As a seasoned trader with over two decades of experience navigating market trends, I must say that the current state of the cryptocurrency market is reminiscent of a rollercoaster ride – thrilling, unpredictable, and full of ups and downs. The recent surge in altcoin prices suggests that we might be on the cusp of an altcoin season, a period where alternative coins outperform Bitcoin.

As Bitcoin approaches its $100,000 goal, it’s encountering resistance that could lead to a period of stabilization or consolidation. This has rekindled curiosity towards the alternative coin market. In 2021, altcoins proved incredibly profitable for traders when Bitcoin temporarily halted its surge, and a similar pattern might be emerging in this cycle.

As traders wait for the next possible surge in the market, we’re examining key cryptocurrencies that might rise again if Bitcoin temporarily pauses. This comprehensive review delves into five altcoins from the 2021 bull run, which seem to be getting ready for another powerful move during this market cycle.

Table of Contents

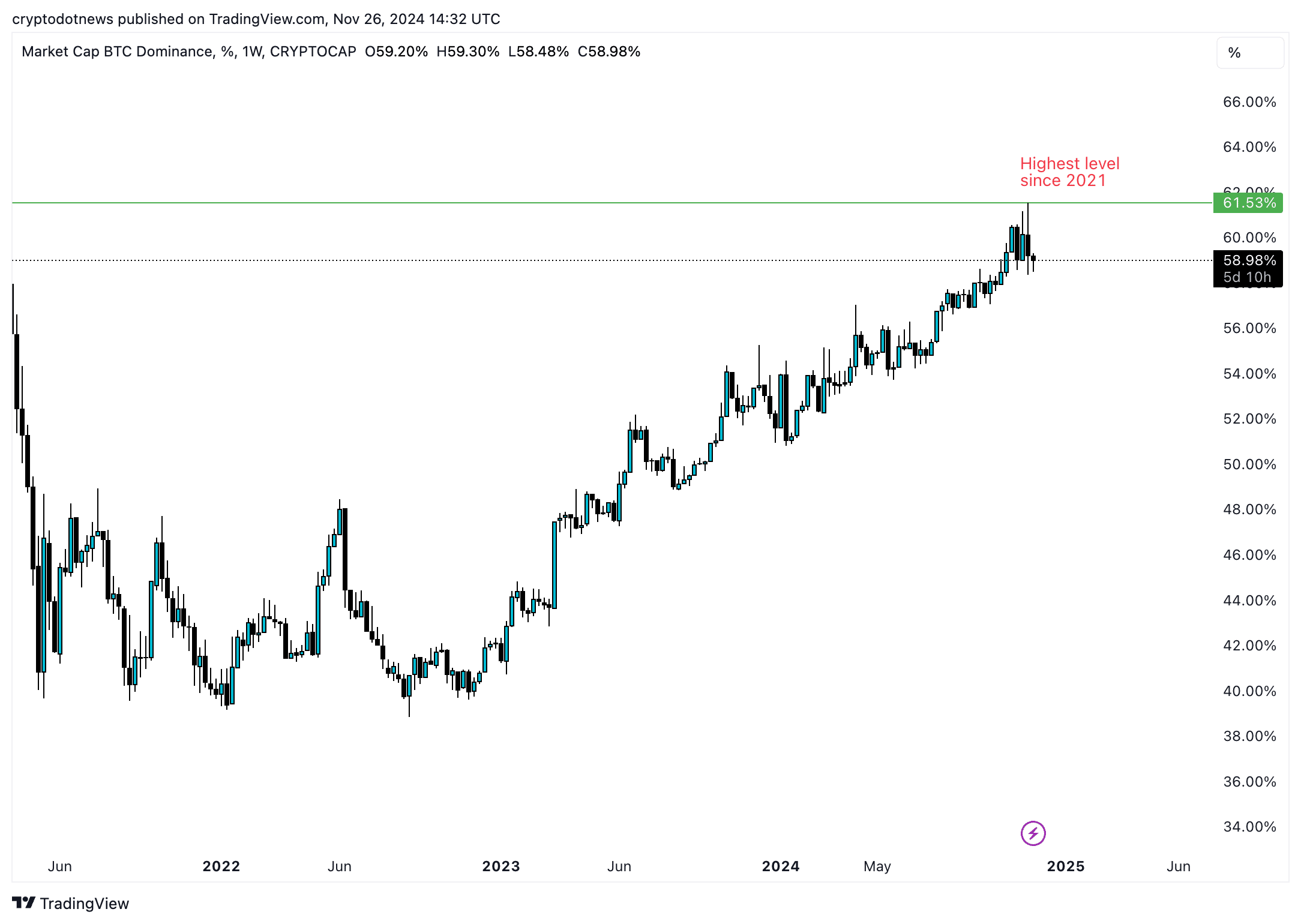

Bitcoin dominance dwindles, altcoin gains likely

On November 18, 2021, Bitcoin’s influence over the cryptocurrency market reached a high of 61.53%, marking its strongest position since then. However, by Tuesday, November 26, 2024, this dominance had decreased slightly to 58.97%.

