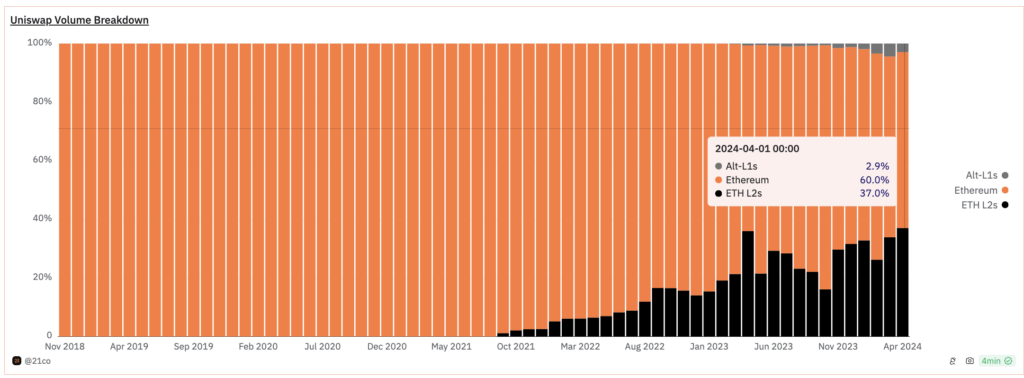

As an analyst with a background in blockchain technology and experience in cryptocurrency market research, I find the growing trend of Uniswap’s volume contribution to layer 2 (L2) blockchains to be an intriguing development in the decentralized finance (DeFi) space. According to recent data, Uniswap accounts for approximately 37% of total trading volume on Ethereum’s L2 networks and has seen a staggering increase in L2 volumes over the past two years – growing more than 650%.

Uniswap, the prominent decentralized exchange on Ethereum, currently drives significantly larger transaction volumes to layer 2 blockchain platforms than was observed two years prior.

As a crypto investor, I’ve noticed that approximately 37% of all trading volume takes place on decentralized exchanges (DEXs) that operate on Ethereum (ETH), the second-largest cryptocurrency by market capitalization.

As a researcher at 21.co, I’ve observed an astonishing growth in the platform’s L2 (Layer 2) volumes. In just 24 months, they surged over 650%, escalating from approximately $4 billion in 2022 to around $30 billion this year. This upward trend may intensify further if more reputable protocols join networks such as Arbitrum, Coinbase’s Base, and Optimism.

As a crypto investor, I’ve noticed an increase in economic activity on Layer 2 (L2) solutions, particularly Base and Arbitrum, which currently make up around 82% of the total L2 volume on Uniswap. Based on this trend, I believe the percentage of L2 volume on Uniswap will continue to rise and reach approximately 50% by the end of this year.

Tom Wan, 21.co researcher

The data reveals that the exchange accounted for just 2.9% of the overall trading activity in altcoin L1s. However, Wan expressed the view that this situation might change in the future. Wan elaborated that by integrating with high-performance EVM-compatible L1s and implementing a multi-chain expansion strategy, the DEX could potentially attract more trading volume on platforms such as Sei and Monad.

Crackdown on Uniswap

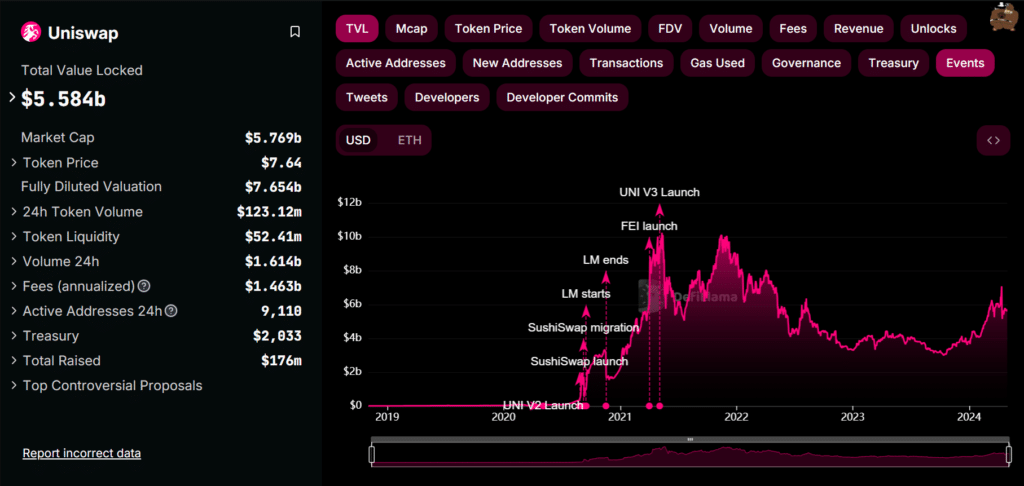

Uniswap (UNI) was the pioneering Decentralized Exchange (DEX) on Ethereum and currently leads as the most significant on-chain trading platform on the crypto Ethereum L1 blockchain, with a staggering cumulative trading volume exceeding $2 trillion across 17 different chains. Additionally, DefiLlama reports that users have securely locked in a total value of over $5.5 billion.

Established in 2017 by Hayden Adams, this crypto service based in Brooklyn is under scrutiny from the US Securities and Exchange Commission (SEC), which is actively clamping down on the crypto industry as part of a widespread enforcement campaign.

According to crypto.news, I received a Wells Notice from the SEC regarding my business. This isn’t unexpected news, although it’s certainly disappointing. Nonetheless, we plan to mount a robust defense against this decision.

Read More

- 10 Most Anticipated Anime of 2025

- Brent Oil Forecast

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Gold Rate Forecast

- USD CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- EUR CNY PREDICTION

2024-04-29 23:44