As an analyst with over a decade of experience in the financial markets, I’ve seen my fair share of market fluctuations – from the dot-com bubble to the 2008 global financial crisis and now, the volatile world of cryptocurrencies. Today’s bearish trend in the crypto market is a stark reminder that volatility is the norm, not the exception, in this space.

As a researcher observing the cryptocurrency market, I’ve noticed a significant downturn or bearish trend over the last 24 hours, leading to an uptick in forced sell-offs, commonly referred to as liquidations.

Based on information from CoinGecko, it’s apparent that the overall cryptocurrency market value dipped by approximately 3% over the last 24 hours. This represents a drop from $2.31 trillion to $2.27 trillion, which is equivalent to around a $40 billion decrease.

The daily trading volume, however, rallied by 50%, reaching $99.5 billion.

Several prominent digital currencies such as Bitcoin (BTC) and Ethereum (ETH) have recently experienced a dip in value. At this moment, Bitcoin can be purchased for around $62,400, while Ethereum is hovering near the $2,400 price point.

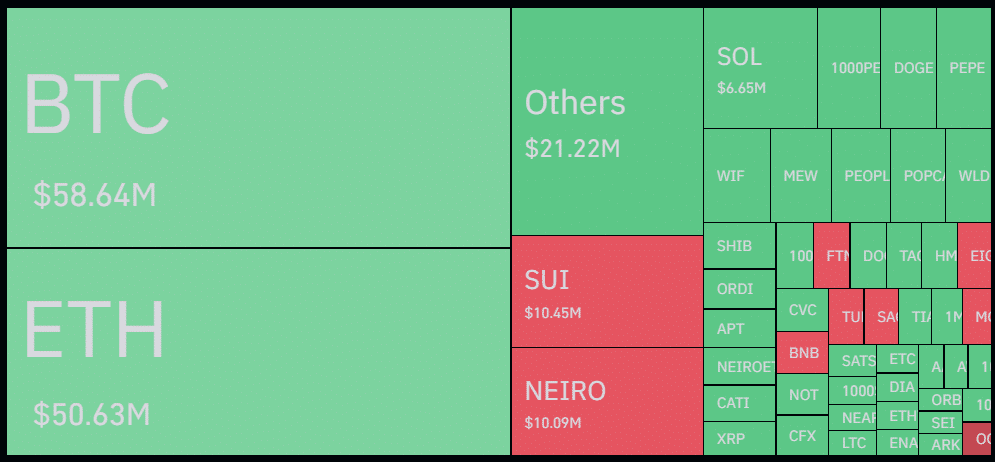

According to Coinglass’s data, a $220 million worth of positions were liquidated across the market due to a general decline. About 69% or $153 million of these liquidations involved long positions.

The data indicates that Bitcoin dominates the rankings, having liquidated trades amounting to approximately $58.6 million; of this, $35.1 million were long positions while $23.4 million were shorts. Ethereum is following closely behind with about $50.6 million in total liquidated trading positions, where the majority ($42.8 million) was invested as longs and a smaller amount ($7.8 million) as shorts.

Binance alone accounts for $105 million in liquidations, followed by OKX’s $74 million.

Based on information from Coinglass, the biggest single liquidation, valued at approximately 10.97 million USD in the ETH/USDT market, took place on the Binance exchange.

After the widespread selling off, the overall cryptocurrency open interest dropped by about 2%, now standing at approximately $60.9 billion.

Typically, a decrease in open interest leads to reduced market volatility because there are fewer anticipated liquidations, which means less trading activity overall.

Read More

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- Gold Rate Forecast

- USD MXN PREDICTION

- Brent Oil Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Ash Echoes tier list and a reroll guide

2024-10-08 10:04