When Bitcoin’s influence lessens, it often signals that investors might shift their funds towards alternative cryptocurrencies. This could potentially mark the return of the ‘altcoin rally’, during which more than three quarters of these digital tokens are likely to outperform Bitcoin over a 90-day period.

In the 2021 cryptocurrency surge, Bitcoin’s influence dipped to around 40%, opening the door for alternative coins to surge. This situation resulted in substantial double-digit profits for traders throughout that cycle. A comparable scenario could lead altcoin prices to climb during this latest bull run as well.

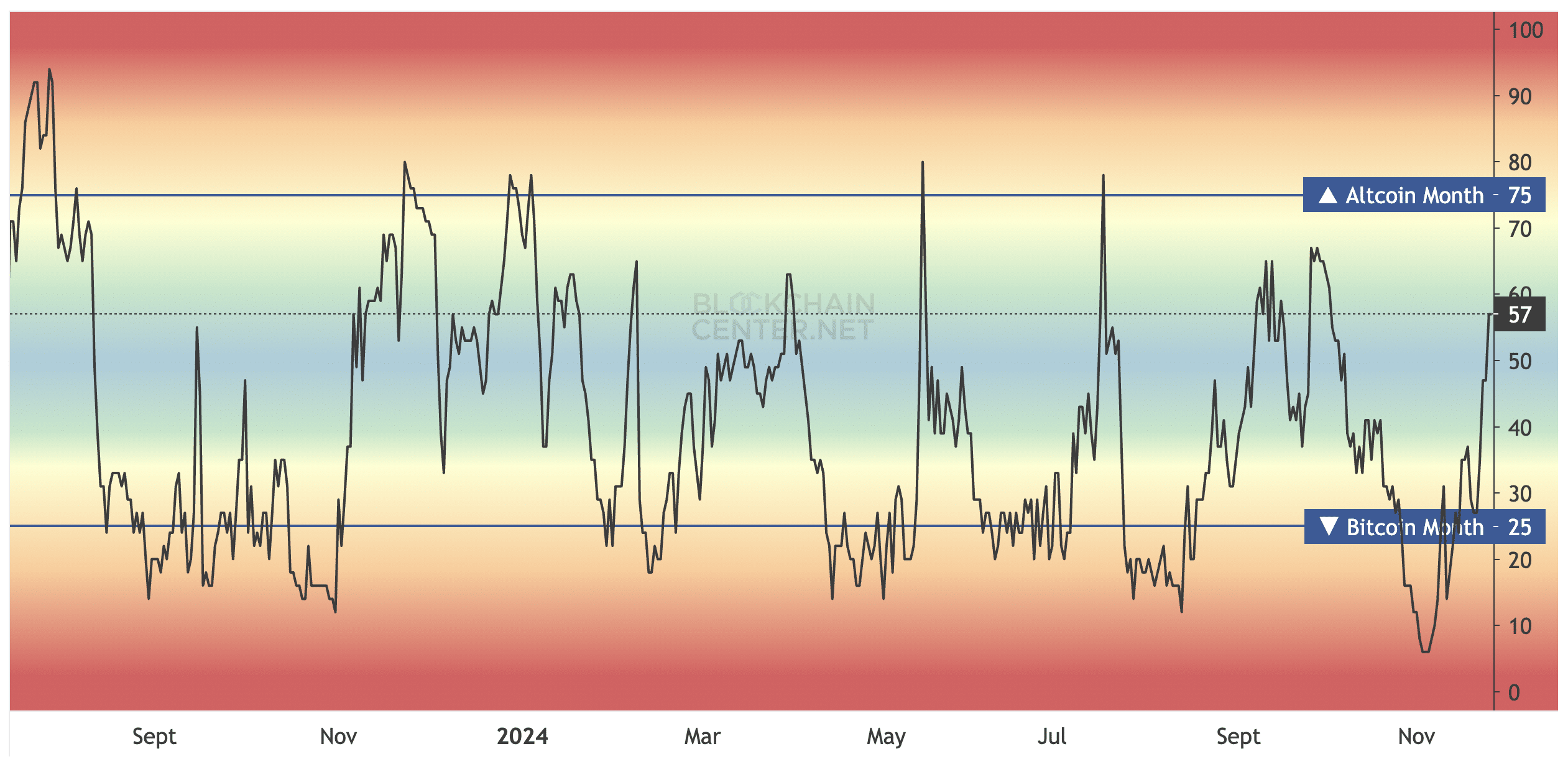

Is it altcoin season?

