As a seasoned analyst with over two decades of experience in the financial markets under my belt, I have witnessed the rise and fall of countless trends and cycles. And yet, the digital asset landscape continues to surprise me with its resilience, innovation, and unpredictability.

Ethereum (ETH) is no exception. Despite a relatively modest 50% return this year compared to its peers, I believe that 2025 could be Ether’s time to shine. The upcoming Pectra upgrade, institutional accumulation, and potential regulatory changes all point towards a bullish outlook for Ethereum in the coming years.

The Pectra upgrade, expected to go live in March or April of 2025, promises to significantly improve Ethereum’s scalability, security, and user experience. With enhancements in account abstraction, validator operations, and network performance, we could see a domino effect on Layer 2 chains that rely on Ethereum for their security infrastructure.

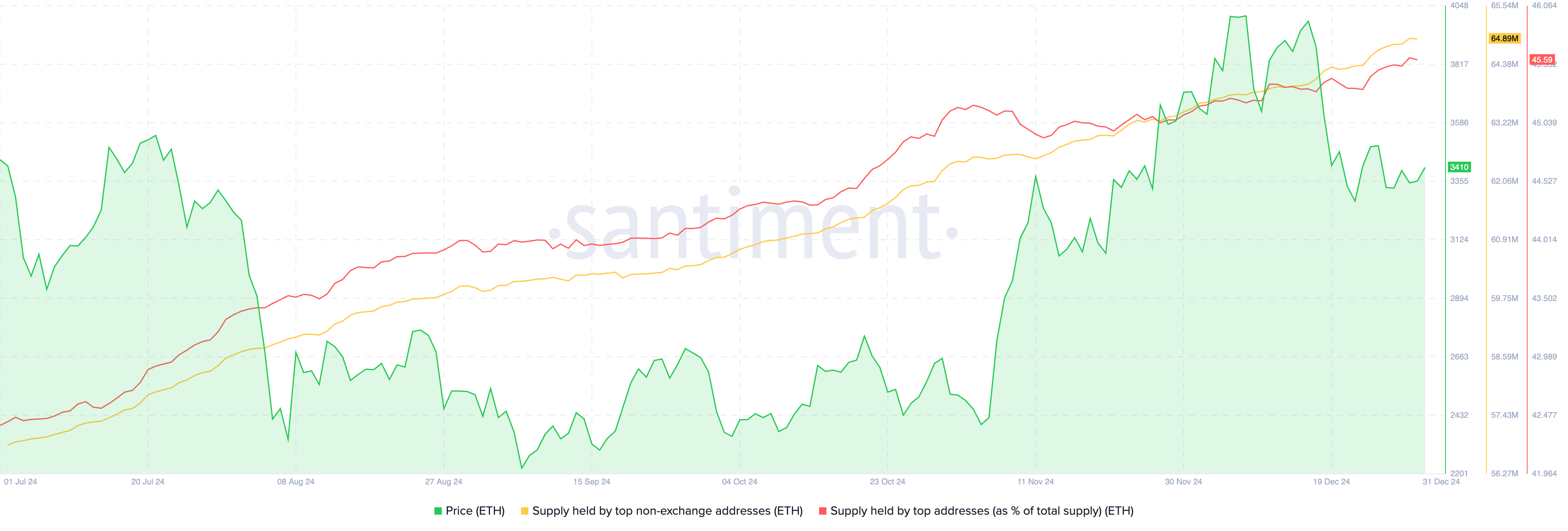

Institutional investors have been quietly accumulating Ether during dips, as evidenced by the increase in supply held by top non-exchange wallet addresses and the token’s top addresses as a percentage of total supply. This trend, coupled with entities like World Liberty Financial buying Ether tokens during price dips, suggests that large wallet investors are betting on Ethereum’s long-term potential.

Regulatory changes under a crypto-friendly Trump administration could also pave the way for U.S.-based Spot Ethereum ETFs to include staking yield, increasing returns for investors and benefiting ETF issuers in terms of NAV, reduced management fees, and dividends.

Lastly, let’s not forget about Ethereum’s unique value proposition as a platform for smart contracts and decentralized applications. As more institutions adopt Ethereum for its underlying technology, we could see a surge in development activity that could drive the price of Ether higher.

In terms of technical analysis, Ether is currently hovering around $3,400, with support at $3,159 and resistance at $3,497. With bullish indicators like an upward-sloping relative strength index and a moving average convergence divergence suggesting that negative momentum is likely waning, traders should watch closely for a potential reversal in Ethereum’s price trend.

My target for Ether is $4,500, with psychologically important support at $3,000. But remember, as always in the world of finance, past performance is no guarantee of future results. As they say, “Don’t worry about the bites you can’t feel; it’s the sharks you need to watch out for.” Happy trading!

On Tuesday, Ethereum (ETH) maintained its position around $3,400, indicating a strong possibility of ending the year with approximately a 50% increase. When compared to Bitcoin and many other leading coins in the top 20 cryptocurrencies ranked by market cap, Ethereum’s returns have been relatively modest.

2025 might bring shifts in the storyline, influenced by factors such as the anticipated Ethereum update, increased investment by institutional entities, and other significant market influencers.

Table of Contents

Ethereum gears for Pectra upgrade in 2025

In 2025, we might witness an enhancement in Ethereum’s scalability, security, and user experience through the Pectra update. This development will incorporate advancements in account management, validator functions, and overall network efficiency.

A key objective we have is to enhance the experience for both users and developers within Ethereum, aiming to make it simpler to carry out future updates that increase its scalability.

