As a researcher who has spent the better part of a decade tracing the rise and fall of Mt. Gox, I can confidently say that this story serves as both a cautionary tale and a testament to the resilience of the crypto industry.

After a full decade since Mount Gox’s demise, I, as a researcher, have been following the progress closely to understand why the long-drawn-out process of creditor payouts began only now at Mount Gox, the once prominent crypto exchange.

Let’s explore the timeline of incidents connected to the collapse of a formerly prominent cryptocurrency trading platform.

Table of Contents

The emergence of Mt. Gox

The history of Mt. Gox goes back to the early days of the crypto industry. It all started in 2010 when developer Jed McCaleb founded the Mt. Gox platform for the Magic: The Gathering game, but then transformed it into a Bitcoin exchange.

About a year after, Mark Karpeles, a developer, acquired the platform from him. Following this leadership shift, Mt. Gox rapidly gained immense popularity as a Bitcoin trading platform.

Consequently, the initial significant cyberattack took place in June 2011. In this attack, hackers managed to steal approximately 25,000 Bitcoins, which was equivalent to around $400,000 at that time. Subsequently, the value of Bitcoin on Mt. Gox plummeted from $17 to nearly zero following the incident.

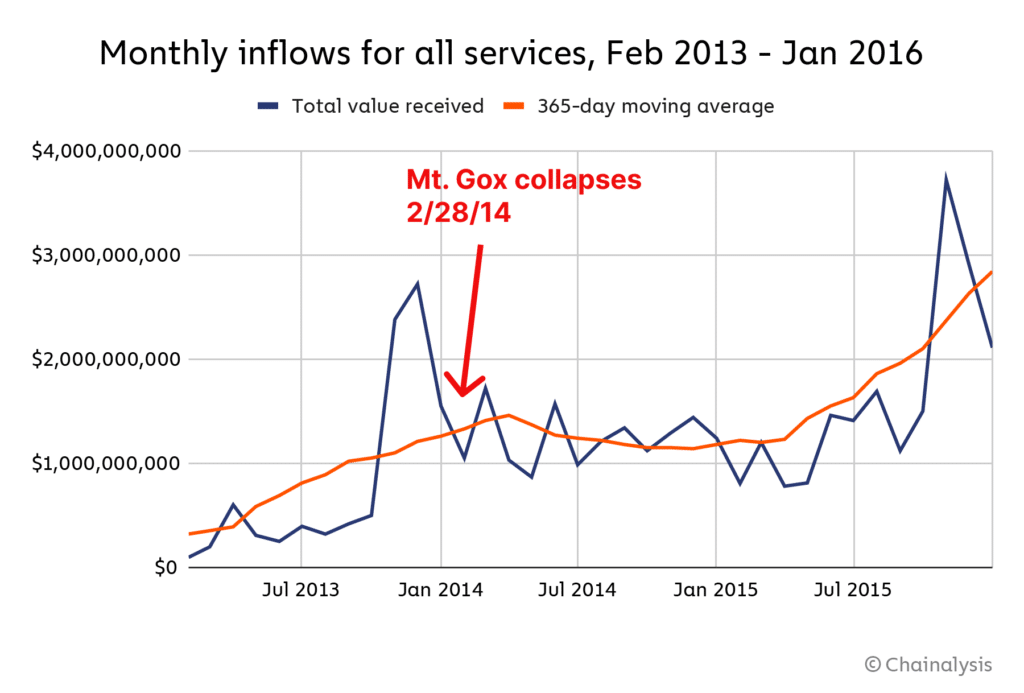

Following the assault, Mount Gox persisted in its growth, handling approximately 70% of all global Bitcoin transactions as of 2013. Yet, the platform encountered technical hurdles which resulted in an escalation of transaction processing duration.

Internal difficulties and hack of Mt. Gox

Regardless of its external achievements, the platform encountered significant internal struggles. For instance, Mt. Gox found it challenging to manage the quality and safety of their code. Furthermore, there was a lack of financial accounting system, making it difficult to keep track of balances and reserves. Essentially, no one kept tabs on the movement of funds and cryptocurrency.

In February 2014, Mt. Gox unexpectedly halted Bitcoin withdrawal services. The team behind the platform announced that a flaw in the Bitcoin software allowed for the unintended duplication of coins, which attackers exploited by making fraudulent transactions to Mt. Gox’s blockchain address. Eventually, the platform ceased all withdrawals.

