As an analyst with a decade of experience in the crypto space, I find the financial health of the Uniswap Foundation quite impressive. With over $36 million in assets and a clear roadmap for grantmaking and operational activities, it’s evident that they are serious about their mission to support Uniswap’s growth.

In their recent update, the Uniswap Foundation disclosed a robust financial status, boasting approximately $36.81 million in assets and numerous fresh grant pledges worth millions for the second quarter.

As an analyst, I’d rephrase it like this: In alignment with our commitment to financial transparency, the Uniswap Foundation – a non-profit entity championing the development of Uniswap – has disclosed its Q2 financial report. On August 7th, they detailed that their assets primarily consist of $36.81 million in cash and stablecoins, with a minimal holding of 680,000 UNI tokens.

As a researcher, I find that the organization has clarified that their cash reserves and stablecoins are earmarked for grant distributions and day-to-day operations. On the other hand, UNI tokens have been set aside for employee recognition awards. The foundation foresees these funds supporting its initiatives until the end of 2025, with a budget of $26.12 million allocated for grants and $10.69 million earmarked for operational costs.

In Q2, the foundation distributed approximately $3.2 million as fresh grants, and almost $2.5 million from earlier commitments.

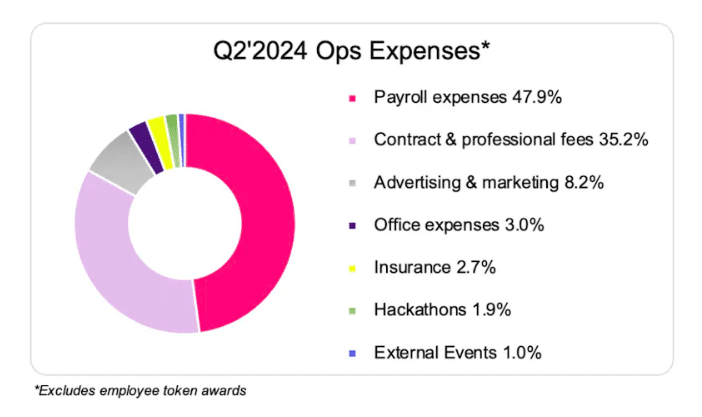

By the end of June 30th, the organization had pledged a total of $7.55 million in grants for the year, with $5.27 million already distributed. The operational costs for the quarter amounted to $1.6 million; 8.2% were assigned to advertising and marketing, while payroll expenses and professional fees accounted for 47.9% and 35.2% respectively.

Read More

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- Silver Rate Forecast

- Gold Rate Forecast

- USD CNY PREDICTION

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD JPY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-08-07 10:02