Ah, dear reader! Since its grand entrance upon the stage in the merry month of March, the stablecoin named USD1 — conceived by the cunning minds of World Liberty Financial — hath astonished the public with a market capitalization truly worthy of applause! Yet, should our brave creators desire to triumph beyond their native shores and tread with flair upon European soil, they must dance a complex minuet called MiCA compliance. What jests await!

In a delightful tête-à-tête with BeInCrypto, the wise sages from Foresight Ventures, Kaiko, and Brickken did declaim the need for stout European bank reserves, limits on operations to shield the euro’s dignity, and the shining light of transparency to avoid the unseemly scandals of conflicted interests. Oh, the intrigue! 🎭

USD1’s Quest for Dollar Supremacy: Trump’s New Pet Project?

The decentralized fiefdom known as World Liberty Financial, linked to the illustrious Trump lineage, proudly announced the birth of USD1 just one moon ago. This token aspires, nay, vows to spread the dollar’s dominion like wildfire across the lands.

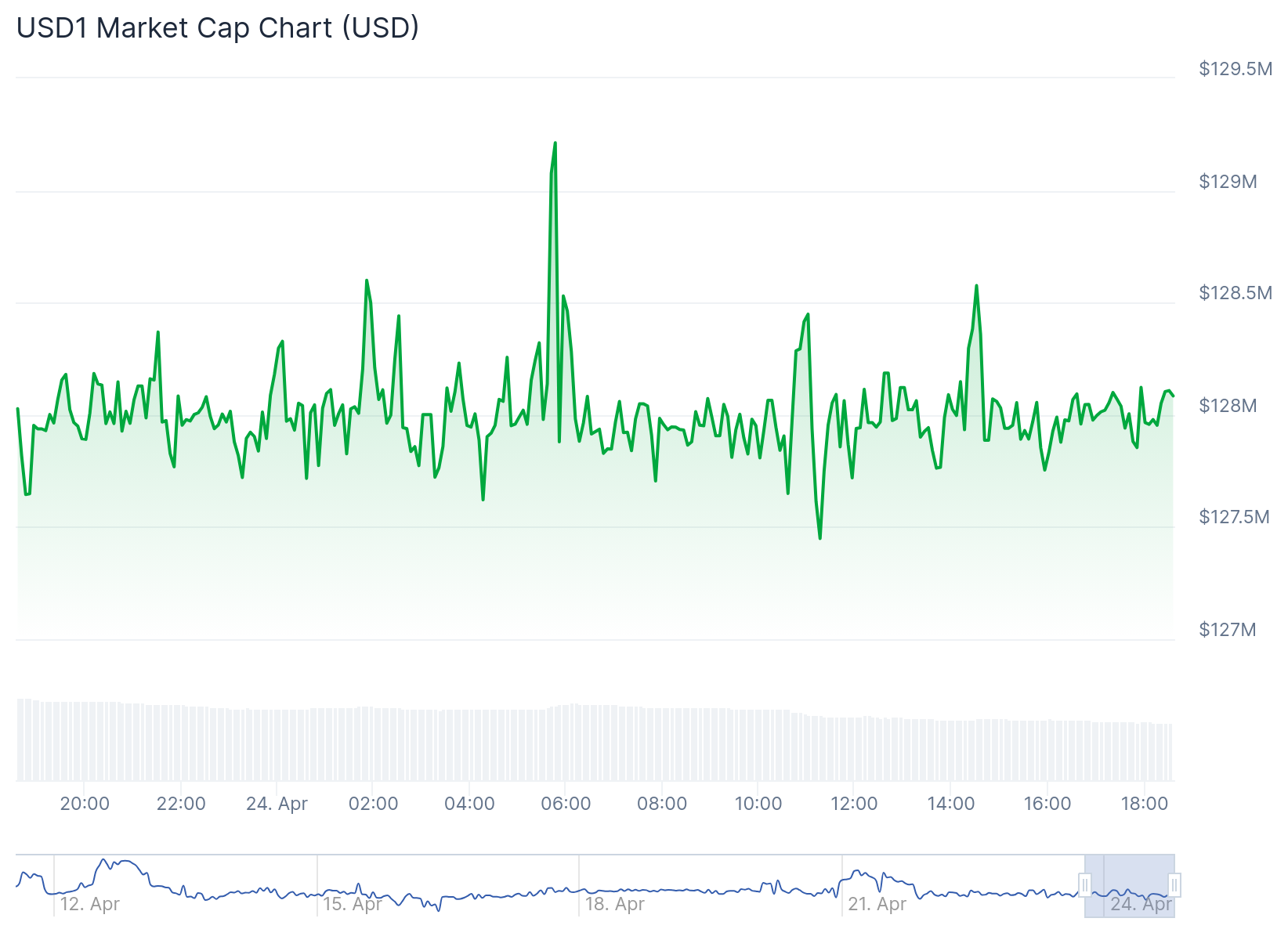

Lo and behold! According to the oracle CoinGecko, USD1 doth boast a treasure hoard of $128 million and daily trade worth $41.6 million — a veritable banquet of tokens, fully sown and scattered upon the market fields.

