As a seasoned crypto investor with a globe-trotting lifestyle, I’ve learned the hard way that tax policies can significantly impact investment strategies. The recent report by Coincub and Blockpit has shed light on this fact, highlighting the diverse landscape of crypto taxation across the world.

A new study by Coincub and Blockpit shows that different tax regulations, such as no taxes in the UAE versus high taxes in the USA, significantly impact crypto investment plans.

The crypto taxation landscape varies widely across the globe, as revealed by a research report from Blockpit and Coincub.

Data reveals that the UAE remains an attractive destination for crypto investors, with no personal income or capital gains tax on cryptocurrency gains for individuals. Similarly, Switzerland positions itself as a tax haven, offering zero personal income and capital gains tax on crypto gains.

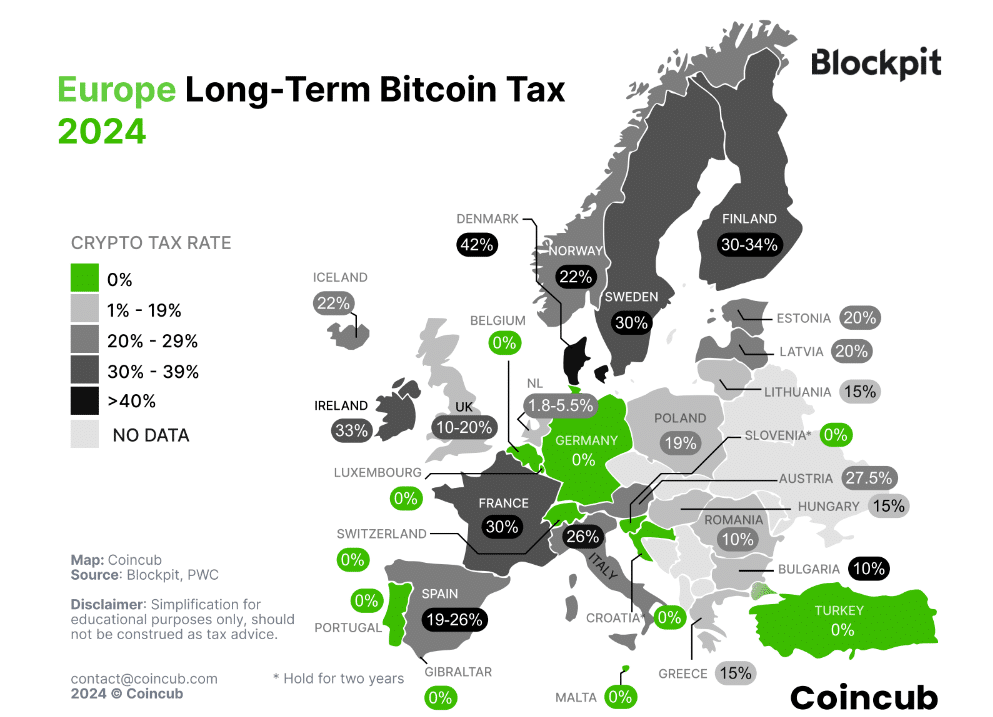

From a researcher’s perspective, I find that Europe presents a diverse landscape when it comes to cryptocurrency taxes. While certain countries offer beneficial tax regimes for long-term investments, others impose high tax rates. For instance, Denmark stands out with one of the steepest personal crypto tax rates worldwide. Long-term and short-term capital gains from cryptocurrencies can be subjected to a local tax authority’s levy amounting up to 53%.

The report indicates that, typically, numerous European nations set comparatively high taxes on cryptocurrency profits. However, Europe offers the greatest number of tax exemptions for long-term Bitcoin holdings.

Currently, the United States holds the highest combined total gains and average tax rates – 17.5% for long-term investments and 23.5% for short-term ones. These taxes could generate around $1.87 billion in revenue, according to analysts’ predictions. However, they caution that excessive taxation might deter investment in crypto, potentially driving such activities into the shadows, or prompt investors to seek out more favorable tax environments elsewhere.

These countries, such as Vietnam, Turkey, and Argentina, could choose to focus more on drawing in cryptocurrency investments, promoting technological advancements, and offering viable options to volatile native currencies rather than collecting taxes promptly.

Blockpit

Experts predict that the worldwide system for taxing cryptocurrencies will experience major transformations commencing in 2025, primarily due to global efforts like the Crypto-Asset Reporting System and the Crypto-Asset Activity Reporting for Tax Administrations.

The OECD’s CARF (Common Reporting Standard for Financial Accounts) seeks to boost financial transparency and combat tax evasion through a worldwide system for recording cryptocurrency transactions. Meanwhile, TARKA, also developed by the OECD, is designed to promote collaboration among tax agencies in the 48 member countries as detailed in the report.

Read More

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- Silver Rate Forecast

- Gold Rate Forecast

- USD MXN PREDICTION

- USD JPY PREDICTION

- Brent Oil Forecast

- EUR CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

2024-11-01 14:04