As an analyst with over a decade of experience in the cryptocurrency market, I must say that the recent surge in TRX price is nothing short of impressive. The God candle formation and the comparison made by Justin Sun to Ripple’s XRP have certainly stirred up interest among investors.

The TRX coin price formed a big God candle, reaching its all-time high of $0.4485, after Justin Sun compared it with Ripple’s XRP.

In the past year alone, the digital currency Tron (TRX) has shown exceptional growth, surging more than double that initial value by approximately 240%.

This increase was primarily linked back to a post shared by Justin Sun, who speculated that TRX might replicate XRP’s market behavior over the past few weeks.

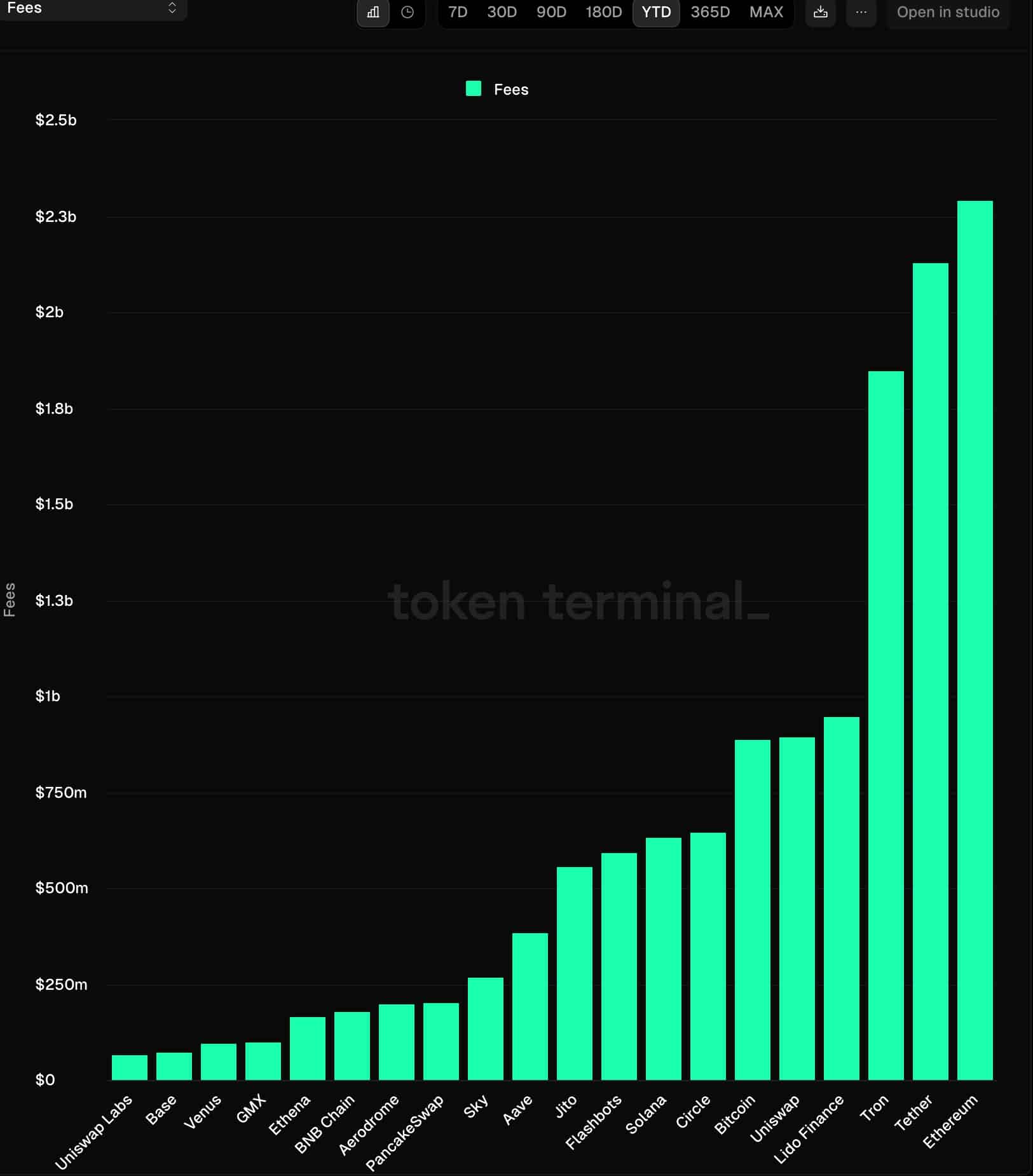

It appears that Tron might soon outperform Tether (USDT) and Ethereum (ETH) in terms of fees collected this year, as suggested by data from TokenTerminal which indicates a total of approximately $1.84 billion in fees accumulated so far this year.

As an analyst, I’m observing a significant trend in the crypto space. This year, Ethereum, the current frontrunner, has generated approximately $2.30 billion in profits. Tether, another notable player, has also made around $2.1 billion. However, if Tron’s network growth maintains its current momentum, there’s a growing likelihood that it could outpace both Ethereum and Tether within the next few months.

In simple terms, Tron’s network earns fees based on the large number of transactions that occur within its blockchain. For example, data from TronScan reveals that the network processed over $229 billion worth of USDT transactions in just 24 hours. This was achieved by handling over 2.1 billion transactions during the same timeframe.