Yet, time presses, for the bloated dragons of USDT and USDC fiercely guard their realms. To outpace these giants, USD1 must not only hurry but do so with cunning wit. The euro’s ghost looms large, too, demanding respect and competitors’ vigilance.

Should our hero set sights upon Europe, a labyrinth of challenges — as tangled as a playwright’s plot — awaits them.

MiCA’s Iron Fist Grips the Stablecoin Stage

The venerable European Union, ever the stern dramaturg, hath penned a grand script named MiCA — Markets in Crypto-Assets — governing the show across 27 kingdoms. For nearly four months, this law hath commanded obedience with a vigor unmatched.

“Stablecoins must bear backing as full as a king’s treasury with liquid assets, submit themselves to strict chronicles of reporting, and abide by a cap of one million daily transactions if their currency is foreign. A generous portion of their gold (30% to 60%) must rest in the vaults of EU-sanctioned banks,” declares the learned Dessislava Ianeva-Aubert.

There is nary a wiggle-room for flights of fancy here; USD1 must acquiesce to each decree of this sovereign script to woo a European audience of over 31 million users.

Political Theater: Senators Cast Shadows upon the Stage

Alas, the spotlight on USD1’s creator, President Trump himself, cast a conspicuous shadow. Mere days after announcing their creation, a troupe of senators, led by the fierce Elizabeth Warren, delivered a missive to the Federal powers, seeking to unmask the regulatory entanglements.

The nobles warn: “A president who both commands the realm and benefits from a treasure tied to his name risks the very order of the financial kingdom!”

“This spectacle, unseen before, may rattle the public’s trust and mar the noble art of governance,” they proclaimed.

And lo, USD1 is still fumbling its scrolls of transparency — a poor showing before the stern eyes of MiCA.

When Conflicts Arise, the Comedy Turns Tragic

Kaiko’s wise Ianeva-Aubert reveals, “Without a clear partition betwixt rulers and servants, the realm’s rules may too easily be twisted. Without vigilance, USD1 risks stumblings in the grand MiCA dance.”

Though promises of partners like BitGo shimmer, no clear proof of anti-trickery measures such as market watchers and trade detectives have yet been unveiled.

In the court of transparency, USD1 currently plays the jester poorly.

Ah, But the EU’s Reserve Demands: A Gilded Cage for Coins

Asked about the mightiest obstacle to MiCA’s favor, experts nod knowingly: “Take your reserves to European banks, or falter!”

‘Tis a burdensome decree, often a thorn in the corporate side—Lower interest, tighter coffers, a game of hoops worthy of the Commedia dell’arte.

“Circle’s USDC had to bend the knee, setting up an EU branch and lodging reserves in regulated banks. Surely, USD1 must prepare for similar trials.”

But Forest Bai, a visionary from Foresight Ventures, whispers a hopeful tune: “Being the little fish in a pond, USD1 might yet evade the traps set for larger beasts.”

Protect the Euro! MiCA’s Device of Volume Caps

To shield the lady euro’s pride, MiCA imposes caps on transaction volumes for foreign coins, lest the continent’s financial heart faces a mortal blow.

“When usage exceeds one million transactions per day or €200 million in daily turnover, issuance must halt, and regulators clamor for a plan to mend the breach,” Elisenda Fabrega declares with a flourish.

This decree renders the dream of unfettered growth in Europe a rare comedy indeed for USD1.

Stablecoins Beware: No Interest, No Gain, No Glory 🎭

Européen law forbids these coins from promising interest or gifts for patience — keeping them steadfastly in the realm of payment instruments rather than investment toys.

“No sweet yields, no artistic returns, no playing the markets like a naughty harlequin,” Fabrega laments, “lest they risk being cast out or shuffled under strict supervision.”

To EU or Not to EU? WLF Ponders the Market’s Lure

Though the EU boasts millions of crypto enthusiasts, far grander crowds throng in Asia and the New World.

“For a fledgling as USD1, warming to the less encumbered lands of Asia and Africa might better suit ambition’s wings, leaving the EU’s complexities for another act,” Bai muses wisely.

Thus, the plot thickens—where to spread their coin and grow their legend?

Home Turf Advantage: Political Favor or Political Folly?

With a president amiable to cryptic arts at its helm, USD1 enjoys princely patronage. But this blessing might also be a double-edged sword, as future political tempests loom.

“A kingdom’s favor is fickle,” Bai warns. “What thrives under one ruler may wilt under the next.”

The Grand Finale: Will USD1 Survive the Regulatory Rigor?

Data from Kaiko reveals a crowd increasingly enamored with the regulated jesters of crypto — the MiCA-compliant stablecoins.

“Those who play by the rules seem to weather storms better than the wild cards,” Ianeva-Aubert assures.

Alas, if USD1 cannot dance the MiCA minuet properly, it risks exile from the grand European theater, limiting its applause and coin purses alike.

But fear not, brave stablecoin! Should you embrace transparency’s light, balance your reserves carefully, and keep your transactions within prescribed limits, you might yet rule hearts—and wallets—for years to come. 🍸

Read More

- 10 Most Anticipated Anime of 2025

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- Gold Rate Forecast

- USD CNY PREDICTION

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD JPY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

2025-04-25 11:41