As a seasoned researcher with years of experience observing the dynamic world of cryptocurrencies, I find myself both intrigued and concerned by the recent layoffs at dYdX and ConsenSys. The timing of these layoffs is particularly interesting, given that the crypto market is experiencing a rally rather than a downturn. It seems that the regulatory uncertainty in the United States, especially regarding the SEC, continues to cast a long shadow over the industry.

In simpler terms, two cryptocurrency firms, dYdX and ConsenSys, have recently announced they’re letting go of some employees. People are pointing fingers at U.S. regulators as the reason behind these job cuts. This is because the strict regulations in the United States might be making it difficult for these companies to operate as smoothly and profitably as they would like, leading to cost-cutting measures such as layoffs.

As a researcher documenting events within the realm of decentralized finance, I recently learned that Antonio Juliano, the esteemed CEO of dYdX, a pioneering decentralized derivatives exchange, has announced a significant workforce reduction amounting to 35%. In his address, he expressed heartfelt gratitude to those departing employees for their valuable contributions. The layoffs were justified as an essential step towards “rejuvenating” the platform, acknowledging that its existing form diverges from the vision dYdX needs to embody – a transformative departure from its current state.

“Time and time again, I’ve witnessed this, and I believe it will persist. The work we’re doing goes beyond merely creating a company, and I want to assure you that you’ll always remain an integral part of it.

Significantly, the job reductions at dYdX occurred not long after ConsenSys reduced its workforce by 20%. ConsenSys CEO Joseph Lubin attributed this move to adverse economic conditions globally, uncertainties surrounding cryptocurrency regulations in the United States, and the expenses associated with a legal dispute with the Securities and Exchange Commission (SEC).

Over the course of the last year, I’ve found myself navigating through a complex landscape shaped by evolving macroeconomic circumstances and persistent regulatory uncertainties. These factors have presented significant hurdles, particularly for companies based in the United States within our specific industry sector.

— Joseph Lubin (@ethereumJoseph) October 29, 2024

At the same time, Lubin called the company’s financial position stable.

He stated that ConsenSys will continue to prioritize its primary income sources, following a strategy it has already implemented in the past. Key products such as MetaMask and Linea, along with the second-layer Ethereum network, will form the foundation for future advancements.

As an analyst, I’d like to add that the ConsenSys CEO has shared that departing employees will be offered a range of post-employment supports. This includes severance packages based on their tenure, aid in securing future job opportunities, and an extension of healthcare benefits beyond their departure from the company.

In simpler terms, Lubin shared with Fortune that around 162 out of a total workforce of 828 employees across all divisions at Consensys will be affected by these job cuts. This makes Consensys the top company in terms of layoffs in 2024, as reported by layoffs.fyi.

Why the SEC is again the culprit of all the worst?

As an analyst, I’d rephrase it this way: I’ve observed that Lubin, in his layoff statement, pointed out the SEC as one of the factors leading to workforce reduction. Interestingly, in June, this regulatory body took legal action against the developer of MetaMask wallet due to alleged violations of law associated with their MetaMask Staking service.

The legal action was initiated not long ago, following ConsenSys’s filing of a lawsuit against the Securities and Exchange Commission (SEC) and five unidentified employees. In this lawsuit, they are requesting the court to endorse terminology that explicitly states Ethereum is not classified as a security.

Due to the questions raised during the investigation by the Securities and Exchange Commission’s Enforcement Division regarding Ethereum 2.0, they chose to discontinue it. This decision was made after the organization submitted a letter seeking clarification on the asset classification when approving the spot Ethereum ETF. However, the ongoing lawsuit against the SEC’s accusations means that ConsenSys is still facing legal expenses.

