As a seasoned investor with over two decades of experience in the financial markets, I have witnessed numerous black swan events that have significantly impacted various asset classes. However, the recent assassination attempt on Donald Trump has left me particularly intrigued by the crypto market’s response.

After Trump’s shocking shooting, the crypto market has seen some surprising developments.

In the sun-kissed saturday of Pennsylvania, an unforeseen incident transpired: Donald Trump, the ex-president of the US and a notable backer of cryptocurrencies, got wounded in his right ear during one of his political gatherings.

After the unexpected incident, I, as part of Trump’s campaign team, reassured the public of his good health. I declared that he was “doing just fine” and expressed his enthusiasm for attending the Republican National Convention in Milwaukee.

Appears he’s ok; pumping his first here. My lord, this is crazy

— @jason (@Jason) July 13, 2024

The heightened interest and extraordinary character of this event have caused a notable change in investors’ attitudes towards the market. With Trump, who is well-known for his supportive views on cryptocurrencies, seeing an uptick in chances for a political resurgence.

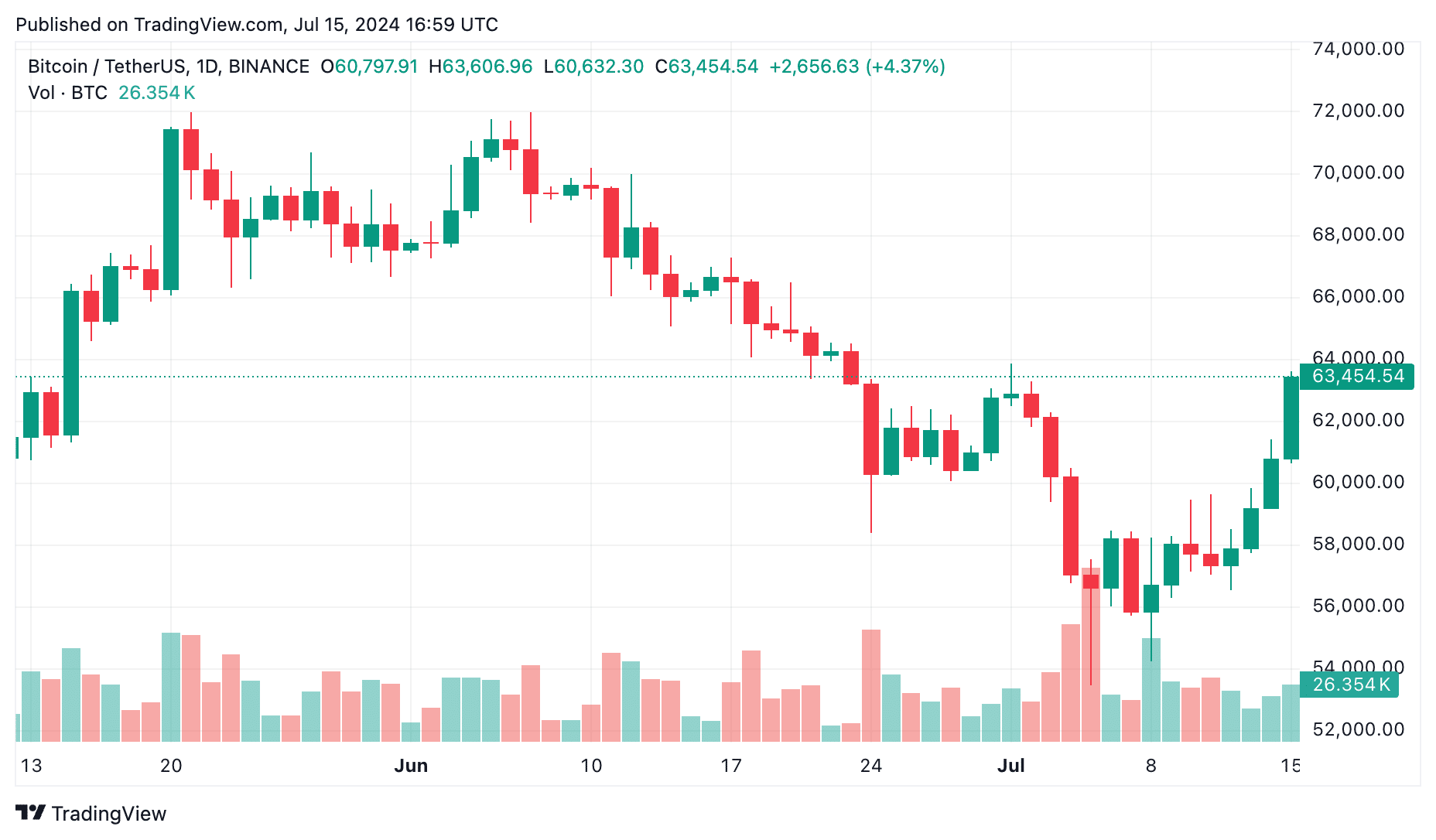

The crypto market has experienced a significant boost due to positive developments. Prior to the announcement, Bitcoin‘s price was hovering around $58,000. Following the news, however, BTC reached a peak of $63,218. Currently, on July 15, Bitcoin is steadily holding at $63,154, representing a 5% increase in value within the last 24 hours.

As a crypto investor, I can’t help but be excited about Bitcoin’s recent price rebound. This uptick in value is significant because it has now surpassed the important 200-day simple moving average (SMA). For me and many other traders, this is a positive sign indicating that the long-term trend may be shifting upwards. It’s like seeing a green light after a long period of uncertainty.

