As a seasoned crypto investor, I’ve seen my fair share of market volatility, and the first week of July was no exception. The bearish pressure that swept through the market led to significant losses for Bitcoin (BTC) and many other assets.

During the initial part of July, there was a significant increase in selling force that caused substantial declines across the crypto market. Bitcoin (BTC) spearheaded this trend, as it repeatedly hit new lows while dealing with intense selling pressure.

Significantly, other parts of the market saw comparable declines. As a result, the total value of all cryptocurrencies plummeted by $140 billion, reaching a low of $2.11 trillion since late February. The majority of assets continued to slide, while some displayed impressive rebounds.

Based on their impressive recoveries during the recent market downturn, here are the cryptocurrencies worth keeping an eye on this week:

Bitcoin drops to 5-month low

As a researcher studying the cryptocurrency market, I’ve observed that Bitcoin began the week with a relatively optimistic tone after a period of consolidation two weeks prior. However, my analysis indicates a shift towards bearish sentiment as Bitcoin deviated from the upward trend of U.S. equities, which are currently experiencing a bullish phase.

This year, Bitcoin faced its most intense wave of bearish selling pressure. The insolvency of cryptocurrency exchange Mt. Gox led to creditor payouts in the form of Bitcoins, Germany distributed numerous BTC tokens, new investors disposed of their holdings, and miners indicated signs of giving up.

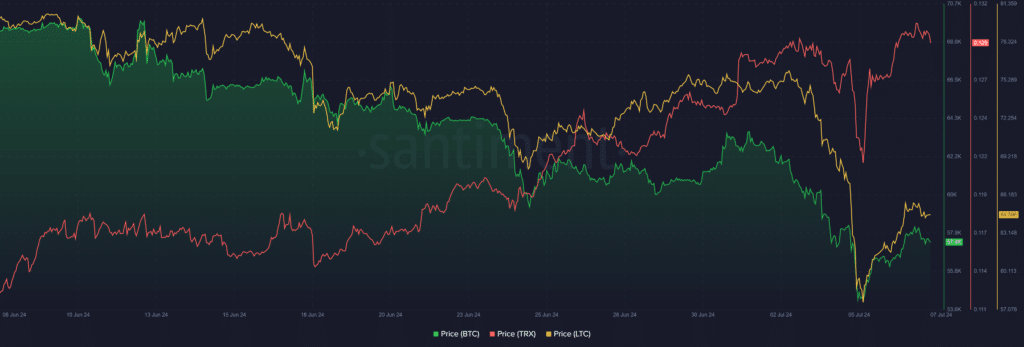

As a researcher studying the cryptocurrency market, I’ve observed some significant movements in Bitcoin’s price last week. After hitting a high of around $63,000, it encountered several psychological resistance levels and eventually dropped to a 5-month low of $53,485 on July 5. Surprisingly, the asset bounced back from this position, but the recovery was only mild. Consequently, Bitcoin closed last week with a decline of approximately 4.5%, hovering slightly above the $58,000 mark.

As of now, the value of the asset has dipped below the $58,000 mark once more, following a 1.13% decline. Nevertheless, it still hovers above the lower boundary of the Bollinger Band at $56,347. The prospects for Bitcoin’s full recovery rely on its success in regaining both the 20-day simple moving average ($61,509) and the upper limit of the Bollinger Band ($66,676).

LTC slumps 12%

I, as an analyst, observed that Litecoin (LTC) endured a setback during the recent market downturn. Initially, the cryptocurrency demonstrated strength and mainly stabilized between June 30 and July 2.

As a crypto investor, I’ve noticed that during the span from July 3 to 5, Litecoin (LTC) experienced three straight intraday setbacks, resulting in a significant decrease of 18.6% for me. However, there was a slight market recovery on July 6 which allowed LTC to register a gain of 5.72%. Unfortunately, the weekly closure saw LTC ending up with a hefty loss of 12.7%.

Litecoin’s MACD line crossed below the Signal line on July 4, confirming the bearish momentum.

As a researcher observing the market trends, I notice that both the lines are presently inclining downwards. This indication points towards an escalating bearish trend for LTC. For it to put up a strong resistance against further decreases this week, LTC must manage to surpass the Fibonacci level at $64.60 (0.236) with a decisive close.

TRX bucks the trend, hits 4-month high

Tron (TRX) was one of the few assets that bucked the overall bearish trend last week.

TRX showed uncertainty at the beginning of the week, but gained ground and rose by 3.5% within a span of four days, reaching $0.12997 on July 3. My analysis indicates that this price level had last been touched on March 13.

The testing of the $0.13 mark aligns with the broad market downturn. On July 5, Tron experienced a decline of 6.7%, reaching a minimum of $0.12117. However, it quickly bounced back after that.

On July 6, Tron experienced a strong bounce back, regaining its bullish trajectory and reaching a new four-month peak at $0.13028. In the previous week, Tron’s price saw a climb of 3.5%.

Read More

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- Gold Rate Forecast

- USD MXN PREDICTION

- USD JPY PREDICTION

- Brent Oil Forecast

- EUR CNY PREDICTION

- Castle Duels tier list – Best Legendary and Epic cards

2024-07-07 18:48