On Blockchaincenter.net, the Altcoin Season Index indicates a consistent rise in its scale, which signifies when we’re experiencing an “alt season.” This is determined when 75% of the top 50 altcoins surpass Bitcoin’s performance over a 90-day period, excluding stablecoins such as Tether, DAI, and tokens backed by assets like WBTC, stETH, and cLINK.

The graph demonstrates a significant rise in the index, climbing from 6 on November 5 to its current value of 57. When the figure reaches 75, it signifies an “altcoin month.” If this happens within a 90-day period, we’re in the midst of “altcoin season.

Even though we’re not quite in ‘altcoin season’ just yet, this development indicates a consistent move towards that direction. Traders might want to start getting ready for potential gains by incorporating appropriate altcoin assets into their investment portfolios, in anticipation of potential profit-taking opportunities over the next few weeks.

Altcoins from the 2021 bull run eye massive gains

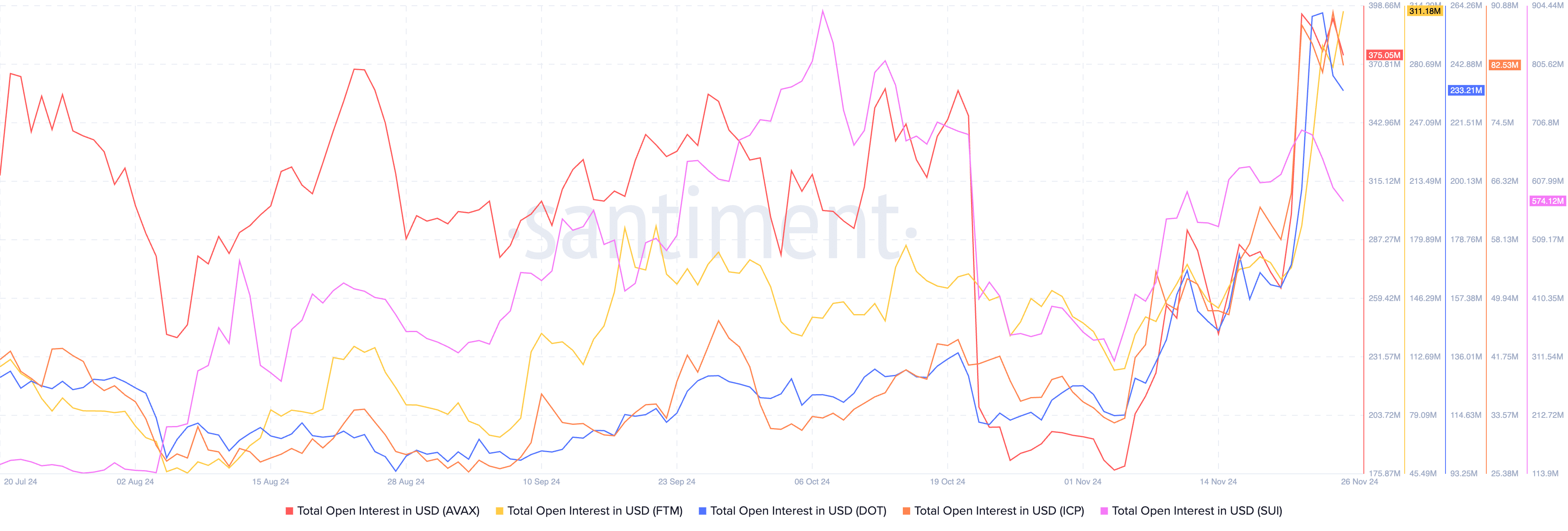

In the 2021 cryptocurrency surge, digital currencies such as Avalanche (AVAX), Polkadot (DOT), Fantom (FTM), Internet Computer Protocol (ICP) and Sui Protocol (SUI) may reappear in this cycle. Technical and blockchain-based signals suggest a resurgence for these assets.

The total open interest for the US dollar is a measure that calculates the combined value of all active derivative contracts across various exchanges for one currency. For AVAX, DOT, FTM, ICP, and SUI, there was an increase in open interest on November 22, and since then, it has remained above the average level, according to Santiment data.

The trading volume for these assets and the associated address activity is typically around or above normal, indicating a growing curiosity or increased engagement among cryptocurrency investors towards these tokens.

