On Tuesday, January 2nd, the price of TRX held its ground, despite the fact that the Tron network kept surpassing Ethereum in terms of earnings.

Currently, the digital currency known as Tron (TRX), created by Justin Sun, is being exchanged at approximately $0.2691, just a tad higher than its bottom point in December which stood at $0.2237.

It’s been revealed through external data sources that the fees on Tron’s network have overtaken those on Ethereum, as activity within both networks increases. TokenTerminal reports that Tron has accumulated approximately $54 million in fees this year, placing it second only to Tether (USDT) in profitability. In contrast, Ethereum has managed to generate only $37 million in fees during the same period.

Starting from late 2024, the trend of increased network fees for Tron has persisted, a development that began back then. Over the past six months, Tron’s total fees have accumulated to approximately $1.8 billion, which is substantially more than Ethereum’s $822 million during the same timeframe.

The rollout of SunPump’s meme coin creator has positively impacted the Tron network. As per CoinGecko, there are approximately 100s of SunPump tokens in circulation, with a total market capitalization surpassing $152 million. Among these, Sundog, Tron Bull, and Tron Bull Coin are the most prominent ones.

On Mondays, Tron shows impressive growth in its stablecoin segment. As per data from TronScan, the network processed over $108 billion worth of stablecoin transactions and recorded a total of 2.15 million transfers. Additionally, the number of Tether holders on Tron has grown beyond 58.9 million.

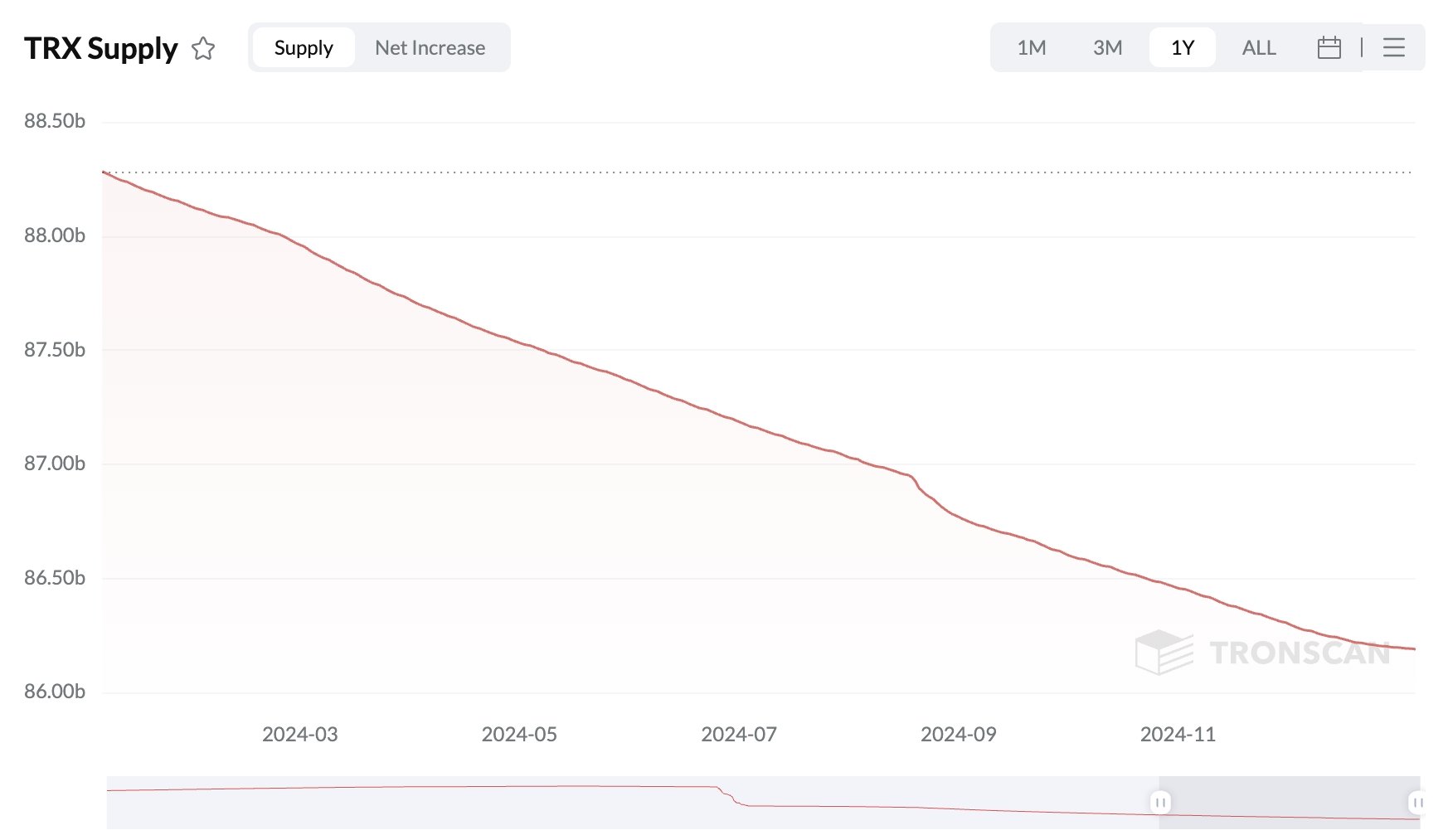

Tron’s on-chain statistics continue to stand out. The network is currently among the most deflationary cryptocurrencies, having incinerated approximately 8.3 million tokens on Monday alone. This reduces the circulating supply to about 86.19 billion tokens, a significant decrease from the 88.3 billion tokens in circulation a year ago.

Staking Tron brings rewards when transaction fees increase, especially as the total token supply decreases. Currently, its staking return is at 4.53%, surpassing both Ethereum and Binance Coin (BNB) in this aspect.

Tron price analysis

Over the past three weeks, the graph demonstrates a steady increase in TRX’s value due to investors capitalizing on the price drop by purchasing more.

The token continues to stay over its prior record high at $0.1842, and it’s also transacting beyond a rising trendline linking the lowest points since November 2022.

According to the 50-week moving average and technical indicators like MACD and RSI, Tron appears to be on an upward trajectory, with targets set at the psychological resistance level of $0.40. However, this optimistic view could change if the price falls below the support at $0.1842.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- USD CNY PREDICTION

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD JPY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

2025-01-07 17:56