As a seasoned cryptocurrency investor with over a decade of experience in the digital asset market, I find myself closely watching the current price swings of Bitcoin, particularly as we approach the US elections. My journey in this space began during the early days of Bitcoin’s inception, and I have witnessed firsthand its remarkable growth and transformation.

Since Vice President Kamala Harris declared her presidential run in July 2024, I’ve noticed Bitcoin‘s value has been on quite a rollercoaster ride, with significant price fluctuations.

Table of Contents

On October 29, 2024, the top digital currency tried but failed to reach its old peak price of $73,738. Traders anticipate increased market turbulence around election periods and following the events, so they are watching closely. Platforms like Polymarket and Kalshi offer insights into crypto traders’ perspectives on the future value of cryptocurrencies.

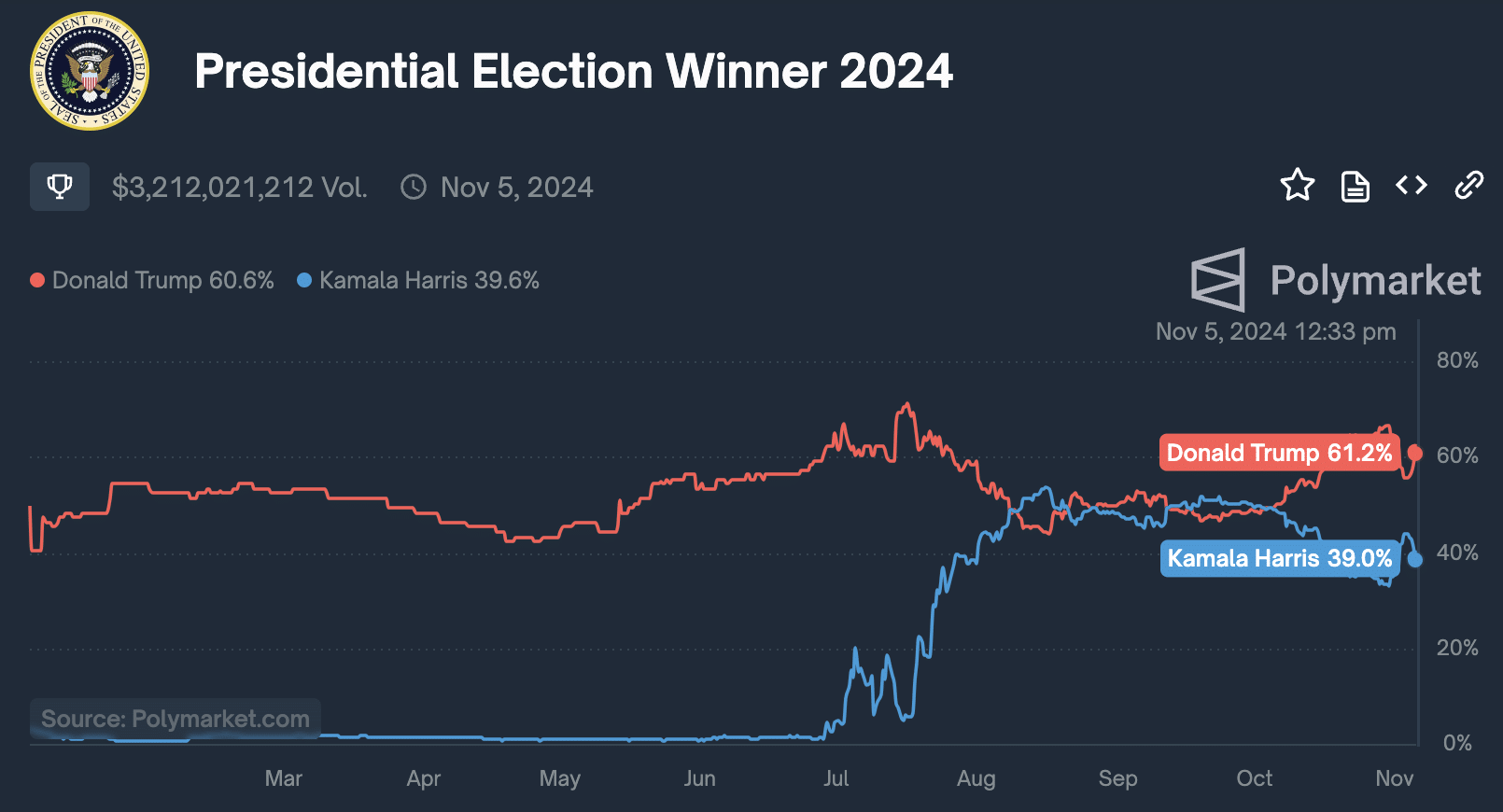

On the prediction market platform, Polymarket, approximately $3.21 billion worth of trades are being made as users place their bets on who will win the November elections. Interestingly, Donald Trump, a former U.S. President and Harris’ opponent, is currently leading the predictions with 61.1% of the total wagers in his favor.

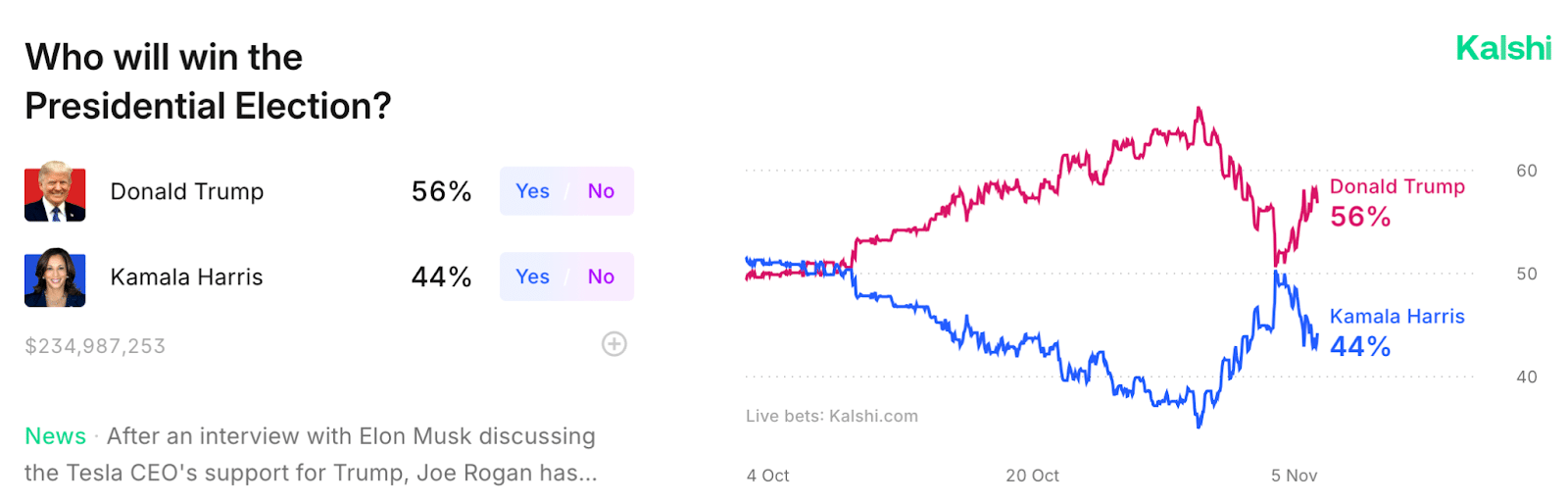

In a U.S. Commodity Futures Trading Commission-regulated prediction market, the probability of Trump winning is estimated at 56.8%, while Harris’ chance stands at 43.2%. As of November 5, 2024, this betting contract has attracted $234.98 million in investments.

The efficacy of betting markets in predicting a winner in the election remains debatable, however it sheds light on the sentiment among crypto traders.

