As a seasoned analyst with over two decades of experience in the ever-evolving world of cryptocurrencies, I must admit that TRON’s (TRX) recent surge has caught my attention. With its 12% jump over the past day, it has proven to be the top gainer in the crypto market, and if the trend continues, it might just challenge the laws of gravity!

In simple terms, TRON’s native token, known as TRX, experienced a 12% increase in value over the last 24 hours, placing it at the top of the list for the day’s biggest cryptocurrency gainers.

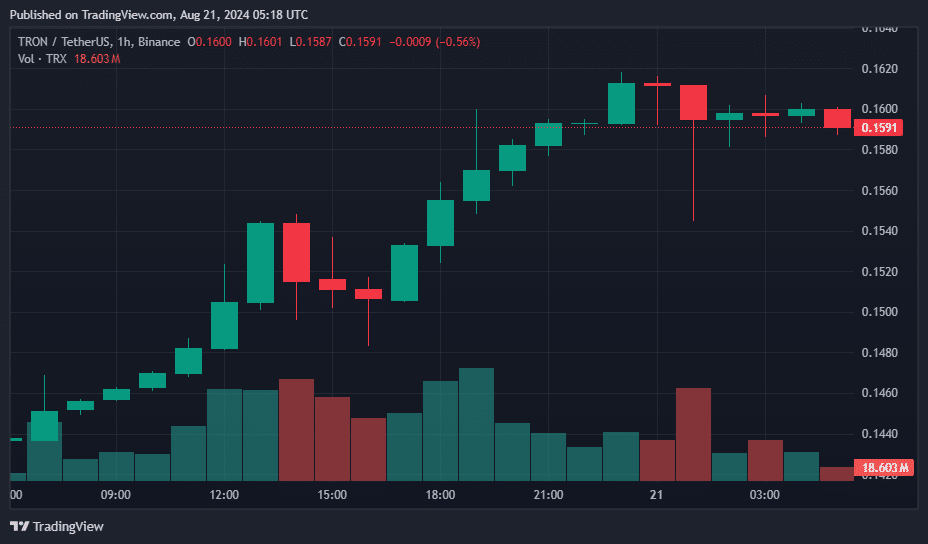

On August 21st, the value of TRON (TRX) increased significantly by 10.6%, reaching a price point of $0.1594 – a level not attained since April 16, 2021. The trading volume for this token experienced a substantial boost as well, climbing up by 121% and standing at approximately $1.92 trillion according to data sourced from crypto.news.

As a researcher, I’ve noticed an interesting development in the crypto world. The market capitalization of TRX (Tron) has significantly grown, currently standing at approximately $13.89 billion. This positions it as the 11th largest cryptocurrency, according to CoinGecko rankings.

It seems that the increase is driven by the debut of SunPump, TRON’s venture into capitalizing on memecoin trends. As reported by Dune Analytics, since its introduction, approximately 18,000 memecoins launched on SunPump have generated a total income of around $1.12 million in TRX (Truecoin) as of the current writing.

Today, I had discussions with key figures from prominent meme communities regarding the meme environment on Tron. They expressed their intentions to attract millions of users to the Tron community and are eager to integrate themselves into the Tron ecosystem as soon as they can. They’re already present—so why not you? Let’s head towards the sunshine together!

— H.E. Justin Sun 孙宇晨(hiring) (@justinsuntron) August 19, 2024

Currently, Justin Sun, the creator of TRON, is stirring excitement within the community by making strategic moves. On August 19th, he hinted on a social media platform that some prominent figures from popular meme communities might be planning to switch to TRON, but didn’t disclose their identities.