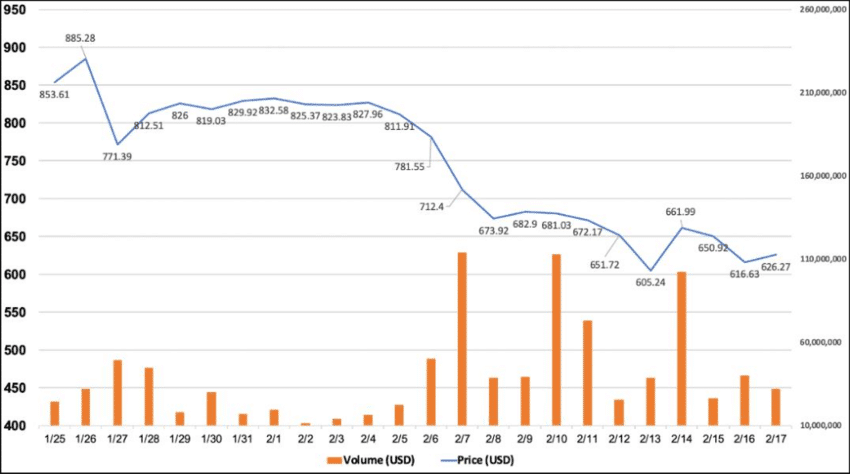

By the end of the month, Bitcoin’s price on Mt. Gox was just 20% of the typical market value, showing that investors lacked faith in the project’s ability to address its issues. On February 24, 2014, all trading activities halted on this platform, and shortly afterwards, its website became unavailable.

In time, it was found that around 750,000 Bitcoins were stolen from users of the exchange platform, with the theft having remained undetected for several years. This revelation led to Mt. Gox’s financial collapse; on Feb. 28, 2014, it declared bankruptcy and ceased operations.

The hack extent and the mystery of missing Bitcoins

cybercriminals breached Mt. Gox’s security system and made off with approximately 844,408 Bitcoin – 744,408 from customers and 100,000 from the company itself. This catastrophic event caused the exchange to go bankrupt. Previous reports suggested that Mt. Gox may have previously lost around 80,000 Bitcoins even before Mark Karpeles acquired it in 2011.

Numerous hypotheses about the hack have emerged, one widely accepted being that Mount Gox, contrary to its claims, didn’t possess the stated number of coins. Some believe that Karpeles might have tampered with the data, giving an appearance of a larger bitcoin stock than was actually available.

From my analysis, it appears there are two main theories about how the hackers managed to infiltrate our system. Firstly, some experts propose that an internal staff member may have unwittingly provided access. Secondly, another theory suggests that as our hot wallet depleted, Bitcoins from the cold storage were gradually transferred to Mt. Gox’s system without adequate security measures in place. This enabled the hackers to move our assets stealthily and undetected.

Bitcoin windfall coming for Mt. Gox creditors after decade-long wait and 10,000% price spike

— CNBC Tech (@CNBCtech) June 29, 2024

Protracted litigation

Between 2014 and 2020, legal proceedings and the restoration process through civil means were carried out. The civil restoration process often spans three to five years and provides a more equitable and streamlined approach for returning assets to those creditors who have been impacted.

Simultaneously, Kraken crypto exchange wasn’t able to gather and assess all creditor claims until May 2016, with a total of 24,750 users submitting requests for payment.

In early 2021, the court agreed to the compensation plan, but the trustees responsible for the exchange repeatedly pushed back the disbursement of compensation to the creditors. They often delayed it by a year, citing technical and administrative issues such as locating missing Bitcoin and streamlining the process of evaluating and meeting the creditor claims.

Compensations and the impact of the Mt. Gox collapse

1. The fall of Mt. Gox stands out as a pivotal incident in the world of cryptocurrencies, demonstrating the necessity of safeguarding digital currency platforms. This event served as the foundation for establishing legal standards across the entire industry.

Beginning on July 5th, the trustees of the exchange announced that they had commenced distributing approximately $9 billion in compensation, divided between Bitcoin and Bitcoin Cash.

As an analyst, I’ve observed that Bitcoin compensation is dispersed via platforms such as Kraken, Bitstamp, BitGo, and Japanese Bitbank. Typically, these exchanges take a few weeks on average to transfer the funds to their respective clients. However, when the initial batch of coins was moved to Bitbank, its customers reported receiving their funds on the same day.

Crypto traders are worried about the potential amount they’ll receive as compensation and the potential for increased selling, which could lower Bitcoin’s price. There’s speculation that some clients might decide to sell a large number of their Bitcoin holdings on the open market following the compensation distribution.

Amid recent headlines, Bitcoin’s value dropped to around $54,000 in early July—the lowest since February 2024. Nevertheless, as we speak, the price of BTC has bounced back and stabilized at approximately $65,000.

Can the Mt. Gox story repeat?

In a simplified manner, it’s essential for the cryptocurrency sector to create innovative systems that blend the robust security of decentralized technologies with the ease and productivity of centralized platforms. Yet, history should serve as a reminder that a recurrence of the Mt. Gox incident is not necessarily guaranteed.

While some well-known cryptocurrency platforms boast transparency, insured deposits, and backing from prominent venture capitalists, numerous smaller or less recognized exchanges may lack transparency in their operations.

Read More

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- USD CNY PREDICTION

- USD JPY PREDICTION

- Gold Rate Forecast

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- Castle Duels tier list – Best Legendary and Epic cards

2024-08-03 01:49