Over the past week, AVAX experienced a growth of almost 20%, DOT saw a 33% increase in value, FTM surged by 44%, ICP witnessed an 18% rise, while SUI declined by 8%. During the 2021 cycle, these digital tokens gained significance due to their practical uses, strategic partnerships, and contributions to the trading community’s ecosystem.

In addition to meme coins and their stories, as well as the concept of utility and real-world asset tokenization, alternative chains to Ethereum such as Avalanche, Polkadot, Fantom, and Sui Protocol have become popular choices in this market cycle. These platforms are now being considered by traders.

Top 5 altcoin targets this cycle

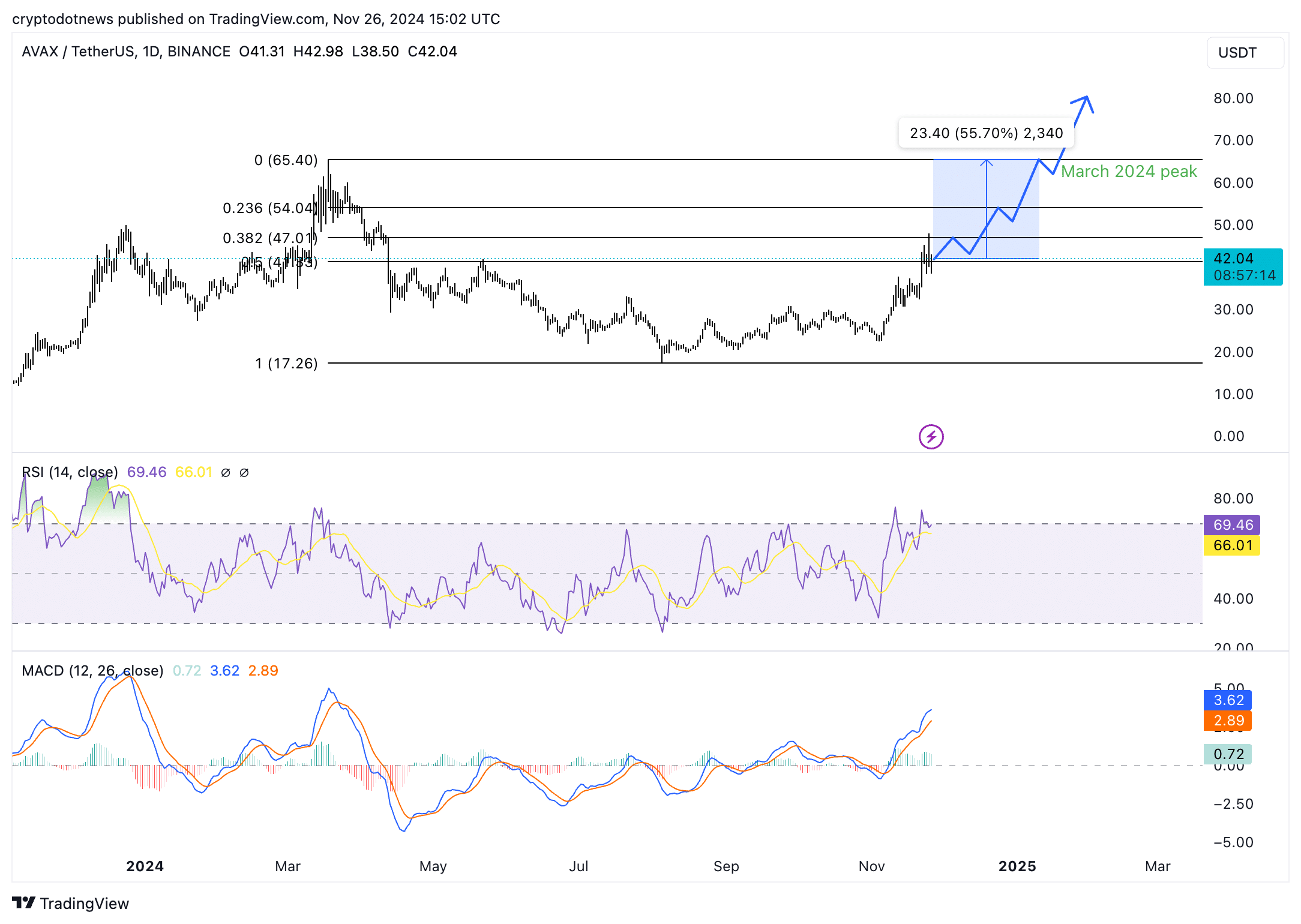

The day-to-day graph of Avalanche indicates a potential increase of approximately 55%, which could bring it back to its March 2024 high, with an estimated value of around $80. This price point holds significant psychological significance for AVAX.

