As a seasoned researcher with over two decades of experience in the dynamic world of cryptocurrencies, I’ve seen my fair share of bull markets and bear markets. The current surge in Uniswap’s (UNI) price has certainly caught my attention, given its impressive 150% jump since early this year.

Uniswap’s (UNI) price has been consistently rising for five consecutive days, reaching an all-time high of $12.37 on Monday, November 25 – the highest it’s been since April 1. This impressive surge represents a significant 150% increase from its lowest point in the year so far.

Analysts think that the current momentum might propel the price further upwards in the next few months. Notably, crypto expert Anasta Maverick, boasting a following of 26,000 on platform X, anticipates UNI to touch $17.70 soon, representing a potential increase of approximately 50%.

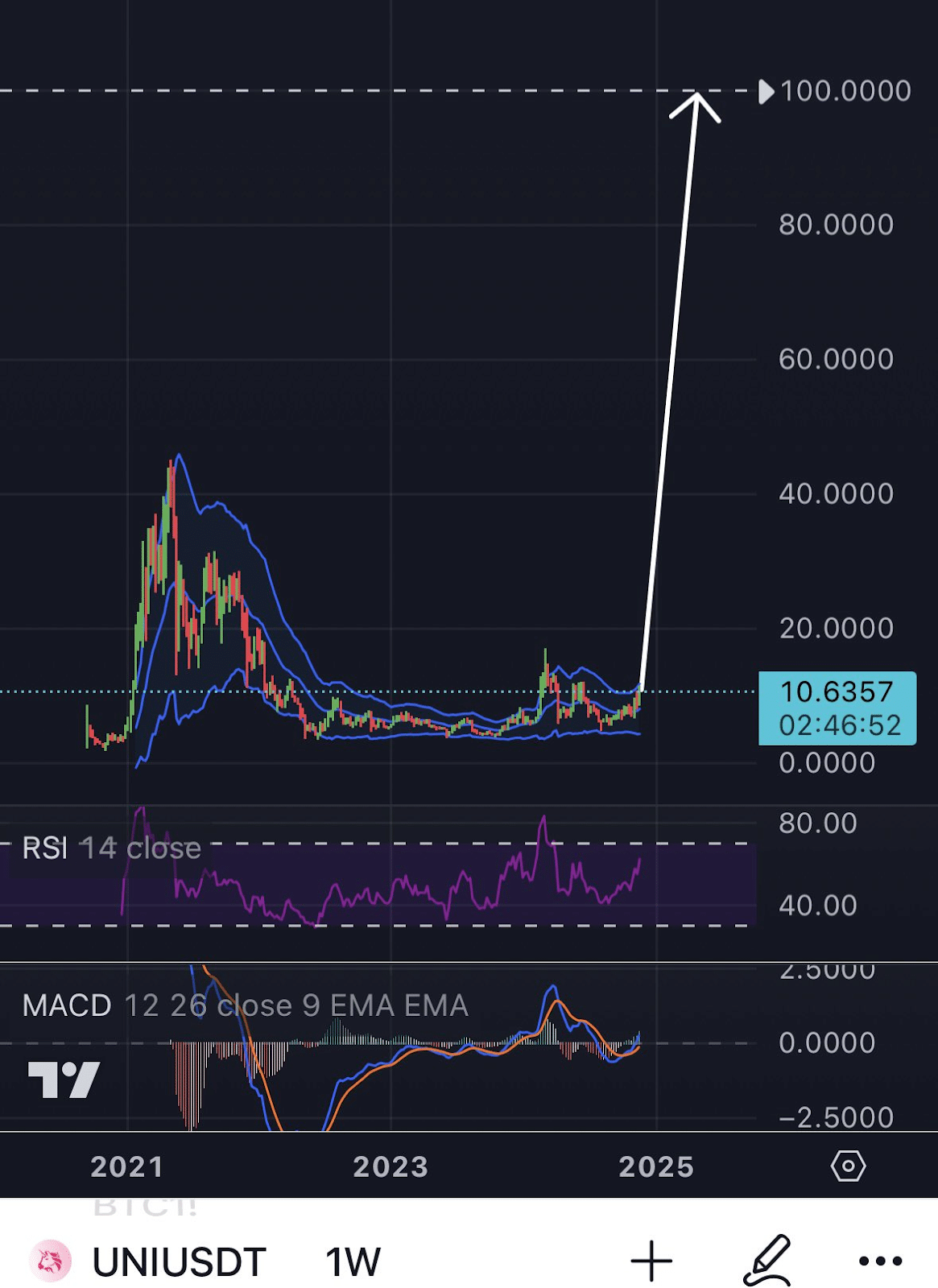

According to another analyst, known as HypeManAlex, there’s a possibility that the token could reach $100, which would be a 733% rise. This positive outlook is based on Uniswap’s strong influence in the decentralized exchange market.

As a researcher delving into the realm of decentralized finance, I can’t help but marvel at the phenomenal growth of Uniswap. Since its inception, this innovative platform has facilitated transactions worth an astounding $1.54 trillion. In just the past month, it has processed a staggering $81.7 billion, and within the last week, it managed an impressive $26 billion in trading volume. What’s more, Uniswap spans across more than 20 different blockchain networks, showcasing its versatility and adaptability.

Simultaneously, Raydium handled a trading volume of approximately $26.86 billion during that timeframe, with a grand total of $231 billion in volumes since its inception.

Boosting Uniswap’s ongoing success is the forthcoming layer-2 scaling solution, Unichain. At present, it’s in the testing phase, with a goal to tackle scalability concerns and stand alongside Ethereum, Solana, and Arbitrum. The main public network for Unichain is projected to debut by late 2024 or early 2025.

Despite the positive signs in the market, it’s important to note that there are still substantial indications of selling interest among large investors. For instance, as per Etherscan data, one whale has offloaded 466,000 UNI tokens valued at approximately $5.4 million to OKX, while another moved $1.29 million worth of tokens to Coinbase. These actions could potentially suggest an increase in selling pressure in the near future.

Read More

- 10 Most Anticipated Anime of 2025

- Brent Oil Forecast

- USD MXN PREDICTION

- Silver Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- How to Watch 2025 NBA Draft Live Online Without Cable

- Castle Duels tier list – Best Legendary and Epic cards

2024-11-25 22:44