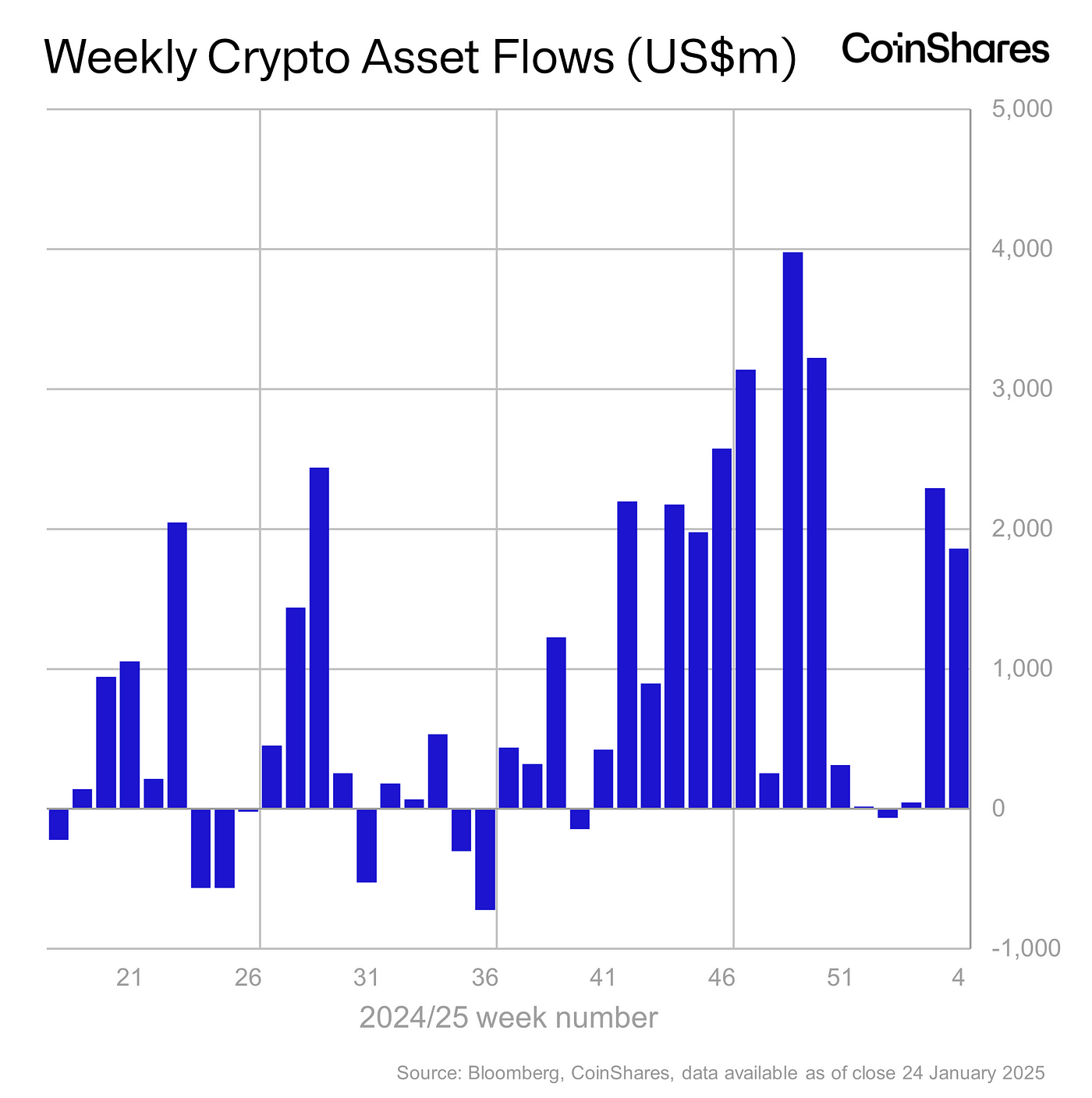

So, let me get this straight: $1.9 billion just flowed into crypto ETF products last week. And why? Because Trump decided to back some Bitcoin reserve idea. I mean, really? Is this what we’ve come to? 🤔

Almost $2 billion in crypto investment products last week alone! That brings the year-to-date total to a whopping $4.8 billion. CoinShares, in their infinite wisdom, decided to share this revelation on January 27. Thanks, guys! 🙄

Bitcoin (BTC) is still the king, pulling in $1.6 billion last week. That’s 92% of the total inflows! It’s like the popular kid in school who just can’t stop getting attention. Year-to-date, it’s raked in $4.4 billion. Meanwhile, Short-Bitcoin ETFs saw a measly $5.1 million. Probably just traders getting ready for the inevitable market pullback after Bitcoin’s latest ego trip. 😏

The U.S. is leading the charge with $1.7 billion in inflows. Canada? A paltry $31 million. Switzerland and Germany? $35 million and $23 million, respectively. I mean, come on! What are they doing over there? 🥴

Ethereum (ETH) made a comeback with $205 million in inflows after a rocky start. XRP? $18.5 million, still riding high after its all-time high last week. And the smaller altcoins? Solana (SOL) brought in $6.9 million, Chainlink (LINK) saw $6.6 million, and Polkadot (DOT) added $2.6 million. James Butterfill from CoinShares pointed out that “no digital asset investment products saw outflows last week.” Shocking, right? 😲

Now, trading volumes on centralized exchanges shot up to $25 billion, making up 37% of the activity on trusted crypto exchanges. Butterfill called it one of the most significant weeks in recent memory. Really? I mean, what’s next? A parade for Bitcoin? 🎉

But wait, there’s more! There’s still a debate about how smoothly Bitcoin will be adopted as a reserve asset. Pierre Rochard from Riot Platforms accused Ripple of leading a lobbying push against the Strategic Bitcoin Reserve. Apparently, they’re spending millions to block it. Sounds like a soap opera, doesn’t it? 📺

Rochard claims Ripple is defending its XRP narrative while pushing for state-backed digital currencies. And let’s not forget Ripple’s previous digs at Bitcoin mining under the Biden administration. Ripple CEO Brad Garlinghouse, of course, had to jump in, saying their efforts align with the Biden administration’s goals. Sure, buddy, whatever you say! 🙃

Read More

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Grimguard Tactics tier list – Ranking the main classes

- PUBG Mobile heads back to Riyadh for EWC 2025

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- Castle Duels tier list – Best Legendary and Epic cards

- Silver Rate Forecast

- Cookie Run Kingdom: Lemon Cookie Toppings and Beascuits guide

2025-01-27 13:15