The Relative Strength Index (RSI) stands at approximately 69, just shy of the overvalued range that exceeds 70. On the other hand, the Moving Average Convergence Divergence (MACD), which measures momentum, has green bars positioned above the neutral line, suggesting a potential for more growth in AVAX.

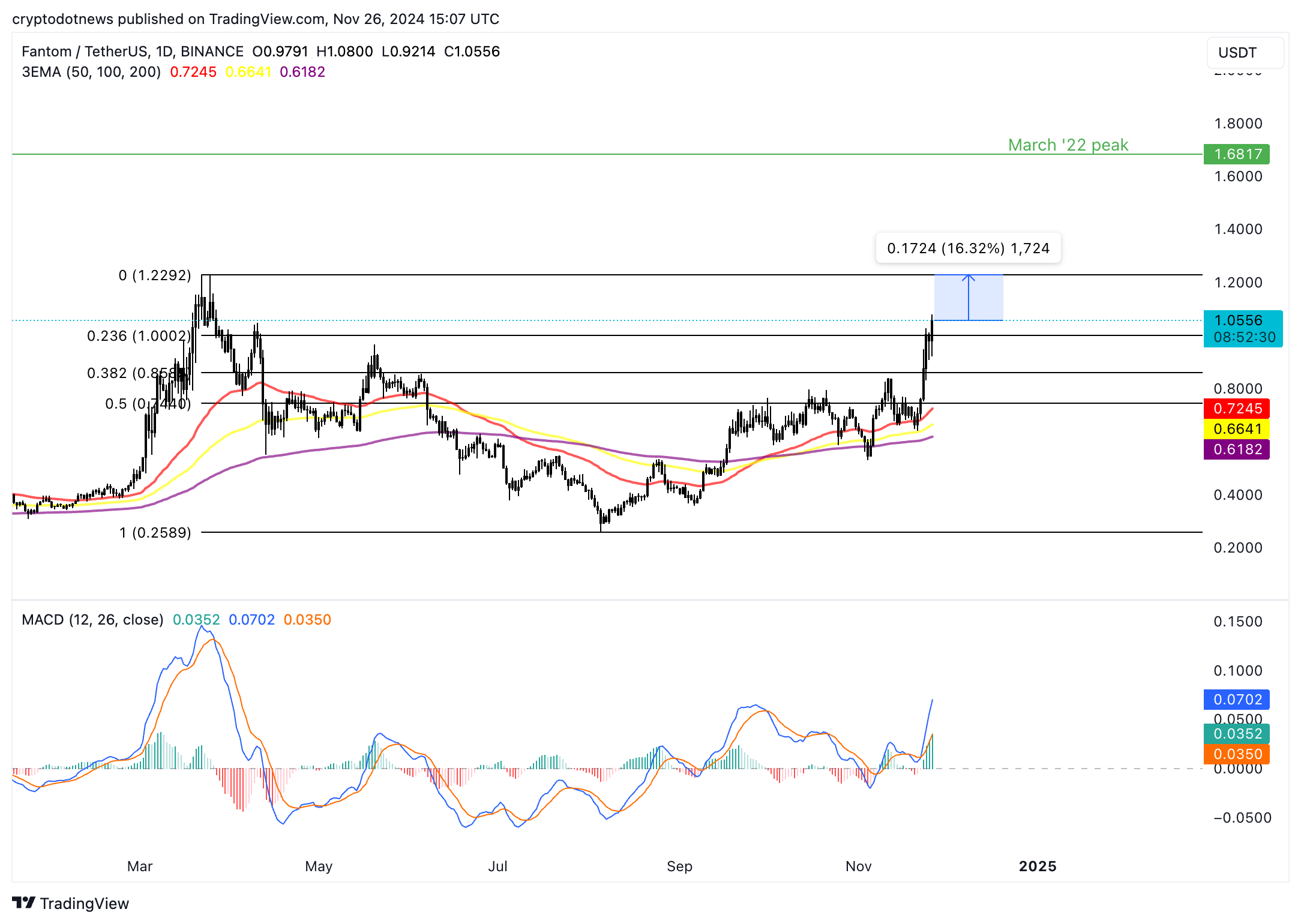

In simple terms, based on the current daily price chart analysis, there’s a possibility that Fantom could increase by approximately 16% in the upcoming weeks. This growth might lead it back to its previous peak in March 2024, which was $1.2292. However, the ultimate goal for Fantom is to reach its peak from March 2022, which stood at a higher price of $1.6817.