The positive outlook towards cryptocurrencies extends beyond Bitcoin, as the overall crypto market experiences a revival. The combined value of all cryptocurrencies has surged by almost 5%, bringing the total market capitalization to approximately $2.29 trillion.

Ethereum (ETH) saw a significant surge of approximately 5.5%, reaching roughly $3,350 in value. Additionally, various altcoins such as Mogcoin (MOG), Pendle (PENDLE), and Stacks (STX) experienced substantial growth, with each coin recording gains of over ten percent.

Let’s dig deeper into the prevailing attitudes towards this occurrence, investigate emerging patterns, and scrutinize the perspectives of experts and investors.

Trump’s resurgence and Crypto’s fate

Trump has more recently expressed supportive views on cryptocurrencies in an attempt to win over the crypto community and distinguish himself from his opponent, Joe Biden, who is perceived to have less favorable regulatory stances.

Trump not only endorses the local blockchain and cryptocurrency industry but also incorporates it into his political endeavors. His campaign welcomes crypto donations, and should he secure another term in office, he intends to advocate for Bitcoin mining.

Despite the assassination attempt, Trump’s determination to connect with the cryptocurrency world continues unwavering. He is slated to deliver a speech at the Bitcoin 2024 conference in Nashville towards the end of this month, according to the event organizers.

I’m thrilled to announce that I’ve confirmed Donald Trump’s intent to deliver his speech in person at Bitcoin 2024. As a researcher studying the intersection of technology and politics, I’m proud to facilitate this engagement between Trump and the global Bitcoin community. We share a common belief in the power of decentralized systems and the importance of free speech and democratic values.

— The Bitcoin Conference (@TheBitcoinConf) July 14, 2024

Based on the news, Trump’s presence at the conference is believed to generate approximately $15 million in donations from contributors. David Bailey, the CEO of Bitcoin Magazine, reportedly made several appeals to Trump and his associates to attend the event.

At present, there’s a noticeable shift in public opinion regarding Trump’s potential win in the upcoming presidential election, as indicated by Polymarket, a decentralized betting platform. Around 71% of its users now wager on Trump’s victory – a significant rise from approximately 60% following the shooting incident.

Instead, President Joe Biden’s prospects of victory are just 18%, which is significantly lower than the 72% for the other candidate.

Last week, Bitcoin ETFs experienced an inflow of approximately $1.4 billion, which represents the fifth largest weekly influx since their creation in early 2024. This trend coincides with speculation surrounding the possible return of Trump to power.

Last week, US-listed Bitcoin Exchange Traded Funds (ETFs) recorded a significant influx of approximately $1.4 billion, marking the fifth largest weekly inflow on record.

— Bitcoin Magazine (@BitcoinMagazine) July 15, 2024

Speculations and support on social media networks

Following the assassination attempt on Donald Trump, there have been noteworthy advancements in the cryptocurrency market, most notably on the Solana (SOL) blockchain, generating much excitement within the community.

As a crypto investor, I’ve noticed an influx of meme coins on the Solana blockchain recently. Platforms like Pump.fun have made it simple for users to create and launch their own tokens, fueling this trend.

After the occurrence, a wave of fresh meme coins inspired by it has arisen. For instance, “The Ear Stay Up” and “Trump vs Gun,” among others, have garnered significant market interest, amassing large market caps in just hours following the incident.

Michaél van de Poppe, a renowned cryptocurrency analyst, pointed out that Germany has completed unloading its Bitcoin stocks, potentially easing market pressure causing downward trends.

Germany has completed its Bitcoin transactions. The global environment is growing more turbulent following the assassination attempt on Trump. Consequently, Bitcoin is primed for a persistent upward trend. The Ethereum ETF is set to debut this week, and its value is climbing once more.

— Michaël van de Poppe (@CryptoMichNL) July 15, 2024

The current global instability, accentuated by the assassination attempt, provides an advantageous context for Bitcoin’s growth. Moreover, the imminent Ethereum ETF debut might add fuel to the crypto market’s upward trend.

The Stockmoney Lizards described the Trump assassination attempt as an extraordinary and unforeseen incident, carrying significant repercussions. Remarkably, they believed this unusual occurrence could lead to profits within the cryptocurrency market.

#Bitcoin

We have indeed witnessed a true black swan event with the #Trump assassination attemp. This will be the first black swan to lead to gains in the crypto market.Trump’s presidency is not yet priced in.

— Stockmoney Lizards (@StockmoneyL) July 14, 2024

Based on current assessments, Bitcoin’s price has not fully accounted for the potential of a Trump presidency comeback. This leaves open the possibility for additional gains as political developments unfold.

Bitcoin Magazine reported a change in stance from Larry Fink, the CEO of BlackRock, regarding Bitcoin. Previously critical of the cryptocurrency, Fink has since developed a strong conviction following intensive examination, notably after BlackRock introduced its own Bitcoin spot Exchange-Traded Funds (ETFs) in January.

JUST IN: BlackRock CEO Larry Fink says he is a major believer in #Bitcoin after studying it.

— Bitcoin Magazine (@BitcoinMagazine) July 15, 2024

As a crypto investor, I view his endorsement as a positive sign for the market. Given BlackRock’s significant influence in the financial world and the increasing adoption of Bitcoin by institutional investors, this endorsement indicates a growing acceptance and confidence in the digital asset.

As the market surges forward in a bullish trend, it’s crucial to exercise caution. The influxion of meme coins could trigger bubbles susceptible to popping unexpectedly, resulting in substantial and swift losses.

It’s important to conduct comprehensive research rather than relying solely on market trends fueled by current news.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-07-15 20:15