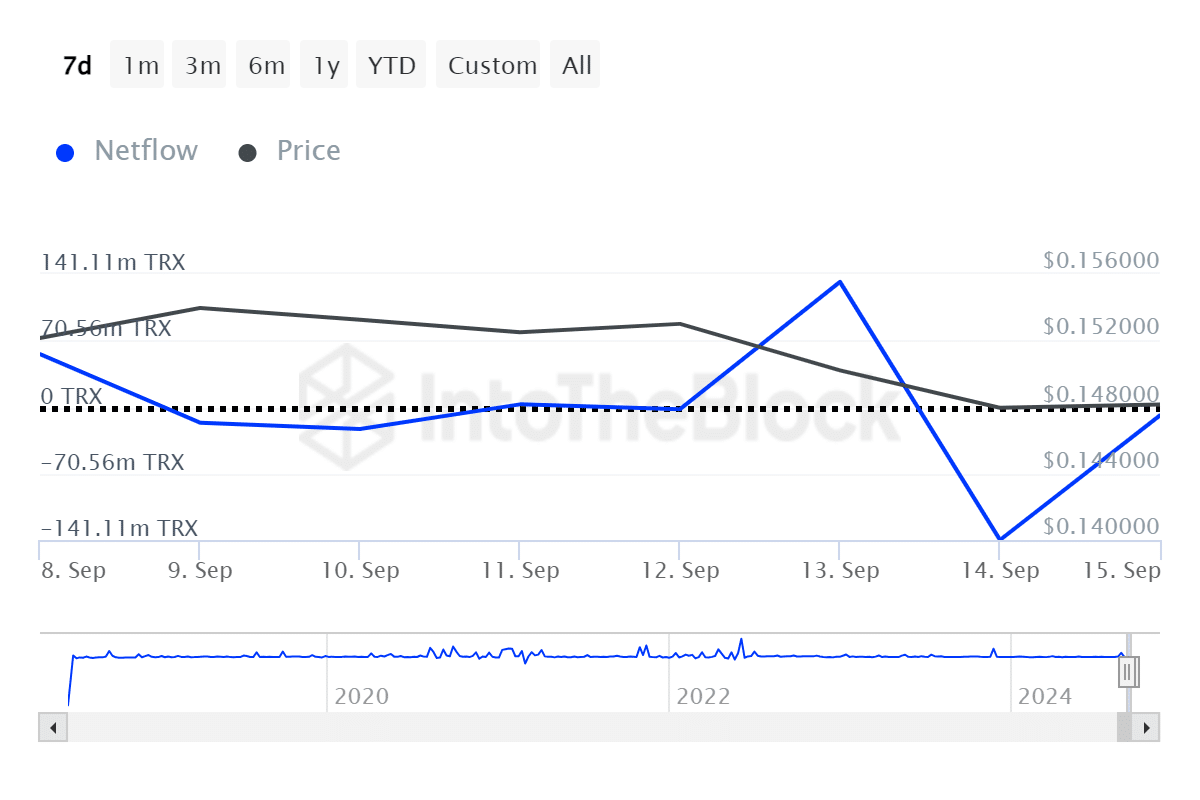

As a seasoned researcher with years of experience under my belt, I find myself intrigued by the current state of TRX. The whale selloff seems to have subsided, as indicated by the decline in large holder net outflow from 141 million to 8.8 million TRX on Sept. 15. This is a positive sign that suggests lower price volatility may be on the horizon.

Whales started taking profits over the weekend, but the bearish momentum seems to have cooled down.

Based on data from IntoTheBlock, the amount of TRON (TRX) held by large investors (whales) decreased from 141 million to 8.8 million TRX on September 15, indicating a considerable drop in whale selling activity for this asset. In simpler terms, large TRON holders are selling less TRX compared to before.

Usually, declining whale activity would also mean lower price volatility.

Conversely, the inflow of TRX tokens on the exchange has been consistently growing. The net flow of TRX tokens on exchanges changed from an outflow of 140 million TRX to a net inflow of 37 million TRX between September 13 and 15.

As a researcher, I’ve been pondering on the recent movements, and it seems there could be two possible explanations. Firstly, it’s plausible that retail traders are positioning themselves to capitalize on potential profits. Secondly, it’s not unreasonable to speculate that smaller TRX holders may be experiencing uncertainty or fear (FUD) due to the broader market correction following a series of significant whale activities over the past three days.

TRX has risen by 1% over the last 24 hours, currently valued at approximately $0.148. Its market capitalization stands at an impressive $12.9 billion, while its daily trading volume is around $250 million.

It’s quite possible that TRX investors might be cashing out their profits right now, given the situation. According to ITB data, more than nine out of ten TRON holders are currently in a profitable position. However, just under 4% of those who purchased TRX at an average price of $0.156 are still experiencing losses.

As a researcher studying Tron (TRX), based on the insights from my Institute (ITB), most on-chain indicators are currently indicating a neutral stance for TRX. This suggests that we might witness a period of price stabilization, with values hovering around the current level, unless there’s a significant breakthrough below $0.15 – a crucial psychological resistance point.

Read More

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- USD JPY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-09-16 11:50