According to Bank of America, the United States economy might face turbulence upon Donald Trump’s inauguration, even with robust job creation and retail sales figures being released. This prediction has sparked fresh interest in the potential prosperity of the cryptocurrency market. What does the future hold for it?

Based on Jinshi’s reports, Bank of America stated on January 20th that employment figures, retail sales, and core inflation are robust, with a core inflation rate of 3.2%. This higher-than-expected inflation figure indicates that the Federal Reserve has limited flexibility to lower interest rates any further.

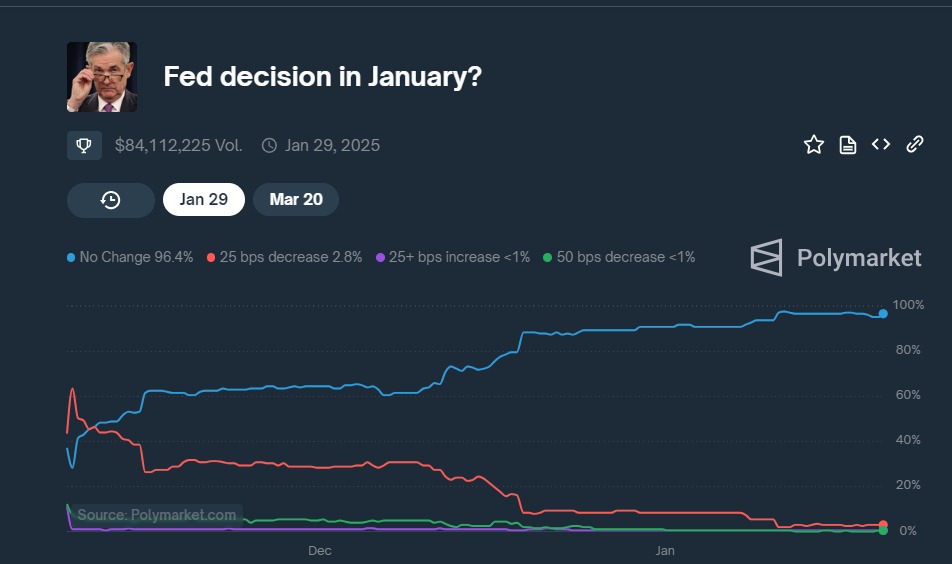

In December 2024, the Federal Reserve (Fed) decreased interest rates by a quarter of a percent, marking the third consecutive adjustment since September. This followed reductions of a similar magnitude in November and a half percentage point reduction earlier in September. Fed Chair Jerome Powell indicated during the December meeting that no more rate cuts would be made unless there’s an improvement in economic data.

The overwhelming majority of bettors on Polymarket, approximately 96%, seem to oppose the idea of a further interest rate reduction in January, as indicated by their votes.

In light of the upcoming presidency and potential return of Trump-style policies, Bank of America cautions that there might be significant uncertainties in both security and fiscal matters. These uncertainties could potentially impact economic decision-makers in varying ways.

Trump’s Protectionist policies

Government measures, like imposing tariffs or taxes on imported goods, or limiting trade with other countries, are called protectionist policies. These policies aim to shield domestic industries from competition by foreign companies.

During Donald Trump’s first term, various factors significantly influenced the stock market. For example, tariffs on Chinese goods and steel provided an edge to U.S. manufacturers facing less competition. However, these tariffs increased costs for companies reliant on imports, such as automakers and tech firms (as reported by the Tax Foundation in May 2024). These ongoing fluctuations directly impacted market trends, particularly during the trade conflict with China.

According to additional reports from Reuters, there’s a possibility that Trump’s potential comeback could impose a 60% tariff on Chinese goods, which might negatively impact the economy. This could lead to increased prices and create uncertainty for investors operating in the international market.

What is in for the crypto market?

The direction of cryptocurrencies in the future will be significantly influenced by both Trump’s economic policies and the Federal Reserve’s decisions. Although protectionist policies typically impact traditional financial markets via inflation, supply chain interruptions, and investor confidence, they can also indirectly affect crypto markets.

Generally speaking, protective policies tend to increase the prices of products and services, as these added expenses are often transferred to the customers by businesses.

If inflation persists at high levels, it’s expected that Bitcoin (BTC) will grow more attractive, given its reputation as an asset for protecting against inflation. This could be particularly true since the president has shown strong backing for Bitcoin as a reserve. In addition, if the Federal Reserve decides not to lower interest rates to control inflation, cryptocurrencies may become increasingly popular as a means of storing value.

In my analysis, while there’s a general optimism among peers regarding the potential creation of a Bitcoin Reserve, it’s important to note that not everyone in the crypto market shares this sentiment. As of January 20th, the collective confidence among Polymarket voters stands at approximately 57%, suggesting that they are not entirely convinced that a Bitcoin Reserve will materialize within the next 100 days.

Historically, whenever the U.S. felt its economic supremacy was under challenge on a global scale, gold prices tended to rise, and conversations about the gold standard regained popularity.

In the late 1990s, Peter Schiff advocated for gold as the authentic currency form, much like today’s equivalent…

— Ki Young Ju (@ki_young_ju) December 28, 2024

In addition, Trump’s favorable stance towards cryptocurrencies might encourage institutional investment in digital currencies by advocating for pro-cryptocurrency legislation, thereby reducing legal challenges faced by cryptocurrency exchanges – a trend that was more prevalent during the Biden administration.

Overall, although protective tariffs on tech products might increase their costs and potentially stunt the advancement of blockchain technology, Trump’s pro-cryptocurrency viewpoint could counterbalance this to some extent by fostering the expansion of the crypto sector.

Read More

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- Gold Rate Forecast

- USD MXN PREDICTION

- USD JPY PREDICTION

- Brent Oil Forecast

- EUR CNY PREDICTION

- Castle Duels tier list – Best Legendary and Epic cards

2025-01-20 13:14