The layoffs come at a time when the market is bucking trends

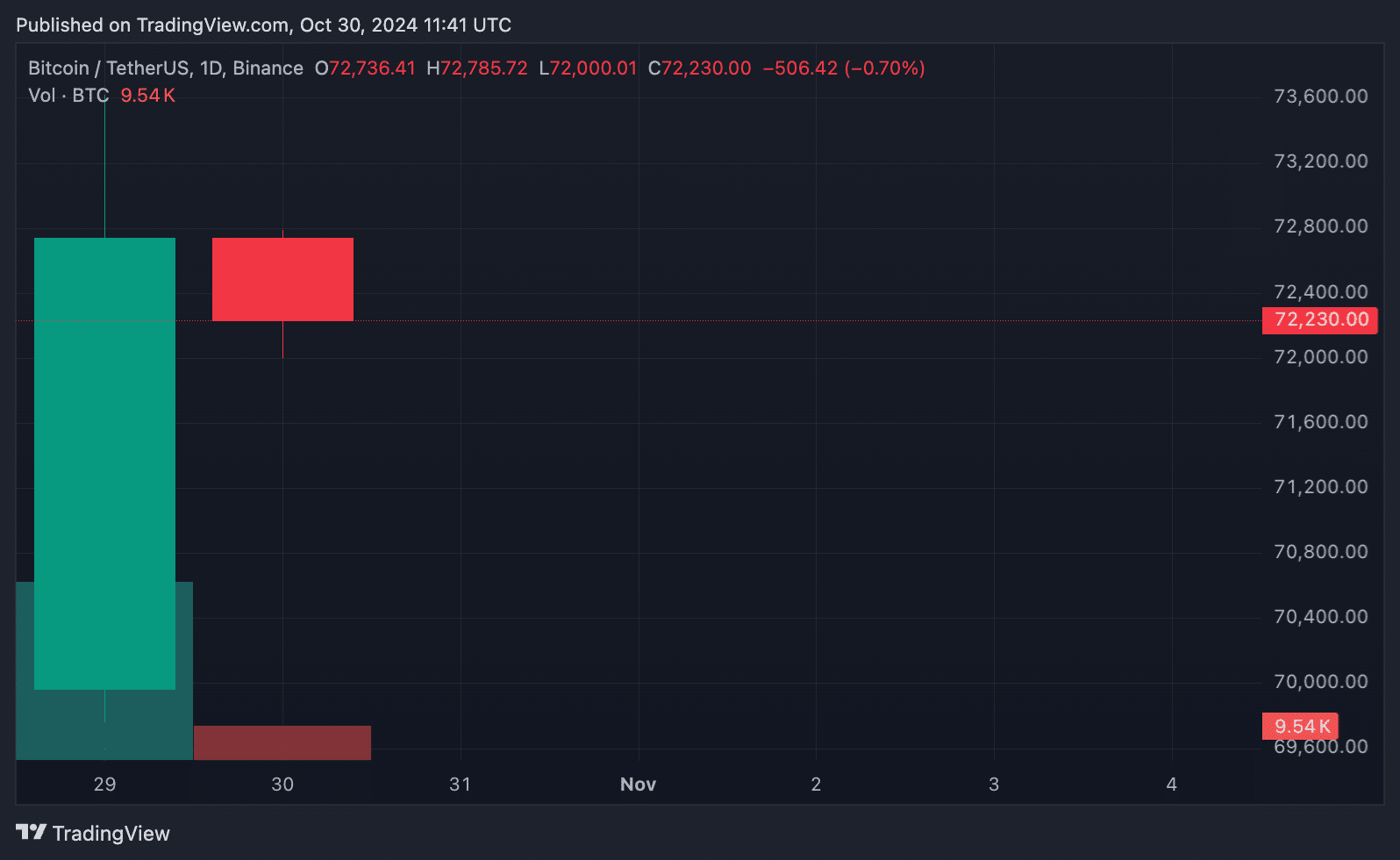

Remarkably, when the company made its layoff announcement, the crypto market was experiencing a surge – a time typically seen as favorable for crypto businesses. On October 29th, the value of Bitcoin (BTC) climbed from $70,000 to around $73,600, nearing its historical peak of $73,777. Since the start of the month, the cryptocurrency’s worth has increased by approximately 12%. This rise is believed to be linked to predictions surrounding the U.S. presidential election.

It’s worth noting that the expansion of Bitcoin can be linked to circumstances within the U.S., a point that the CEO of ConsenSys had earlier voiced concerns about, leading to job cuts in their company.

The rise in Bitcoin’s value can be attributed to multiple reasons, with a notable one being the growing interest from large corporations like BlackRock towards Bitcoin Exchange-Traded Funds (ETFs). This increased attention has led to substantial investments. Notably, over $2.7 billion flowed into these Bitcoin ETFs in the U.S., attracting new investors and contributing to a price hike.

Furthermore, the drive to shield investments from inflation is strongly influencing the financial market. With a declining dollar and escalating inflation rates, numerous investors are switching to exclusive assets like Bitcoin as a means of safeguarding their funds.

dYdX cuts staff while competitors gain momentum

As an analyst, I’ve observed a significant rebound in the crypto market since the start of this year, following a prolonged crypto winter. Notably, major exchanges such as Crypto.com, Binance, Coinbase, Gemini, and Kraken are expanding their operations, which aligns with the uptick we’re seeing in cryptocurrencies like Bitcoin. However, it appears that dYdX is not actively recruiting at this time.