Trump garnered crypto enthusiasts’ backing by advocating a supportive regulatory stance towards cryptocurrencies, as well as his address at the Nashville Bitcoin Conference. The ex-U.S. President outlined his vision for a national Bitcoin reserve and suggested boosting U.S. dominance in Bitcoin mining. According to Trump’s proposal, the United States would retain all the Bitcoin it owns.

Harris’ “Opportunity Agenda for Black Men” represents Vice President Harris’ perspective towards cryptocurrency, albeit providing only an outline, it suggests a cautious strategy regarding this financial asset class.

On Tuesday, U.S. stock markets will close early due to vote counting, but it’s important to note that this rule doesn’t apply to cryptocurrency markets. Interestingly, if Trump wins the election, some analysts predict that Bitcoin could approach the $80,000 mark based on data from BTC derivatives markets.

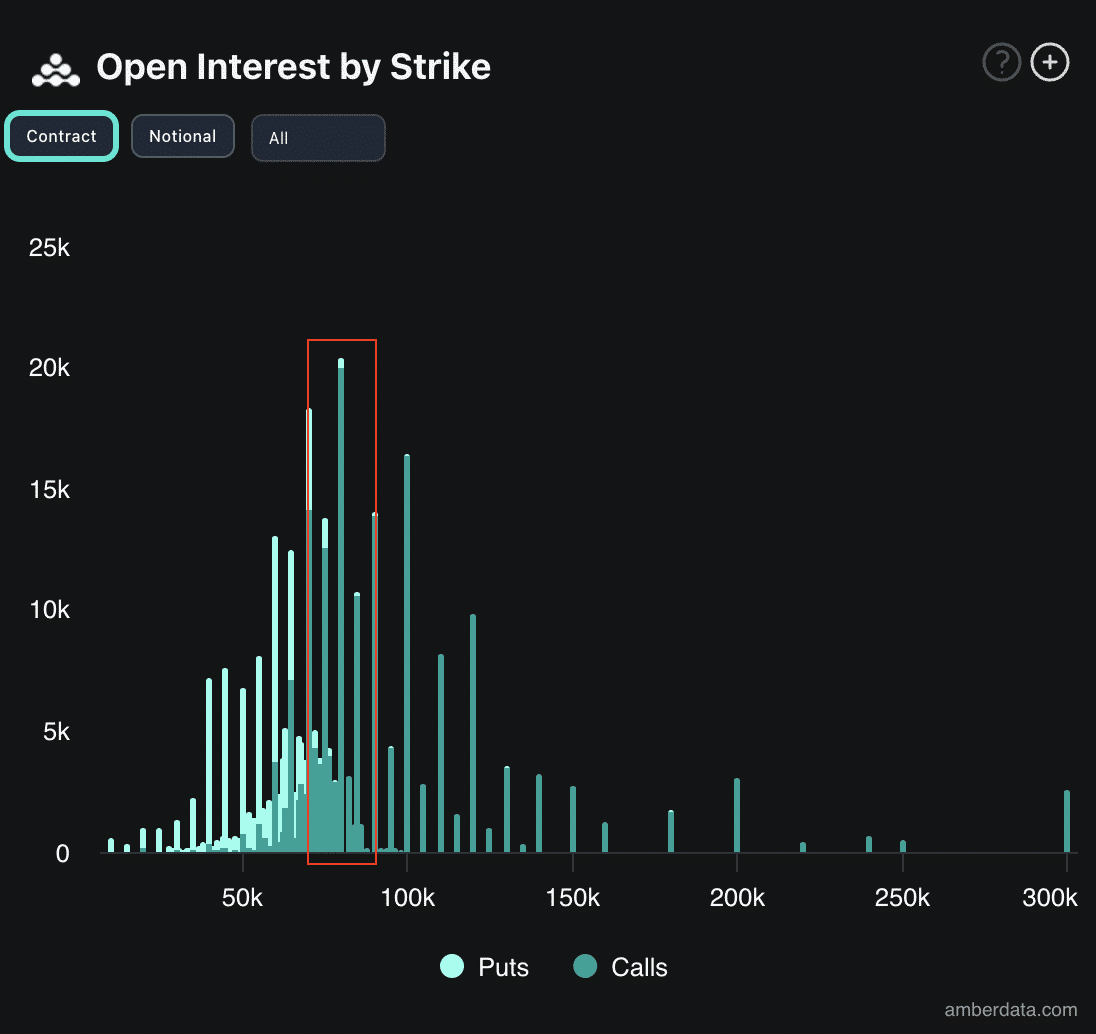

Derivatives data points at a run to the range between $60k – $80k

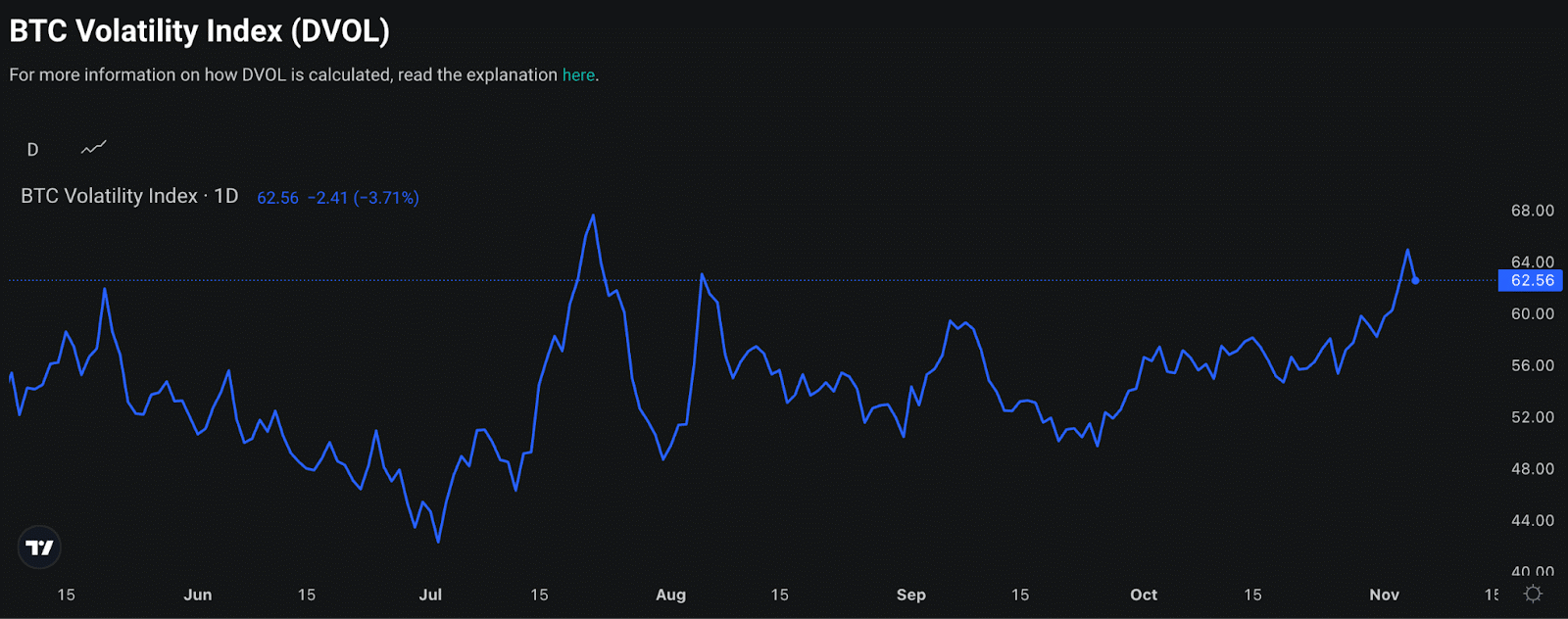

Since September 26, 2024, Deribit’s Bitcoin Volatility Index has been steadily increasing, but it hasn’t yet reached the significant surge observed during key events such as President Joe Biden leaving office in July or the U.S. stock market correction in August.