The Moving Average Convergence Divergence (MACD) indicates a possibility of additional growth in Fantom, suggesting potential increases in FTM value. The three exponential moving averages serve as crucial support points for Fantom’s price movement.

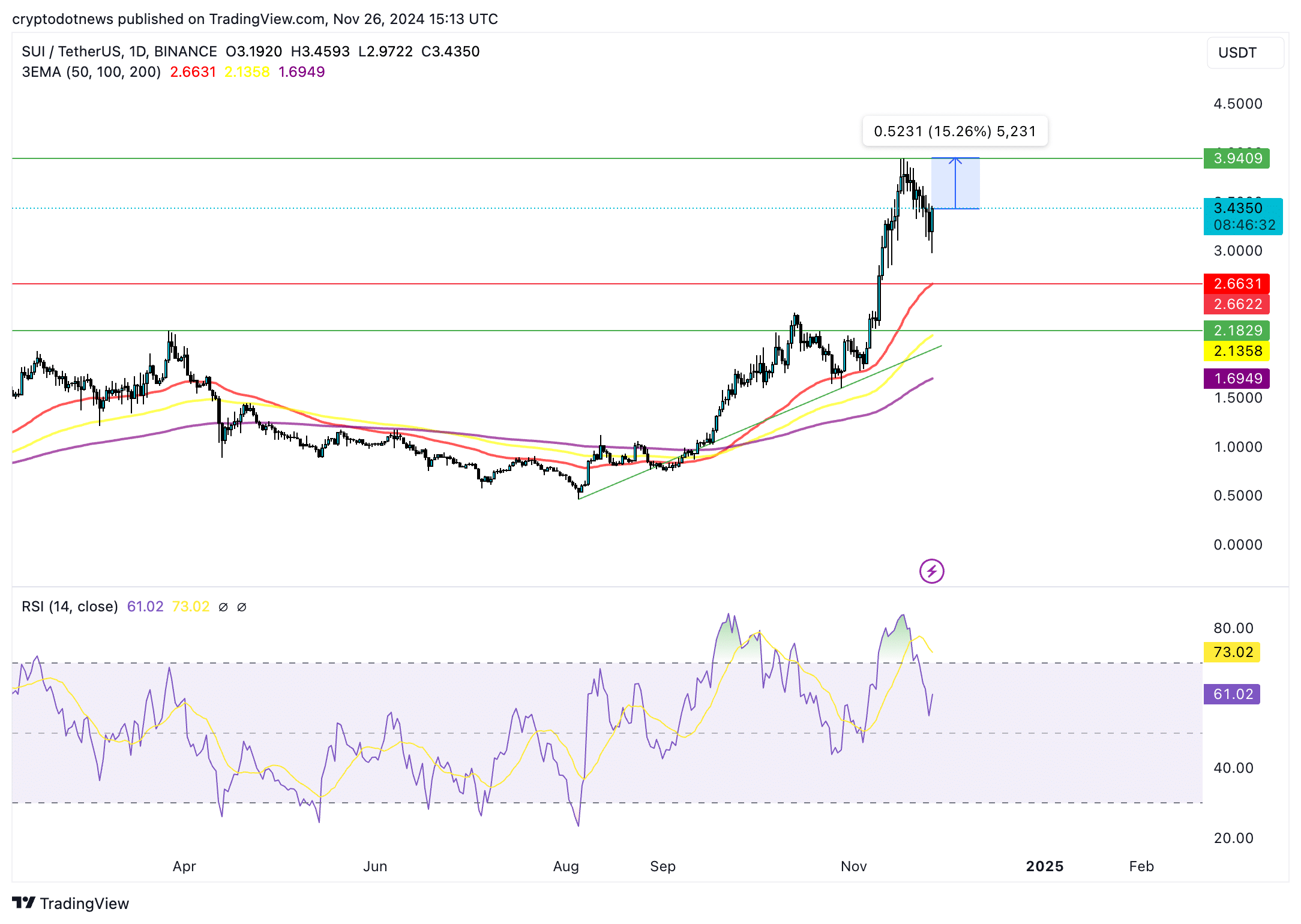

At this moment, the value of Sui Protocol’s token is recorded at $3.4350. There’s a possibility that SUI could return to its highest point in 2024, which was $3.9409. Currently, the token is trading above its three Exponential Moving Averages (EMA), with the 50-day EMA at $2.6631 serving as a significant level of support.

SUI could rally 15.26%, upward sloping RSI supports the bullish thesis for the token.