As a crypto investor, I found it intriguing when Juliano recently shared that our exchange, in its present state, deviates significantly from what it ought to be. He didn’t elaborate on the specifics, but he emphasized that future growth necessitates a workforce capable of rejuvenating the platform. Given the ongoing surge in crypto markets, his decision to reduce staff by 35% might seem counterintuitive at best and illogical at worst. However, Juliano seems unfazed by the fear of missing out (FOMO). Instead, he appears focused on building a stronger foundation for our exchange’s future success.

How the dynamics of layoffs in the crypto industry have changed?

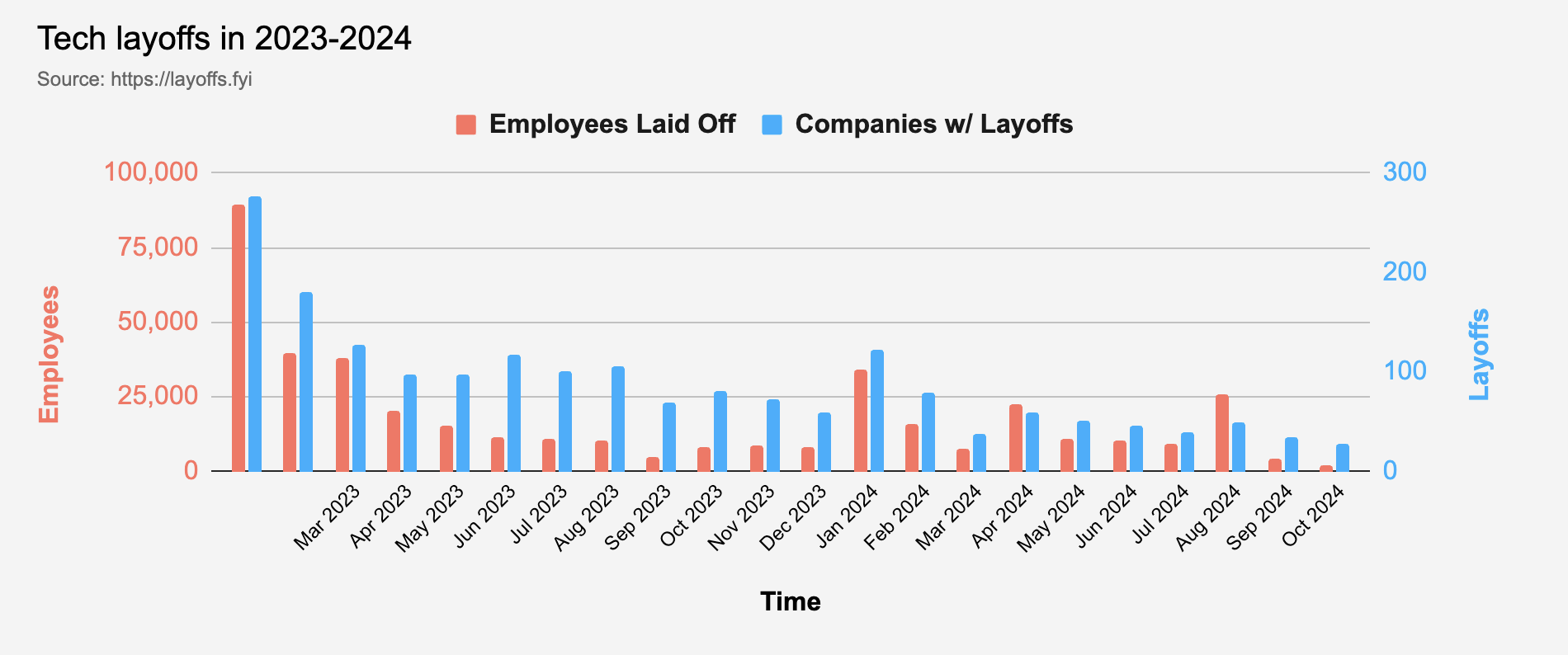

Based on data from layoffs.fyi, the highest number of job losses occurred during Q1 of 2023, affecting over 167,000 employees. In contrast, the year 2024 shows significant improvement: The peak layoff count was still in Q1 but only affected approximately 57,000 workers. The number of job losses decreased even further in the subsequent quarters – to 43,000 in the second quarter and 38,000 in the third quarter.

Therefore, rather than being a common occurrence, the narrative surrounding dYdX and ConsenSys has evolved into an exception to the norm for the year 2024. Following significant workforce reductions in 2022 and 2023, the blockchain job market appears to be on the mend.

Read More

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- Silver Rate Forecast

- USD CNY PREDICTION

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- USD JPY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-10-31 03:18