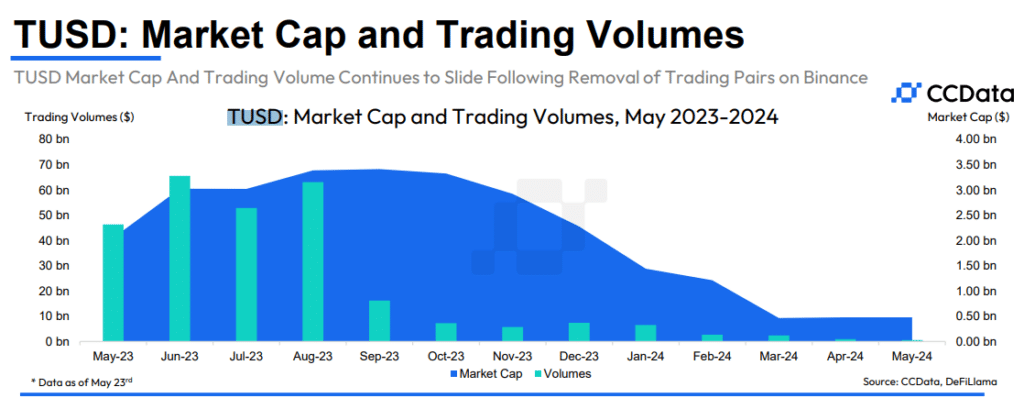

As a seasoned crypto investor who has closely followed the market since its inception, I’m deeply concerned about the recent developments surrounding TrueUSD (TUSD) and its association with Justin Sun. The near-80% decline in TUSD’s market capitalization following Binance’s decision to delist several trading pairs is a significant blow for investors like me who have trusted this stablecoin as a reliable store of value.

As a crypto investor, I’ve noticed that the market cap of my stable investment in TrueUSD (TUSD), which is linked to Justin Sun, took a significant hit – approximately 80% – following Binance‘s decision to delist several trading pairs with this stablecoin.

As a financial analyst at CCData, I can share that my team and I have uncovered some significant developments regarding TrueUSD (TUSD), the stablecoin issued by TrustToken, which is now known as Archblock. Following this announcement, TUSD experienced a substantial decrease of approximately 78.9%. This decline was primarily due to several TUSD trading pairs being removed from Binance, a prominent cryptocurrency exchange platform.

CCData’s newest study on stablecoins reveals that the monthly trading volume for TUSD pair transactions on central exchanges has decreased to approximately $569 million. This is a significant drop of almost 99% compared to May 2023 figures.

As an analyst, I’d interpret the data as follows: Among all exchanges dealing with TUSD pairs, Binance holds the largest market share at approximately 68.2%. WhiteBit and BitMart come in second and third place, respectively, with a market share of around 13.4% and 5.32%. In an effort to increase adoption of TUSD, Bitci has recently introduced a promotional offer featuring zero trading fees for the TUSD/TRY pair.

CCData

Experts observed that the combined worth of stablecoins expanded by 0.63% in May, reaching a total value of $161 billion. This represents the eighth consecutive month of growth and an all-time high since April 2022. The uptick indicates a rebound in the stablecoin sector which had experienced a 17-month slump following the demise of TerraUSD, as reported by CCData.

In March 2018, TrustToken, a company founded by Rafael Cosman, Stephen Kade, Jai An, and Tory Reiss, introduced TrueUSD as a stablecoin offering. TrueUSD aims to provide transparency and legal protection, with each token being backed by the U.S. dollar in full collateral. This design intends to maintain a consistent value for the coin. However, the removal of TrueUSD from Binance and challenges faced with custodian Prime Trust have resulted in several instances where its value has deviated from that of the U.S. dollar, fueling doubts about its dependability.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- USD CNY PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-05-30 14:44