As a seasoned analyst with over two decades of experience in the financial markets, I find myself intrigued by the recent surge in Ethereum (ETH) prices. Having navigated numerous bull and bear cycles, I must admit that the ongoing bullish Ethereum price forecast is, indeed, contrarian but not entirely surprising given the market’s unpredictable nature.

On November 27, the price of Ethereum saw a powerful surge, breaking out from its previous levels, as Bitcoin and many other cryptocurrencies rebounded following several days of decline.

The price of Ethereum (ETH), the second-largest cryptocurrency, reached a new high of $3,690 since June 10th. This represents an increase of approximately 70% from its lowest point this month. A well-known analyst predicts that it could climb up to $10,000 during this current bull market trend.

In a recent post on X, well-known crypto analyst Ali Martinex – who boasts nearly 100,000 followers – predicts that the coin could reach $6,000 during this cycle. Over the long term, he anticipates ETH’s price to soar as high as $10,000. If his predictions prove true, it implies a potential increase of 65% and 176% for the coin.

In my analysis, I’ve built my predictions on a trend regression study conducted on the daily chart, which traces back to its lowest point in January of the previous year, that being Ali’s data.

Dan from Crypto Trades, a well-known analyst, believes that Ethereum is gearing up for another price surge as well. He predicts that Ethereum will likely perform exceptionally well during the first three months of the upcoming year, given its past performance patterns.

So far, Ethereum (ETH) appears to be performing well in the fourth quarter. Historically, it’s Q1 that typically sees strong performance from ETH and a better ratio of ETH to Bitcoin (ETH/BTC). Let’s watch and see if this trend holds true for this time around.

— Daan Crypto Trades (@DaanCrypto) November 28, 2024

The ongoing bullish Ethereum price forecast is largely contrarian since the coin has underperformed most of its peers this year. Its spot ETFs are also not seeing substantial traction, with the cumulative inflows being at $240 million. Bitcoin’s inflows stands at over $27 billion.

It appears that there are indications that Solana (SOL) is potentially taking over some market share from Ethereum. According to DeFi Llama’s data, decentralized exchange protocols on Ethereum processed a volume of approximately $68 billion over the past 30 days, while Solana handled around $126 billion during the same period.

Ethereum price has strong technicals

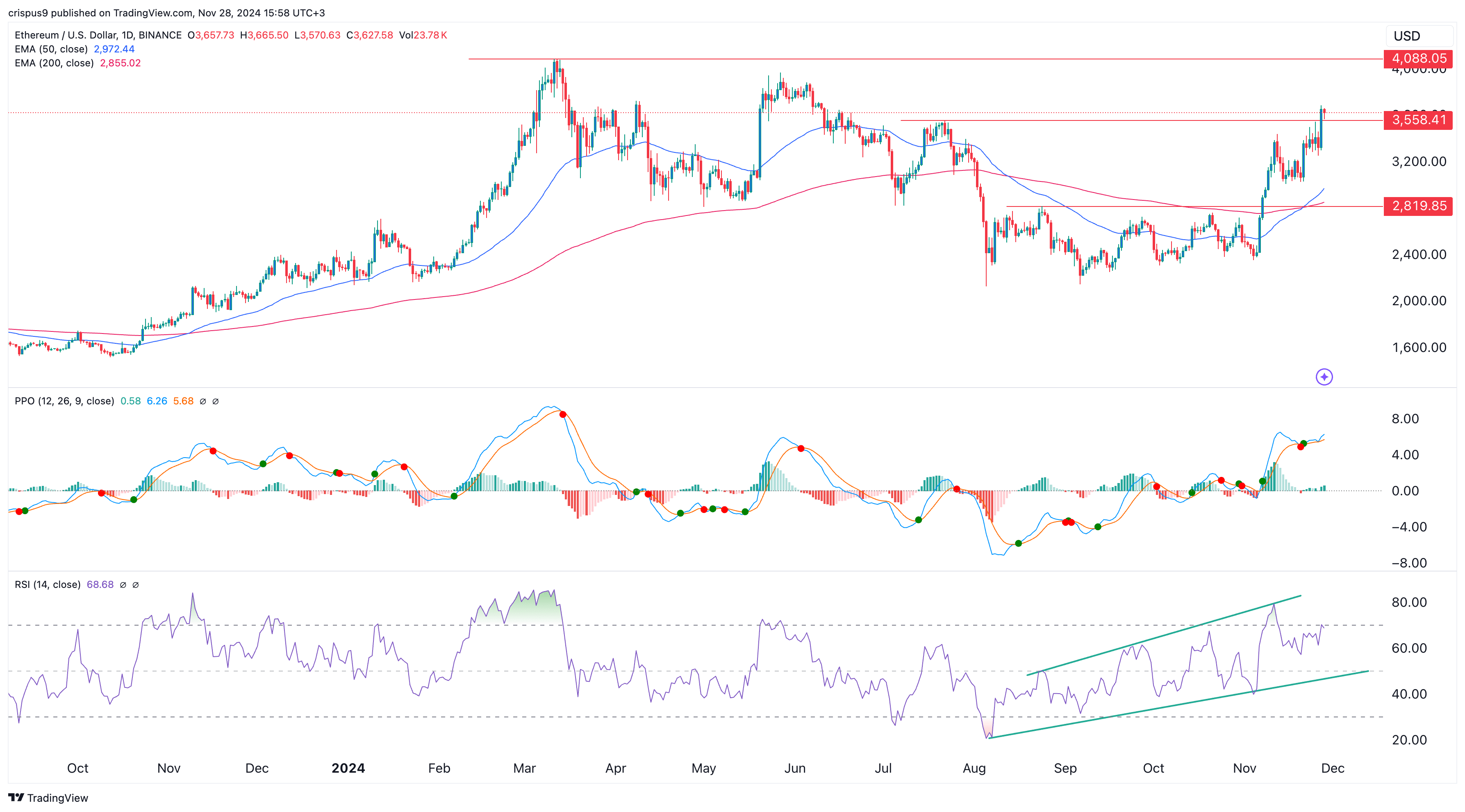

Today’s graph indicates that Ether (ETH) prices have been performing favorably over the recent days. Notably, it has recently displayed a golden cross formation, with the 50-day and 200-day Exponential Moving Averages intersecting. This pattern is widely recognized as a strong indication of potential market bullishness.

The cost of Ethereum has surged beyond a significant threshold at approximately $3,558, marking a new peak since July 21. Moreover, both the Percentage Value Fluctuation and the Relative Power Indicator are trending upward as well.

Based on current trends, Ethereum (ETH) is likely to surge and revisit its highest price this year, which stands at $4,088. If ETH manages to break through that barrier, further growth can be anticipated, with a significant focus on the psychological mark of $5,000. However, if ETH falls below the support level of $3,100, this prediction may no longer hold true.

Read More

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- USD MXN PREDICTION

- USD CNY PREDICTION

- USD JPY PREDICTION

- Gold Rate Forecast

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- Castle Duels tier list – Best Legendary and Epic cards

2024-11-28 16:22