Tron processed over $10.57 billion worth of transactions in the past day, representing a whopping 480% rise compared to the day before. Furthermore, the number of TRX tokens in circulation has been decreasing due to token burning events. Currently, it stands at approximately 86.29 billion, a drop from 88.5 billion during the same period last year.

TRX price analysis

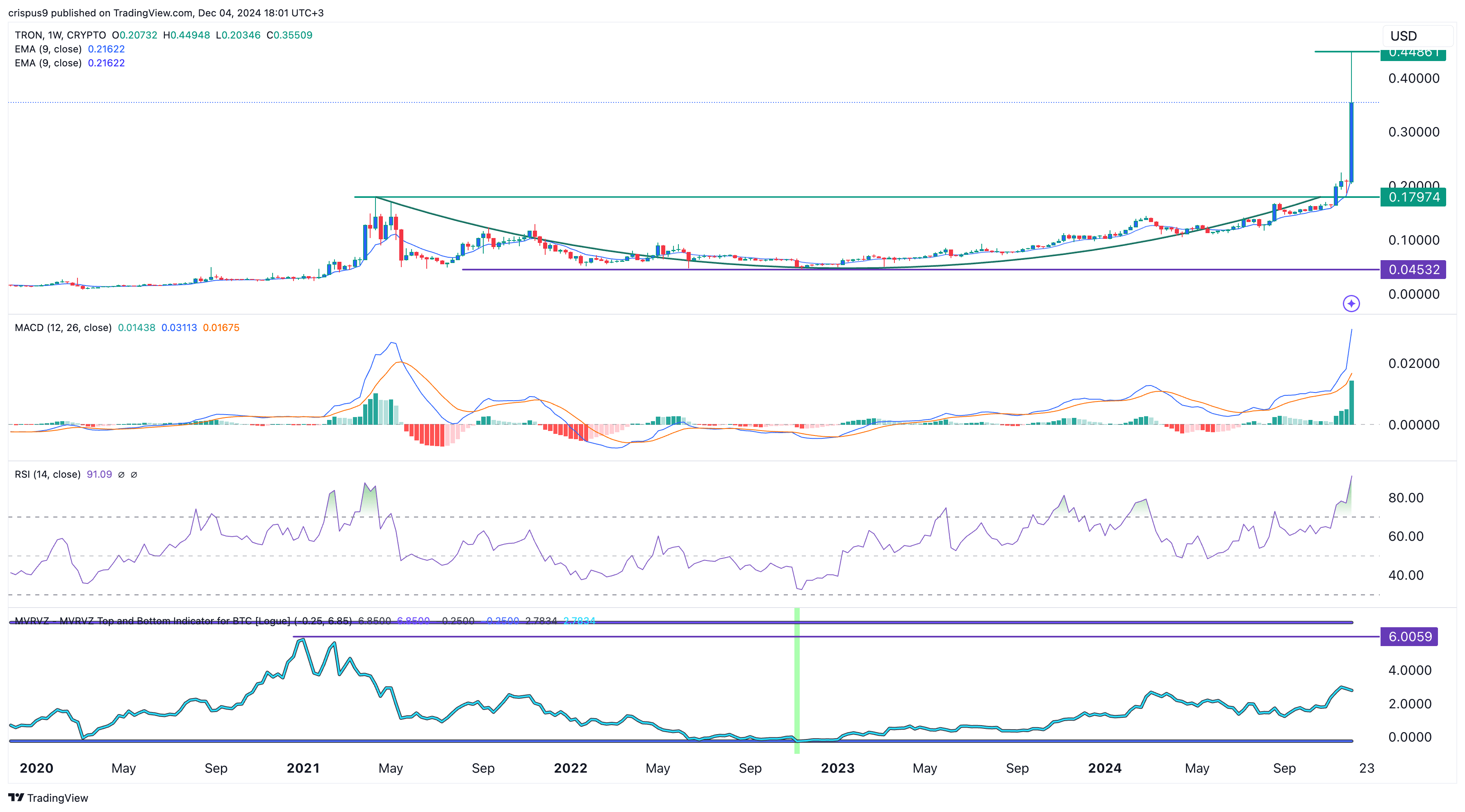

The TRX token has continued to rise in a positive trend since hitting its lowest point at $0.04532 in 2022 and 2023. On its weekly chart, it has broken through an important barrier at $0.1797, which marks the upper boundary of the popular “cup and handle” pattern, a commonly used bullish signal.

According to current analysis, Tron’s price has surpassed its various moving averages, and both the Moving Average Convergence Divergence (MACD) and the Relative Strength Index (RSI) are showing signs of excessive buying activity, suggesting potential market saturation.

The Market Value to Realized Value indicator, a closely monitored metric, has climbed up to 2.8, which is still substantially lower than its record high of 6. This implies that Tron’s price might have additional room for growth. If TRX surpasses this week’s peak of $0.4488, it could potentially surge even more as bulls aim for a significant resistance point at $1, reinforcing the trend of further upward movement.

From my perspective as a researcher, if the Tron price were to drop beneath the $0.1797 mark, it could potentially challenge or invalidate the bullish outlook, given that this level represents the upper side of the ‘cup and handle’ chart pattern we’ve been observing.

Read More

- 10 Most Anticipated Anime of 2025

- Brent Oil Forecast

- Silver Rate Forecast

- USD MXN PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- How to Watch 2025 NBA Draft Live Online Without Cable

- Castle Duels tier list – Best Legendary and Epic cards

2024-12-04 18:40