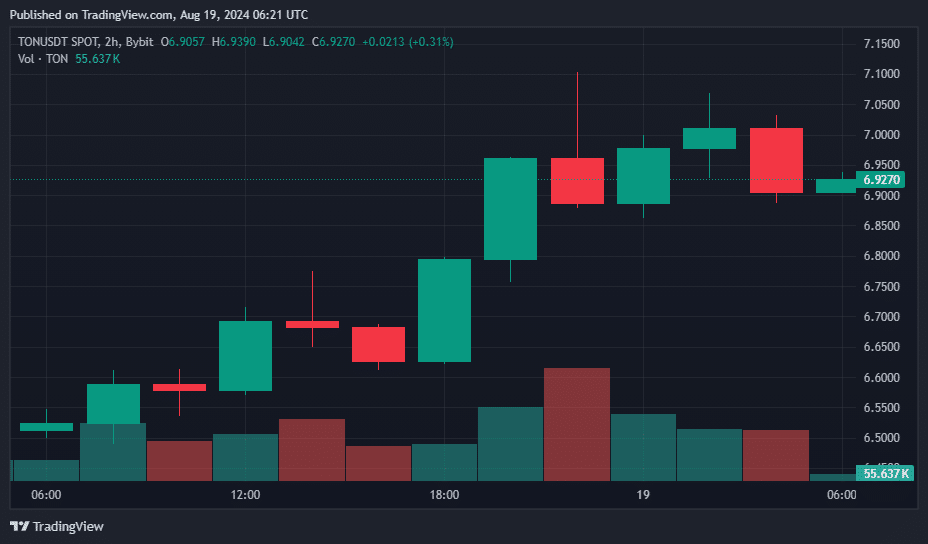

As a seasoned crypto investor with battle-scarred fingers from riding the volatile waves of the blockchain market, I find myself intrigued by Toncoin’s recent 7% surge that placed it at the top of the crypto market on Aug. 19. With its current price hovering around $6.92 and a daily trading volume of $568 million, this coin seems to be making a strong comeback.

On August 19th, Toncoin experienced a 7% increase in its value, placing it at the forefront of cryptocurrency market gains.

As a crypto investor, I’m currently observing a positive trend with Toncoin (TON). At the moment of writing this, it has surged by 6%, trading at approximately $6.92 according to data from crypto.news. The daily trading volume for this asset has significantly increased by 143%, reaching around $568 million. This substantial rise places its market cap at a substantial $17.3 billion, positioning Toncoin as the 9th largest cryptocurrency in the market.

At present, Toncoin’s price hovers slightly above the middle of the Bollinger Band, specifically at around $6.3421. It also sits notably higher than the lower band at $5.4265. This placement suggests a relatively robust position for the coin within its current trading range. However, it remains below the upper Bollinger Band, which stands at approximately $7.2578.

The arrangement suggests a notable rebound from lower points, but the coin hasn’t quite reached an overly bought state, implying there could be more space for further growth before it encounters strong resistance.

According to the Directional Movement Index (DMI), the +DI line, representing upwards price movements, currently stands at 24.8112 and is higher than the -DI line at 18.8496, indicating that recent market trends have been generally bullish. However, it’s important to note that a strong trend is indicated by the average DI line at 24.7785.

Generally speaking, when the Average Directional Index (ADX) is above 25, it indicates a strong trend direction, whether it’s upward or downward. In such a situation, a high ADX value combined with a more dominant positive directional indicator (DI+) over the negative directional indicator (DI-) signifies a powerful bullish movement. However, it is essential to keep an eye on this momentum for any signs of potential shifts that could indicate growing bearish forces.

As a researcher analyzing the cryptocurrency market, I’m observing a noticeably bullish trend for this coin with strong indications of price growth continuing. This bullish inclination is backed by a solid trend strength, as suggested by the ADX and DI lines. However, it’s crucial to stay alert since we’re approaching the upper Bollinger Band. This proximity might hint at an impending resistance or perhaps a change in market sentiment.

As a researcher observing the cryptocurrency market, I’ve noticed an intriguing development regarding Toncoin. According to data from CoinGlass, the total open interest in Toncoin has surged by approximately 14.7% over the past 24 hours. This upward trend has propelled the open interest from $246.83 million to a current figure of $283.03 million. This growth suggests a heightened level of trader interest in Toncoin, as the price appears to be rebounding.

Toncoin RSI suggests cautious outlook

In simpler terms, the Relative Strength Index indicates a prudent viewpoint regarding TON‘s market direction. Since its RSI value is 55.58, TON isn’t showing signs of being overbought or oversold. This equates to a neutral stance, suggesting that there’s currently no imminent danger of a sudden price reversal caused by overvaluation.

For Toncoin, the Relative Strength Index (RSI) isn’t definitively pointing towards a continued uptrend. At its current level, the RSI indicates a potential for price fluctuations in either direction, as it doesn’t show signs of being excessively extended in one direction or the other.

toncoin’s price surge lately aligns with increased trading activity, which suggests strong demand from buyers. Yet, if trading volume decreases as prices stay high, it could be a sign that the upward trend is weakening, possibly triggering a price adjustment or correction.

Keeping an eye on trading volume and the Directional Movement Index (DMI) lines is important. A significant drop in volume, or a scenario where the negative DMI -DI outpaces the positive DMI +DI, might suggest an upcoming price adjustment or correction.

Should trading volumes stay elevated and the +DI continues to climb, this could fuel additional price hikes. Even though the current upward trend has been strong, conflicting signals from these technical indicators necessitate close monitoring for any potential shifts indicating a possible reversal. This implies that while the rally might persist, it’s crucial to exercise caution due to the possibility of its impending end.

Read More

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Gold Rate Forecast

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-08-19 10:40