As a seasoned analyst with years of experience navigating the turbulent seas of the cryptocurrency market, I have to say that Toncoin’s current situation is a familiar sight. The sharp sell-off and the formation of a death cross are red flags that I’ve seen many times before.

As an analyst, I observed a significant downward trend in Toncoin‘s price on Monday, mirroring a widespread sell-off among tap-to-earn tokens within its network. Furthermore, the burn volume also seemed to recede.

Toncoin (TON) experienced a drop, now trading at around $4.90 – a decrease of 41% from its peak this year. Additionally, it has seen a decline of almost 30% since August 24th, following the arrest of its founder, Pavel Durov, in France.

The decrease in value happened at the same time as a blend of reports regarding its environment. On the optimistic note, the usage of stablecoins within this environment reached over $1 billion for the first occasion.

A large majority of these digital coins are Tether (USDT), the most prominent stablecoin in the market. The rise in the number of stablecoins indicates that the network is growing in popularity among users, as they serve as the main currencies within the realm of blockchain technology.

Toncoin’s price has decreased because of several underperforming indicators within its ecosystem. To illustrate this, statistics from TonStat reveal that the daily number of TON tokens being burned has significantly dropped in recent times, currently at 6,373, which is substantially lower than the year-to-date peak of more than 32,000.

It seems that the latest information shows network fees have fallen significantly, reaching their lowest point in quite a while. They peaked at around 77,000 TON in September, but now they’ve dropped down to only 12,746 TON. This decrease could indicate less activity on the network.

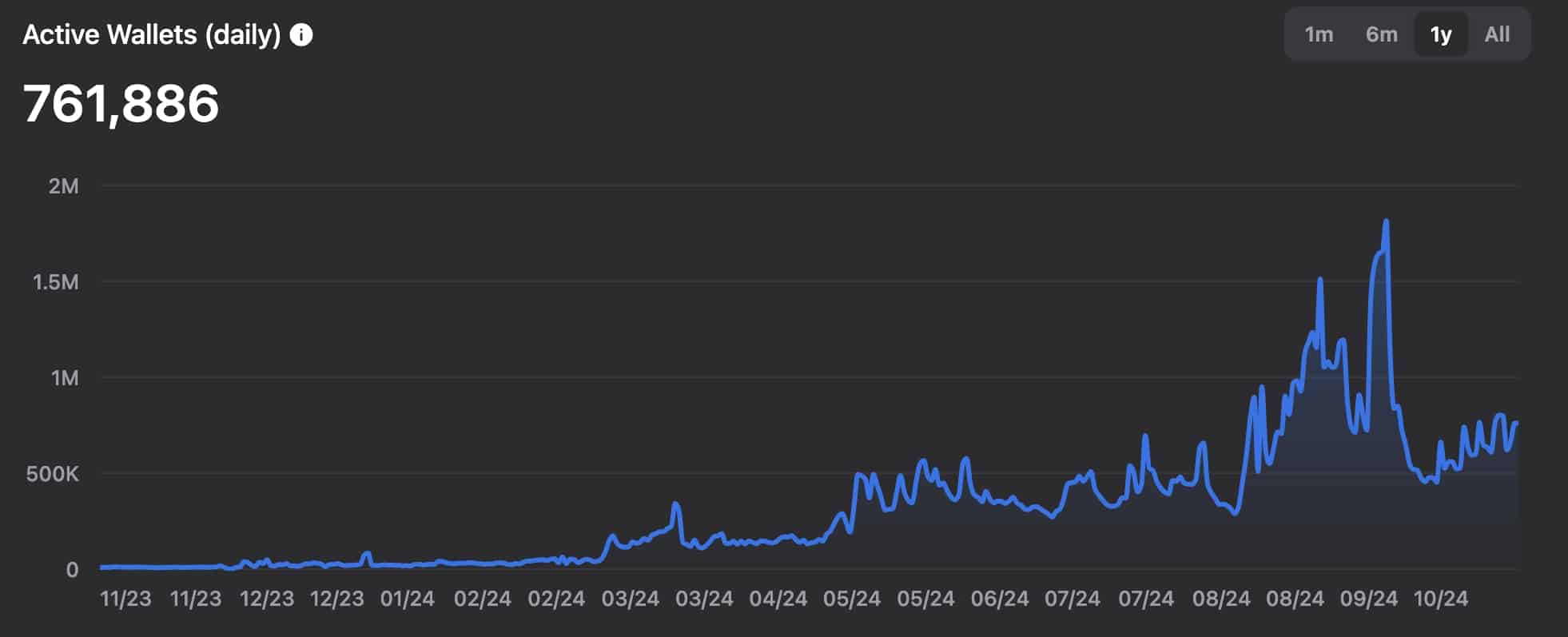

Further analysis of on-chain data indicates a consistent decline in daily transactions, with numbers approaching their lowest points over the last half year. Similarly, the number of active digital wallets has significantly decreased.