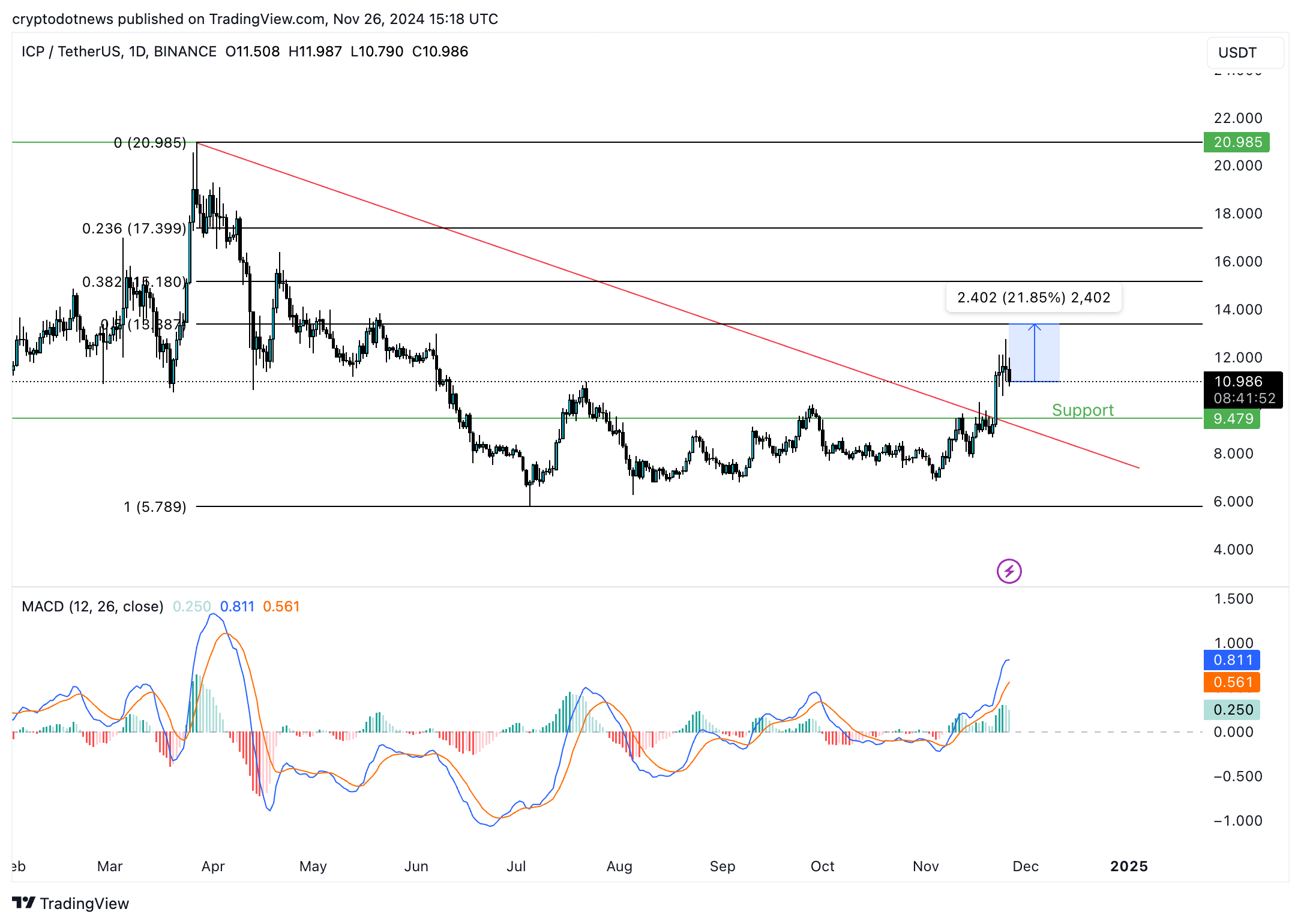

ICryptocurrency (ICP) appears to have broken its prolonged decline on November 22nd. It’s possible that this token could challenge its anticipated high for 2024, which stands at around $20.9850. However, along its journey towards this goal, ICP may encounter resistance at various Fibonacci retracement levels: $13.3870 (representing the 50% level), $15.1800 (the 38.2% level), and $17.3990 (the 23.6% level).

The momentum indicator MACD supports ICP’s bullish thesis on the daily timeframe.

$9.4790 is a key support level for ICP, in the event of a correction in the token.