During the timeframe after the elections, data from Deribit exchange indicates that the $60,000 to $80,000 range attracted the highest number of active futures contracts, encompassing both optimistic (bullish) and pessimistic (bearish) trades by traders.

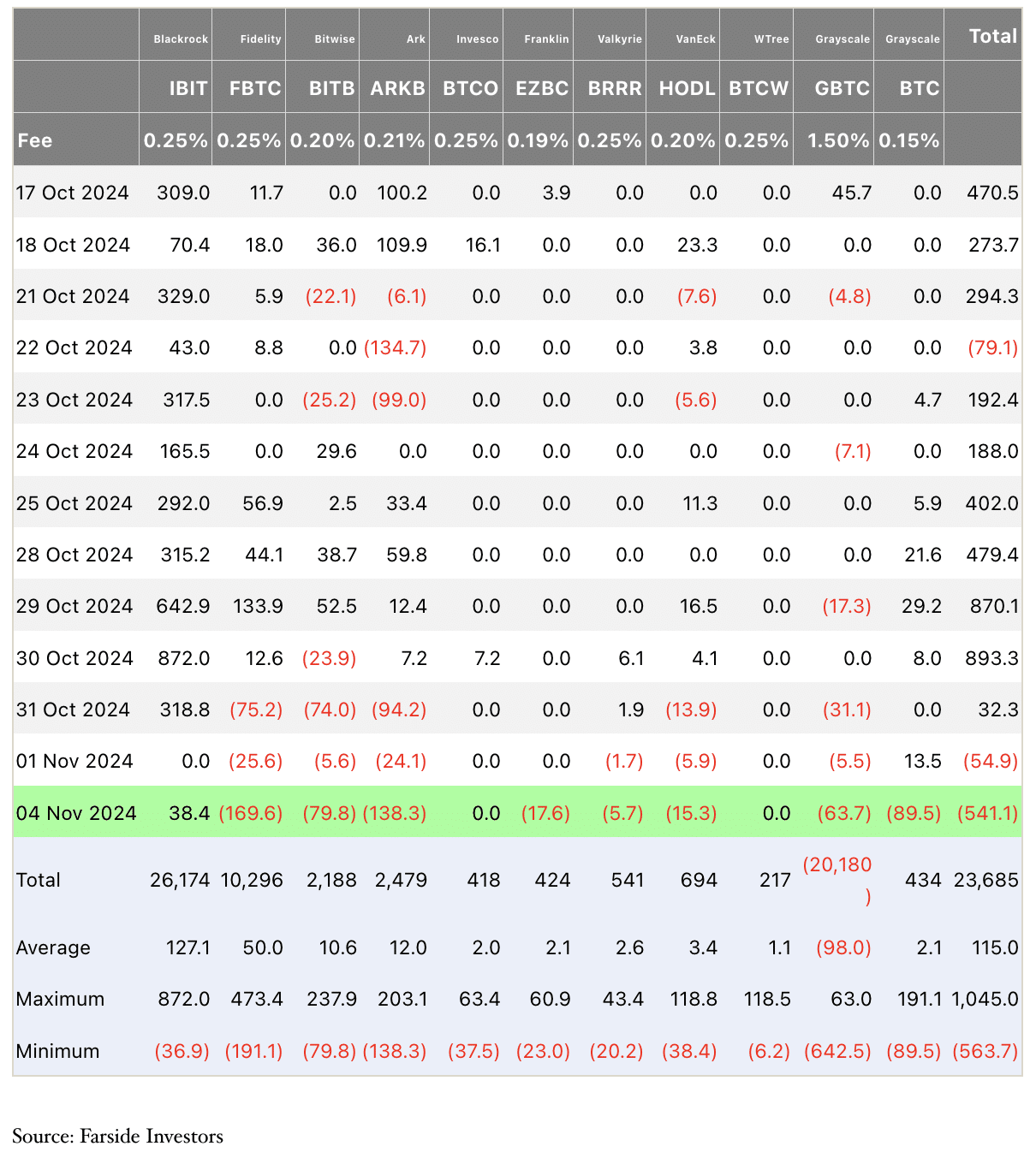

Data from Farside Investors indicates that Bitcoin Spot Exchange Traded Fund experienced a net withdrawal of approximately $541.10 million on November 4th. This is the second day in a row where institutional investors have been withdrawing funds from the asset, possibly anticipating market volatility following the election and preparing accordingly.