Enhancing validator stake constraints, facilitating smoother staking withdrawals, and simplifying smart contract creation may bolster Ethereum’s network safety and performance. Such improvements could ripple through to Layer 2 chains, which heavily depend on Ethereum for their security foundation.

In simpler terms, after the “Merge,” Pectra is expected to be the third major improvement within the Ethereum network. If it’s implemented successfully, it could potentially spark a revival for Ether by the year 2025.

According to analyst Anthony Sassano, the Pectra update is expected to be implemented sometime between March and April of next year. It’s worth mentioning that Unichain, a protocol built on Ethereum, plans to launch its main network in early 2025. Notably, improvements in Pectra could potentially assist Ethereum in meeting the scalability demands set by Unichain, as Unichain intends to employ blobs and may benefit from such advancements.

In March or April, we expect the blob size to double from 3/6 to 6/9 with Pectra.

Meanwhile, Unichain plans to debut their mainnet in early 2025, utilizing blobs.

As for Ethereum, it’s gearing up to expand to accommodate the growing blob demand!

— sassal.eth/acc 🦇🔊 (@sassal0x) December 31, 2024

Institutional investors accumulate Ether during dips

Based on my years of experience in the cryptocurrency market, I find it intriguing to observe the trends displayed by Santiment’s on-chain data intelligence platform. Specifically, the consistent increase in two key metrics – supply held by top non-exchange wallet addresses and the token’s top addresses as a percentage of total supply – is something that catches my attention. This pattern suggests growing interest and confidence in the project among whales and major holders, which can be a promising sign for the future. As someone who has witnessed numerous market cycles and fluctuations, I always keep a close eye on such indicators to gauge the health and potential of a digital asset.

A rise in these measurements from November through December suggests that significant Ether holders are stockpiling Ether.

Data from Lookonchain indicates that organizations such as World Liberty Financial, which is linked to Donald Trump, have purchased Ether tokens when the value of ETH was lower.

As more Ether is stored by significant entities outside trading platforms, this trend often indicates that ‘whales’ are amassing Ether, which can be a positive sign, or an indication of a potential increase in the value of Ethereum (ETH).

US based Spot Ethereum ETFs could pass on staking yield

In the United States, some Exchange-Traded Funds (ETFs) tied to Ethereum spots have received approval from the Securities and Exchange Commission (SEC), but none of these currently offer returns derived from staking. Unlike regulatory bodies in Switzerland and Canada, the SEC has been resistant to all ETF proposals that involve staking.

Positive cryptocurrency regulations during President-elect Donald Trump’s term might create opportunities for investors to enhance their earnings via Ethereum (ETH) staking incentives. Exchange-Traded Fund (ETF) issuers could potentially profit from these staking rewards in several ways, such as by boosting their Net Asset Value (NAV), lowering management fees, and distributing dividends.

Based on my years of experience following the cryptocurrency market and observing the regulatory landscape, I believe that under a crypto-friendly Trump administration, the Securities and Exchange Commission (SEC) could potentially approve staking yield for Ethereum ETFs. The reason being, a more favorable stance towards cryptocurrencies from the White House could lead to increased dialogue between the SEC and the crypto industry, making it easier for regulatory approval of innovative financial products like Ethereum ETFs that offer staking yields. This would be a significant development in the crypto space, as it would provide investors with more opportunities to gain exposure to Ethereum while also earning rewards through staking, much like they do with traditional assets. However, it’s important to note that this is just one possible scenario and the ultimate decision will depend on various factors, including the SEC’s stance on crypto, market conditions, and potential legal challenges.

Higher adoption among institutions, outside of token utility

Dario Lo Buglio, CTO at Brickken, told Crypto.news in an exclusive interview:

As someone who has been closely following the world of cryptocurrency for several years now, I can confidently say that one key point about Ethereum stands out to me. While it shares financial use cases with Bitcoin, such as serving as a medium of exchange, it brings something unique to the table: smart contracts.

Having dabbled in programming myself and witnessed the rise of decentralized applications (dApps), I can attest to the immense potential that Ethereum holds for creating innovative, efficient, and secure applications. However, striking a balance between the value of Ethereum as a form of payment and its utility within the realm of dApps is crucial.

In my personal opinion, this delicate equilibrium will play a significant role in shaping the future of Ethereum, as well as the broader crypto landscape. It’s exciting to see how this versatile technology continues to evolve and shape our digital world.

Instead of claiming a delay in pricing, I would rather point out a possible delay in active development. This is due to the fact that it’s the largest decentralized blockchain, which means any modifications take time compared to networks like Solana and other protocols that can be swiftly updated with minimal complications.

Lo Buglio maintains a positive outlook on Ethereum’s potential for institutional adoption, given its robust smart contract capabilities and advanced underlying tech.

Technical analysis and targets

On New Year’s Eve, Ethereum was hovering around $3,400. However, it encounters resistance at approximately $3,497 and finds its footing within the value gap ranging from $3,159 to $3,257. In the ETH/USDT daily price chart, technical indicators suggest a bullish forecast for Ether.

The Relative Strength Index (RSI) stands at 46 and is trending upward, which suggests a strong underlying trend. Meanwhile, the Moving Average Convergence Divergence (MACD) exhibits progressively smaller bars in its histogram, implying that any negative momentum may be diminishing.

Traders should watch closely for a potential reversal in Ethereum’s price trend.

On the ETH/USDT daily price chart, the goal for Ether is set at approximately $4,500. Notably, significant psychological support can be found around $3,000.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-12-31 18:25