researcher with years of experience observing and analyzing the cryptocurrency market, I have to say that the latest surge in Bitcoin’s price and the concurrent increase in miners’ OTC desk balances has me cautiously optimistic but also wary. Historically, such trends have often signaled a potential downturn in the market. However, the current retail accumulation trend is encouraging and suggests that there might be more long-term investors entering the market, which could help mitigate any potential sell pressure.

Once more, Bitcoin exceeded the $60,000 threshold, while the overall market experienced a rebound. However, a crucial signal suggests anticipation for another potential price drop.

As an analyst, I’m observing a 2% upward jump in Bitcoin (BTC) over the past 24 hours, with its current trading price at approximately $60,800. The daily trading volume has experienced a significant boost, climbing to around $34.8 billion – a 30% increase. Notably, Bitcoin’s market capitalization is teetering on the edge of the $1.2 trillion threshold.

Based on a recent post by CryptoQuant, the price increase can be attributed to a significant rise in Bitcoin over-the-counter (OTC) desk holdings for miners. Over the past three months, these holdings have swelled by 71.2%, climbing from 215,000 BTC to 368,000 BTC – marking the first time since June 2022 that they surpassed the 300,000 BTC threshold.

“Over-the-counter (OTC) Bitcoin holdings have reached a two-year high recently, which historically tends to coincide with falling Bitcoin prices. This observation comes from @EgyHashX.”

— CryptoQuant.com (@cryptoquant_com) August 22, 2024

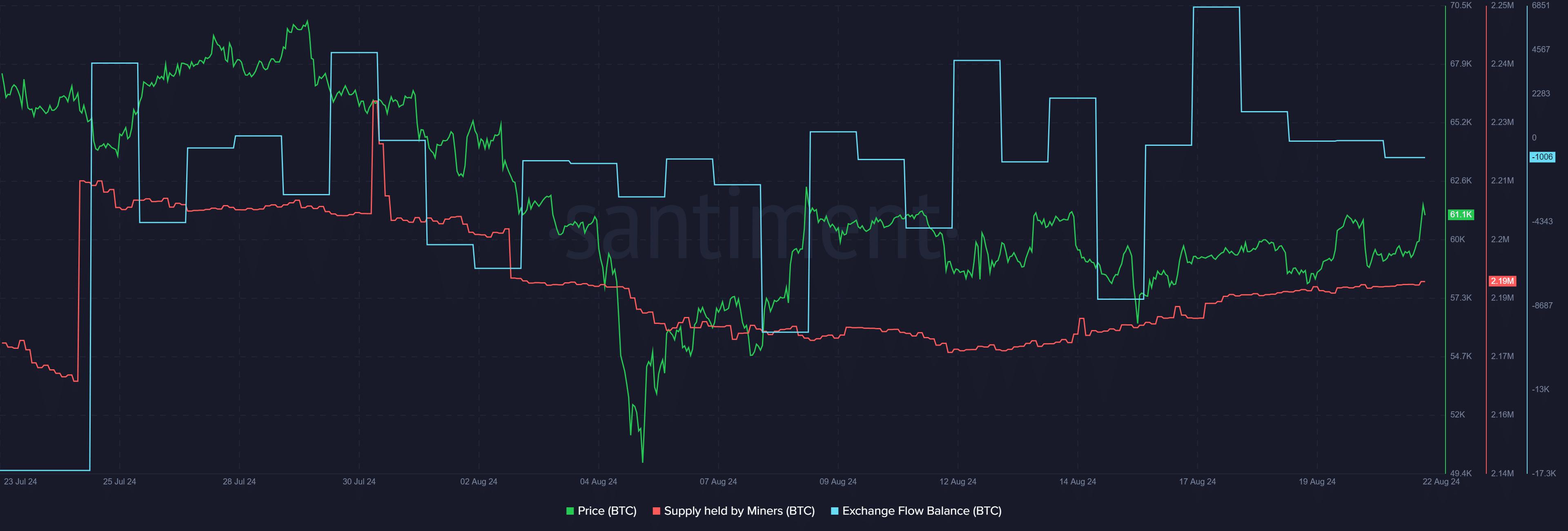

Typically, miners decide to offload their holdings through Over-The-Counter (OTC) transactions instead of cryptocurrency trading platforms, as depicted by the graph. Notably, the last three substantial increases in Bitcoin’s OTC miner balances have significantly influenced the selling dynamics and affected both Bitcoin and the overall crypto market.

A user going by the name @EgyHashX pointed out that traditionally, an increase in Bitcoin OTC desk balances tends to coincide with a decrease in Bitcoin’s market price. As per Santiment’s data, the amount of Bitcoin held by miners has grown by approximately 20,000 coins, rising from 2.17 million to 2.19 million, over the past month.

Conversely, information gathered from market intelligence sources indicates a rise in Bitcoin retail buying. According to Santiment, the asset’s exchange flow shifted from a net inflow of 6,783 BTC on August 17 to a net outflow of 1,006 BTC on August 22.

The chart also shows the number of coins sent to self-custodial wallets is currently bigger than holders trying to sell the asset.

Read More

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Brent Oil Forecast

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD JPY PREDICTION

- USD CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-08-22 12:10