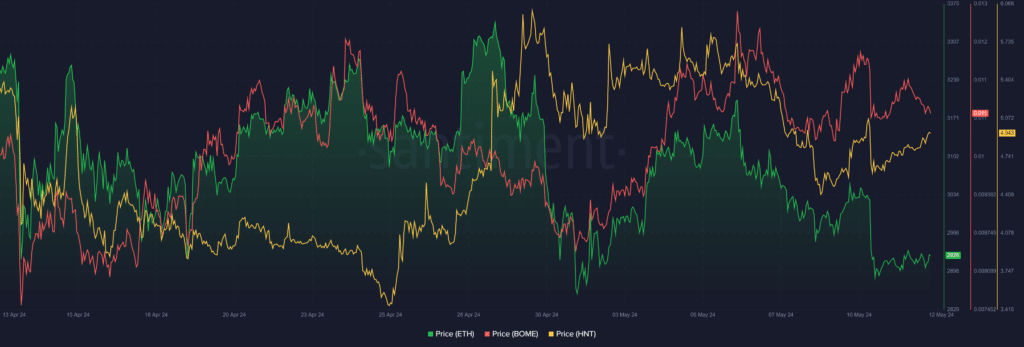

As a crypto investor with some experience under my belt, I’ve seen my fair share of market volatility. Last week’s $100 billion loss was a harsh reminder that cryptocurrencies can be a rollercoaster ride. Ethereum (ETH), in particular, took a hit and saw its value drop below the $3,000 mark.

Last week, the unpredictable nature of the cryptocurrency market led to a shocking loss of approximately $100 billion. This significant drop was mirrored in the total value of all cryptocurrencies, causing the market cap to decrease by 4% and reach $2.36 trillion as of this writing. Keep an eye on these top cryptocurrencies over the coming days.

Ethereum drops below $3,000

Ethereum (ETH), the second-largest cryptocurrency, saw its value fall below the $3,000 threshold.

In the final days of the week, Ethereum made an effort to mount a late comeback. However, this attempt was thwarted as the bearing market trend continued to put significant downward pressure.

As a researcher observing the cryptocurrency market this week, I noticed that Ethereum (ETH) began on an unwelcome note, experiencing a 2.37% price decrease on May 5.

As of May 8, the asset had endured a three-day losing streak following its initial decrease.

Over the given timeframe, Ethereum experienced a 5.3% drop in value, which was more than outpaced by Bitcoin‘s (BTC) liquidations. Nevertheless, Ethereum held firm and didn’t give way below the significant support level of $2,935. This crucial price point aligned perfectly with the lower limit of its Bollinger Bands on the daily chart.

As a crypto investor, I’ve noticed that Ethereum slipped below the significant $3,000 mark again after a brief stint above it at the end of last week.

As a researcher studying Ethereum’s price movements, I revisited the significant support level of $2,935 on May 8th. The day after this test, Ethereum bounced back with a noteworthy recovery, registering a 2.10% increase and breaking above the $3,000 mark once again.

As a researcher observing the market trends, I noticed that the initial rebound we experienced came to a halt when a substantial 4.17% decrease occurred on May 10th. This setback erased all of the previous gains completely.

Ethereum has struggled to bounce back despite attempts at recovery, currently hovering under the $3,000 mark. Its weekly performance shows a decline of 6.4%, with a current market value of $2,934.

Alternative coins such as Book of Meme (BOME) and Helium (HNT), which are less well-known, are likewise facing similar decreases in value.

BOME retests 26-day EMA

As an analyst, I’ve observed that even the unique meme coin, Book of Memes (BOME), experienced market turbulence impact despite its historical tendency to thrive during market slumps on its own. At the onset of this week, BOME’s trading price was noticeably above its 26-day Exponential Moving Average (EMA).

Last week, BOME‘s price dipped beneath the trend-following signal line, signaling downward market pressure, or bearish momentum. However, starting from last Wednesday, there was a bounce back that ultimately propelled the price above the critical threshold.

This past week, bears attempted to push BOME down below its 26-day Exponential Moving Average (EMA), a potential action leading to further price decreases around $0.010. Following a retest of the moving average on May 6th, however, BOME experienced a surprising surge of 7.89%, defying the general market downtrend.

After a delay of 26 days, the bears conducted a sequence of tests on the moving average (EMA) and eventually overtook it.

At the current moment of reporting, the BOME stock is being sold for $0.010863 on the market, just a tad higher than its moving average of $0.010828. If it falls beneath the moving average, the next support level for BOME would be around $0.010475.

Helium sees surge in selling pressure

As a researcher studying the commodities market, I’ve observed that helium followed the broader downtrend and experienced a three-day price decrease similar to Ethereum at the beginning of the week. However, its losses intensified on May 8 with a more substantial decline of 19.6%.

The prolonged decline caused HNT to leave behind the $5 price mark for the first time in May, dropping down to $4.5 instead. A rebound attempt started on May 9, but overcoming the significant resistance at that level proved challenging.

A retest of $5.126 on May 10 eventually resulted in another price collapse.

The price of helium remaining below the $5 mark can be attributed to heightened selling activity. The Accumulation/Distribution indicator has consistently decreased this month, falling from a level of -3.036 million on May 1st to -3.505 million in the latest reading.

A prolonged decline in the market indicates an increase in selling activity, as investors choose to withdraw from the market in response to the downward trend.

Furthermore, according to Coinglass data, there has been an inflow of approximately $2.127 million in HNT from investors to exchanges since April 30, indicative of a consistent increase in exchange deposits.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- USD CNY PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-05-12 20:12