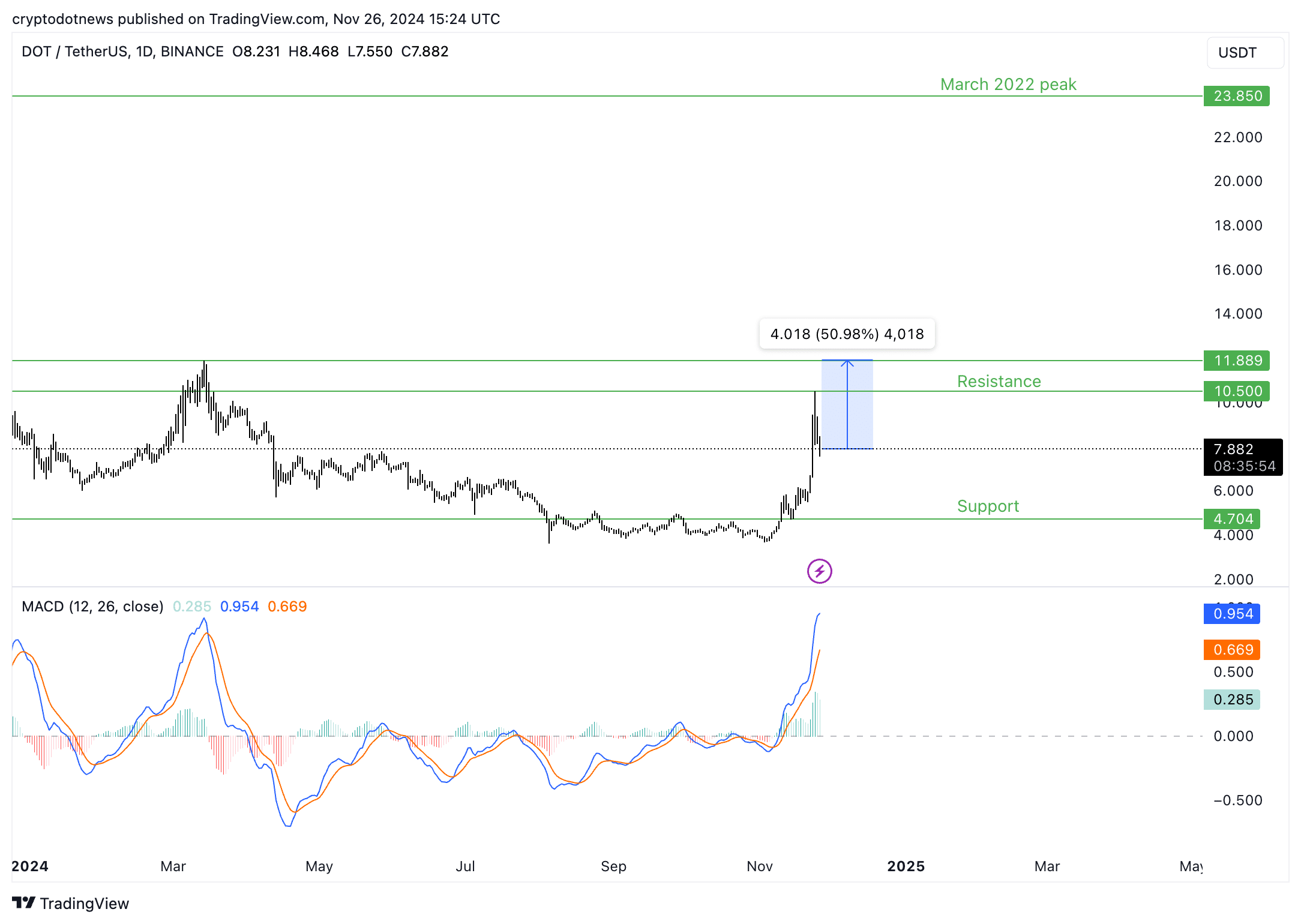

If Polkadot’s token recovers during the next altcoin rallies, it might see a jump of up to 50%. Currently hovering around a price point, DOT could encounter some resistance at roughly $10.50. Overcoming this hurdle may propel it toward $11.8890, which represents a potential increase of nearly 51% from its current value.

The March 2022 peak of $23.850 is the target for DOT, the token could find support at $4.7040.

The Moving Average Convergence Divergence (MACD) indicates a positive outlook for Polkadot (DOT). At present, there’s been a drop in DOT over the past week, but a quick rebound may occur in the near future.

For traders to keep in mind, an increase in the prices of alternative coins (altcoins) is often tied to a decrease in Bitcoin’s dominance and a shift of capital from Bitcoin to these alternatives. If Bitcoin surpasses $100,000 on the daily timeframe and continues to rise, the altcoin season might be postponed or could occur as late as early 2025.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- PUBG Mobile heads back to Riyadh for EWC 2025

- Castle Duels tier list – Best Legendary and Epic cards

- USD MXN PREDICTION

- Silver Rate Forecast

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD CNY PREDICTION

2024-11-26 19:34