By examining information from both prediction markets and Farside Investors’ Bitcoin ETF transactions, it appears that institutional investors exhibited optimism towards Bitcoin, boosting their investments significantly when it seemed likely that Trump would win, with approximately 67% chance on October 30th. On the same day, Bitcoin ETFs recorded a total of $893.3 million in inflows.

In March, Bitcoin reached its record peak of $73,738 due to a significant influx of capital into U.S.-based Spot Bitcoin Exchange Traded Funds (ETFs). Currently, as I write this on Tuesday, November 5th, the price of Bitcoin is hovering near the $69,000 mark, which is just under 10% shy of its all-time high.

Technical analysis: Bitcoin eyes rally to new ATH

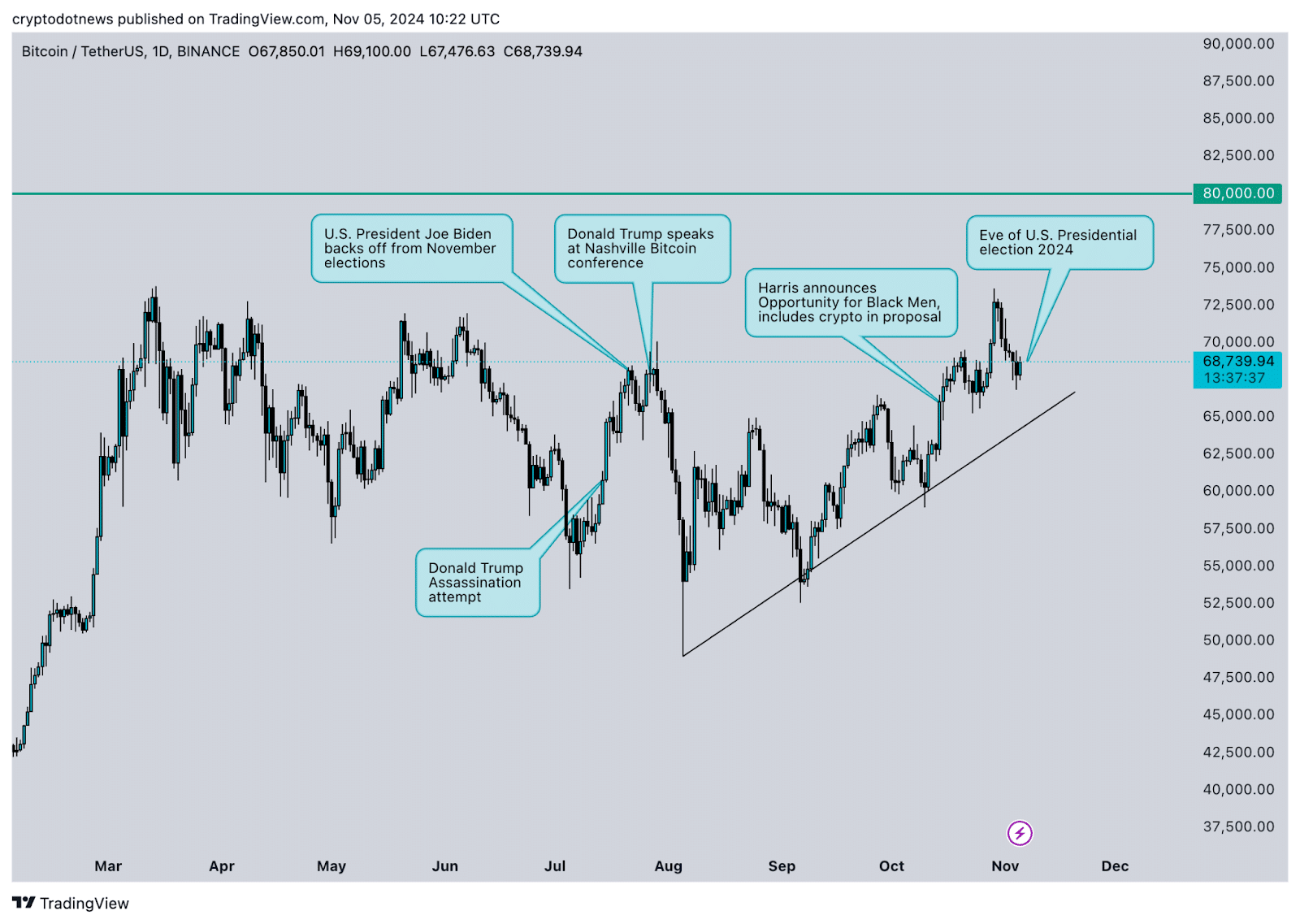

Since July 2024, significant developments have contributed to the fluctuations seen in Bitcoin. A close look at the BTC/USDT daily chart from TradingView reveals that Bitcoin has been trying to reach its prior record peak following Harris’s declaration of her cryptocurrency plan.

Derivatives data highlights the importance of the $60,000 to $80,000 range for Bitcoin price. The asset traded within this range throughout the events since July, with the exception of its August 5 decline to $49,000.

Bitcoin has been on an upward trend recently, starting from August 5th, and there’s a possibility it might continue to rise, reaching new highs and lows. If the trend continues after the elections, we may see further gains. The previous all-time high of $73,738 serves as a significant barrier for Bitcoin. Overcoming this level could propel BTC towards its projected target of $80,000.

Bitcoin is still undervalued ahead of the election

Crypto.news talked to experts ti get insights on Bitcoin price.

Today marks the U.S. Election, and some people think that the victorious candidate’s viewpoint on cryptocurrency could instantly influence its value due to differences in their perspectives about digital assets. Trump has been generally accepting of digital assets compared to Harris. However, while this could be valid in the immediate future, traders should take into account that the price of crypto is influenced by more than just party support. Instead, it heavily depends on policies related to inflation, global political debates, and the accessibility of investment opportunities within the cryptocurrency market.