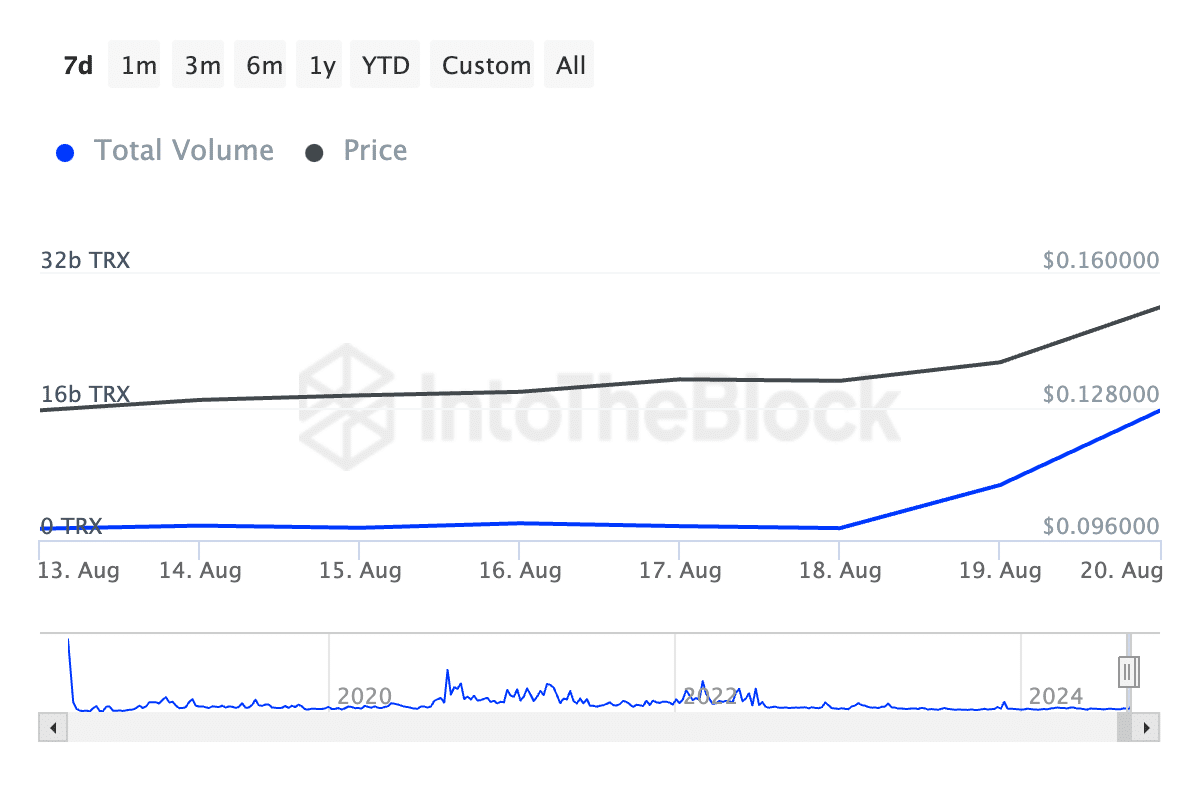

If these communities opt for TRON, there’s a possibility that the network could witness an increase in transaction volume. Notably, since the beta launch of SunPump on Aug. 13, the transaction volume has skyrocketed by more than 1045%. Furthermore, according to IntoTheBlock’s data, the number of daily active addresses has also risen by over 10%.

As TRON’s transaction volume surges, overbought signals loom

In Q2 of 2024, as per Token Terminal’s report, the TRON blockchain handled approximately $1.25 trillion in transaction settlements. This figure represented around one-third of the total settlement volume processed by Visa during the same period. This significant contribution has added to the general optimism about the blockchain’s capabilities.

Moreover, it’s worth noting that TRON’s 30-day revenue figures are exceptionally strong, outperforming Ethereum‘s protocol earnings by a significant margin of 230%. As a result, the price of TRX has been climbing steadily and is currently only 31.3% below its 2021 peak, indicating that it could soon reach this high once more.

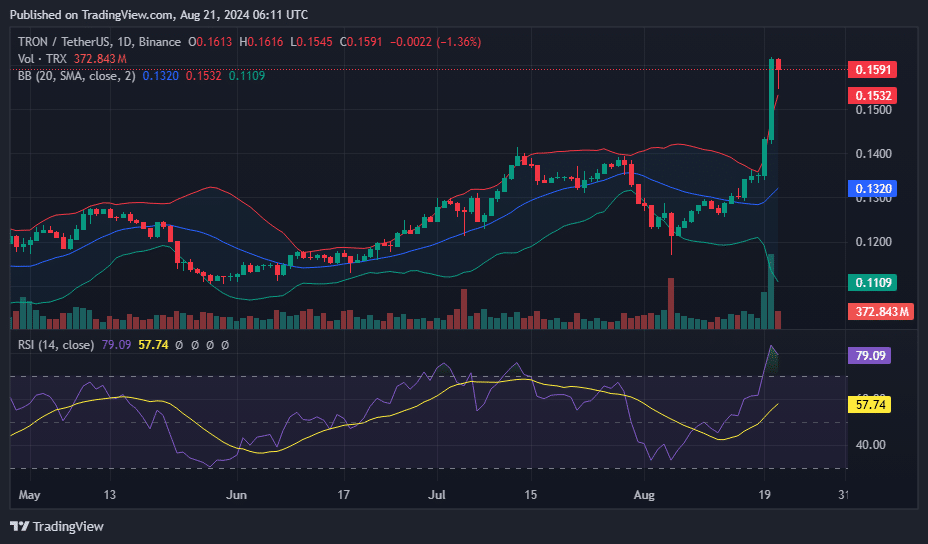

Right now, TRX‘s price is somewhat higher than the upper limit of its Bollinger Band at approximately $0.1532. This suggests that it’s trading outside its usual range and could potentially be overbought. The recent growth has propelled TRX past the upper band, which might imply an upcoming resistance or a possible correction.

TRON’s Relative Strength Index (RSI) stands at 79.09, surpassing the 70 threshold, which suggests robust upward momentum yet potentially hints at an impending market reversal or consolidation. Concurrently, the trading volume for TRX has swelled alongside its price, reflecting high buyer interest. However, it’s important to exercise caution as the RSI is in overbought territory and the price is beyond the Bollinger Band. This could indicate an upcoming correction or consolidation before the next price movement.

Based on these technical elements, the market could be gearing up for a period of consolidation (sideways movement) before moving forward, or it might experience a reversal (pullback). Therefore, keeping an eye out for indications of decreasing momentum or heightened selling activity becomes crucial.

Read More

- 10 Most Anticipated Anime of 2025

- Brent Oil Forecast

- Silver Rate Forecast

- USD MXN PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

- Gold Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- Pi Network (PI) Price Prediction for 2025

- How to Watch 2025 NBA Draft Live Online Without Cable

- Castle Duels tier list – Best Legendary and Epic cards

2024-08-21 10:30