Ah, World Liberty Financial (WLFI), that grand crypto investment firm, proudly backed by none other than Donald Trump himself, has found itself in a rather unfortunate predicament. Over the weekend, it was as if the heavens themselves conspired against it, delivering a series of blows that would make even the most stoic investor weep into their morning coffee. 🥲

From the 19th to the 31st of January, WLFI, in its infinite wisdom, poured a staggering $242.77 million into the volatile abyss of cryptocurrencies. Alas, the market, in its capricious nature, decided to take a nosedive, leaving the firm with a 21% depreciation. A loss of $51.77 million, unrealized but no less painful, as if a thief had crept into the vault and made off with a king’s ransom. 💔

Ethereum (ETH), the crown jewel of WLFI’s portfolio, suffered a 24.45% drop, slashing $36.67 million from its value. Wrapped Bitcoin (WBTC) fared no better, tumbling 12.07% and losing $8.07 million. But the true pièce de résistance was Ethena (ENA), which plummeted a jaw-dropping 43.72%, wiping out over $2 million in a single, dramatic swoop. 🎭

Other holdings, such as TRON (TRX), AAVE, and Chainlink (LINK), joined the chorus of despair, each contributing their own somber notes to the symphony of loss. The crisis deepened, as if the very foundations of WLFI’s empire were crumbling beneath it. 🏰

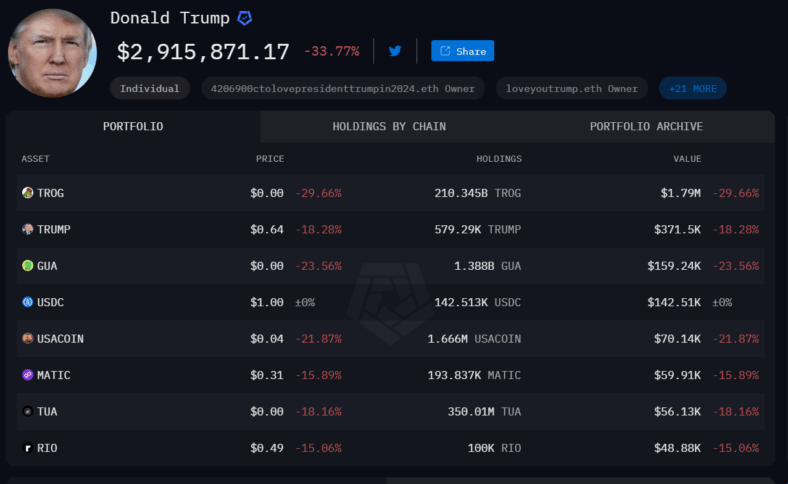

And what of the president’s personal crypto portfolio? Ah, it too was not spared. His beloved memecoin, once the pride of his digital wealth, has fallen 64% in value since January 20, reducing his overall crypto fortune to a mere $20 billion. Even his donated crypto holdings, largely composed of memecoins, have dipped below $5 million. A tragic fall from grace, indeed. 😢

The cause of this calamity? A combination of economic and political events that sent shockwaves through the entire crypto market. Analysts point to Trump’s newly imposed tariffs as the catalyst for the collapse, which wiped out nearly $500 billion in market value. Some argue that the fall was inevitable, given the overheated market conditions, but the tariffs certainly hastened the sell-off. “The crypto market was already teetering on the edge of disaster,” remarked one expert, “and the tariffs were the final push over the cliff.” 🏞️

And so, the tale of WLFI and Trump’s crypto empire serves as a cautionary reminder of the fickle nature of fortune. One moment, you’re riding high on the waves of success; the next, you’re drowning in a sea of red. Such is life in the world of cryptocurrency. 🌊

Read More

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- Gold Rate Forecast

- USD MXN PREDICTION

- Brent Oil Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Castle Duels tier list – Best Legendary and Epic cards

2025-02-03 18:45