BingX spokesperson

According to a BingX executive, this recent cycle has been particularly poor in terms of performance after the Bitcoin halving, which suggests that the price of Bitcoin may still be lower than its true value.

Considering the trends in other market sentiment indicators, crypto-related stocks have been increasing recently. Specifically, MicroStrategy and Robinhood have both seen gains in the month leading up to today’s election. Historically, this pattern might suggest a potential increase in the price of digital assets.

“Should the chosen candidate be favorable towards cryptocurrencies, this could strengthen market trust; otherwise, it might introduce some doubt. This doubt about the election results could lead to fluctuations in the market. Therefore, investors should keep a close eye on election news and market responses, and be ready to handle risks appropriately.

Ryan Lee, Chief Analyst at Bitget Research

In simpler terms, Thielen points out that while politics might not play a significant role, major events or trends are usually the primary causes of a bull market. As an example, he suggests it’s unlikely that your neighbor would start using Bitcoin to buy contraband on the Silk Road exchange just because the Federal Reserve Chair lowered interest rates in 2011. Therefore, trying to find a direct link between political election outcomes and Bitcoin price fluctuations may not be the most accurate approach.

Markus Thielen, CEO at 10x Research

The executive argues that the primary driver of the Bitcoin rally is the institutional adoption of BTC, sparked by BlackRock’s application for a Spot BTC ETF earlier this year.

Read More

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- Gold Rate Forecast

- USD MXN PREDICTION

- USD JPY PREDICTION

- Brent Oil Forecast

- EUR CNY PREDICTION

- Castle Duels tier list – Best Legendary and Epic cards

2024-11-05 23:18