As a seasoned crypto investor with battle-scars from the 2017 bull run and the subsequent bear market, I can confidently say that Uniswap’s current rally is not just a blip on the radar but a potential game-changer. The robust inflows across DEX networks, Uniswap’s industry-leading volume, and the imminent launch of UniChain all point towards a bright future for UNI.

The cost of using Uniswap has surged, breaking through an important barrier, leading numerous cryptocurrency analysts to foresee additional increases in the future.

The price of the Uniswap (UNI) token spiked to reach a peak of $19.44, marking its highest point since late December 2021, as the overall strength in the cryptocurrency market persisted.

As a crypto investor, I’ve noticed this recent surge aligns with substantial inflows into the decentralized exchange (DEX) ecosystem. The data clearly shows that these platforms traded an impressive $372 billion worth of tokens last November, setting a new all-time high for monthly growth.

In the recent seven-day period, Uniswap handled a massive trading volume of approximately $30.86 billion, establishing it as a dominant force in the industry. Notably, this volume surpassed the combined total of competitors such as Raydium and PancakeSwap. Since its inception, Uniswap has been instrumental in facilitating over 465 million trades amounting to more than $2.36 trillion in value.

The price of Uniswap is picking up speed because traders are eager for the arrival of UniChain, the standalone Layer-2 chain that Uniswap is developing. UniChain’s goal is to facilitate smooth cross-chain trading on a single platform. At present, UniChain is in its testing phase and is scheduled to launch at the start of next year.

Concurrently, it’s increasingly likely that the Trump administration may choose to forgo the legal action initiated by the Securities and Exchange Commission against Uniswap. The SEC asserted that the company failed to register the securities offered on its platform.

Uniswap price analysis

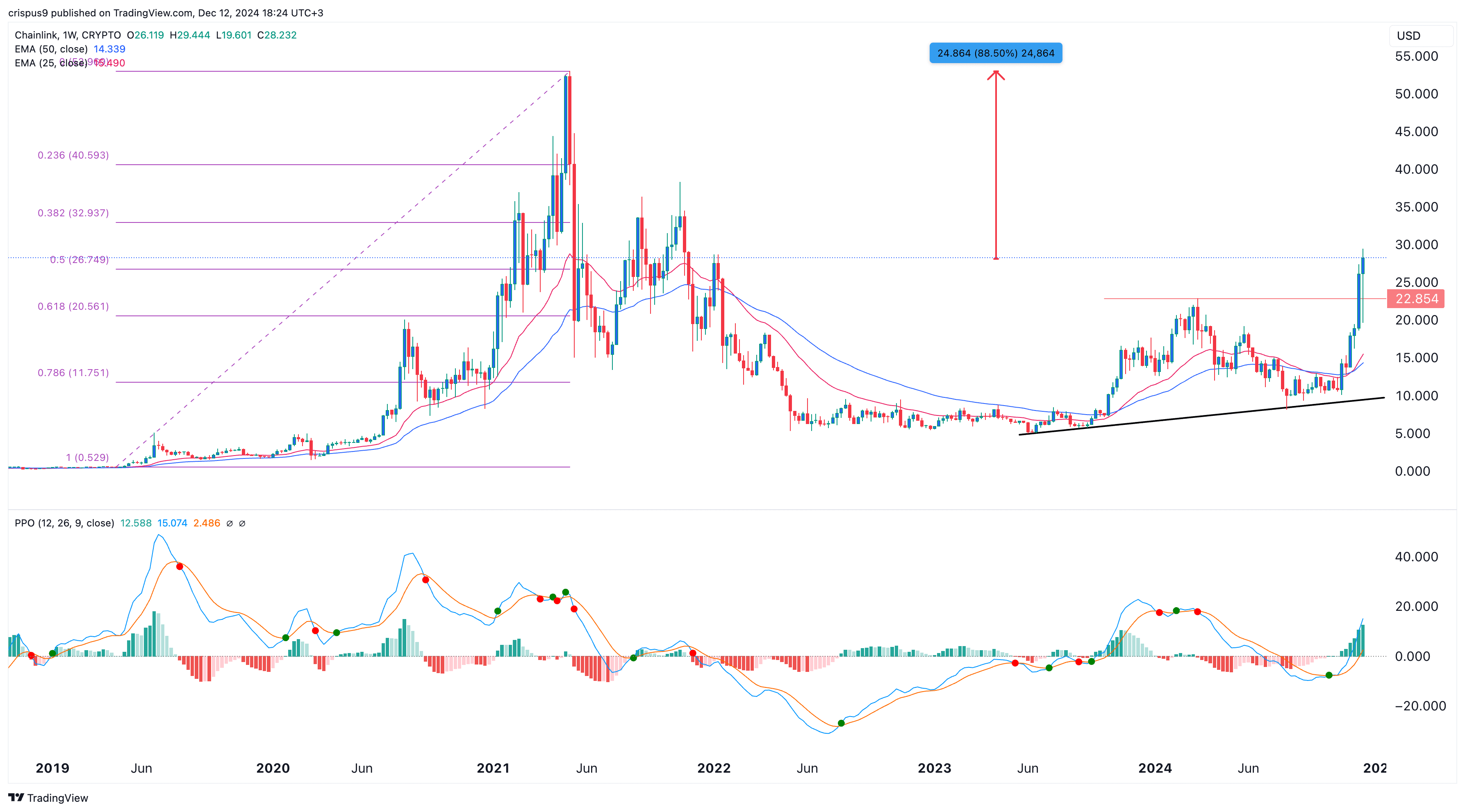

The weekly graph shows that UNI is exhibiting a triangular three-bottom structure, which is typically a sign of a bullish trend reversal. The price surpassed the pattern’s horizontal line at $17.13, implying that the buyers have taken charge.

The University of Nebraska (UNI) is nearing a significant level – the 38.2% Fibonacci Retracement point, which is approximately $19.23. Additionally, it has surpassed its 50-week moving average, and both the Moving Average Convergence Divergence (MACD) and Relative Strength Index (RSI) are increasing.

It seems that the easiest direction for UNI is pointing upward, potentially reaching a future value of $50 – which is about double its current price. This forecast mirrors the expectations expressed by analysts such as Crypto Tigers.

To occur, the price of Uniswap must increase significantly, surpassing the 50% Fibonacci retracement level at approximately $24 and reaching its previous all-time high of around $45.

Read More

- Brent Oil Forecast

- USD MXN PREDICTION

- Silver Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD JPY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- EUR CNY PREDICTION

2024-12-12 19:38