As I delve into the world of decentralized finance (DeFi), I’ve noticed an interesting shift in the Total Value Locked (TVL) on the TON Blockchain. Currently, it stands at approximately $375 million, a significant drop from its previous position among the top ten chains in the industry. This downward trend has relegated TON to the 20th spot, underscoring the dynamic nature of this rapidly evolving landscape.

The cost of TON has likewise decreased as investors keep an eye on the poor showing of several significant tokens within its ecosystem, such as Hamster Kombat (HMSTR), Notcoin (NOT), and Catizen. Each of these tokens have fallen significantly from their peak values this year.

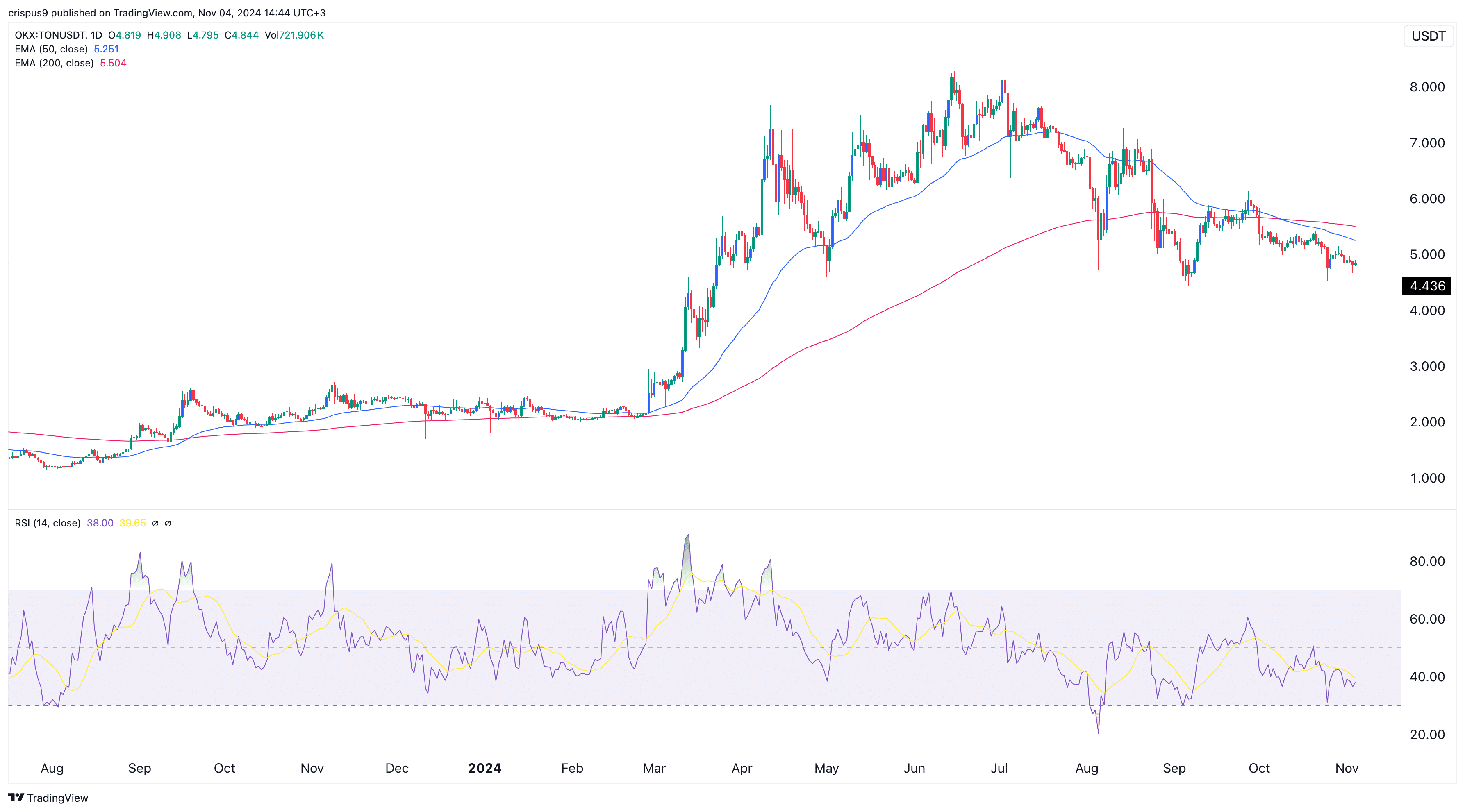

Toncoin has formed a death cross

Over the last several months, there’s been a substantial decrease in the value of Toncoin on its daily chart, indicating a prolonged bearish trend. Moreover, a ‘death cross’ occurred when the 200-day and 50-day moving averages intersected, signaling potential further declines.

All oscillator tools, such as the Relative Strength Index and Moving Average Convergence Divergence, are indicating a downward trend. As a result, it appears that the token price will likely keep decreasing, with traders aiming for key support at $4. This analysis holds true only if the token falls below its key support level of $4.43, which was its lowest point on Sept. 7.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-11-04 17:13