As a researcher with a background in economics and experience in the crypto industry, I’m closely monitoring the recent market downturn. The sudden drop below $55,000 for Bitcoin and double-digit percentage losses for altcoins like Etherena (ENA), Solana (SOL), and EOS are concerning signs. The total market capitalization has dropped from a year-to-date high of $2.7 trillion to $2 trillion, highlighting the magnitude of this selloff.

As a researcher studying the cryptocurrency market, I observed a significant downturn on Friday. The price of Bitcoin dipped below the vital threshold of $55,000, resulting in a sea of red across the industry.

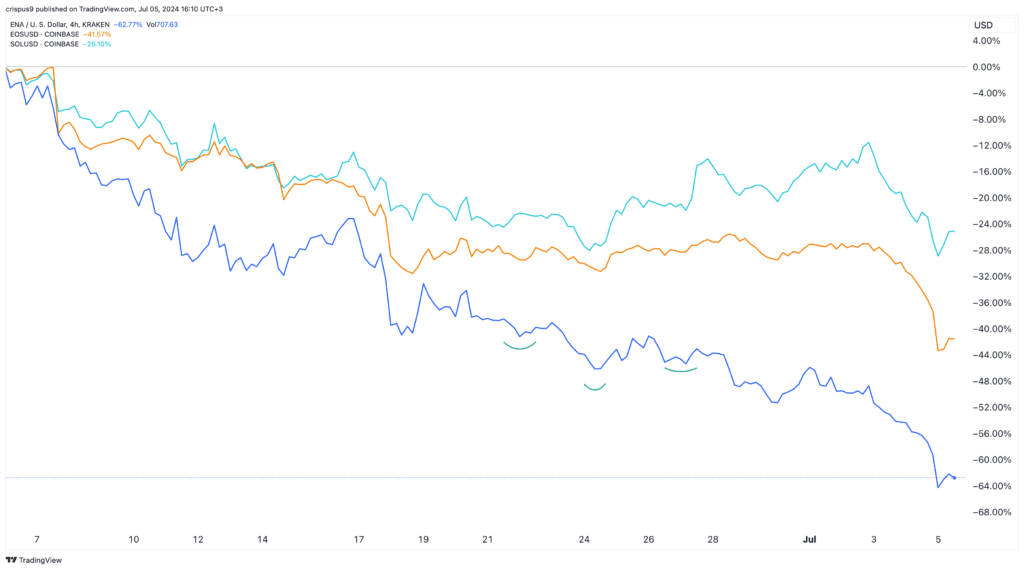

In the last 24 hours, there was a significant decline of more than 10% for cryptocurrencies such as Ethana (ENA), Solana (SOL), and EOS. The combined market value of all coins has dropped from its year-to-date peak of $2.7 trillion to currently stand at around $2 trillion.

Ethena vs Solana vs EOS prices

US nonfarm payrolls (NFP) data

As a crypto investor, I was dismayed by the latest development in the cryptocurrency market. The downward trend took another hit when the US Bureau of Labor Statistics (BLS) reported stronger-than-anticipated nonfarm payroll (NFP) data for June. With an unexpected addition of 206,000 jobs to the economy instead of the forecasted 191,000, this news strengthened the US dollar and put further pressure on digital assets.

An alternate expression could be: The data from the ADP report released on Wednesday indicated that the private sector created 150,000 new jobs in July, but our numbers revealed a more elevated figure.

In June, the report indicated a continued expansion in wage growth, with an annual increase of 3.9% in average hourly earnings. However, there was a disappointing development as the unemployment rate went up from 4.0% in May to 4.1%.

The labor market is thriving, with it having created more than 1.57 million new jobs in the current year.

Implications for Ethena, Solana, and EOS prices

Based on the latest employment figures and inflation data, it appears that the Federal Reserve is unlikely to reduce interest rates imminently. The headline Consumer Price Index (CPI) decreased slightly to a yearly rate of 3.3% in May, while the Personal Consumption Expenditure (PCE) inflation measure remained constant at 2.5%. In simpler terms, the Fed is likely to keep interest rates unchanged because inflation has been relatively stable this year.

In his statement this week, Jerome Powell, the Federal Reserve Chair, expressed the need for additional proof that inflation is on the decline. Concurrently, minutes from the committee meeting revealed their expectation for one interest rate reduction in 2021, potentially in December.

Based on current circumstances, it is expected that the Federal Reserve, known for its aggressive monetary policies, will exert greater influence on the markets, potentially causing a decline in prices for assets such as Ethna, Solana, EOS, and Bitcoin.

I’ve conducted extensive research on the recent price drop of Bitcoin (BTC). Several factors are contributing to this trend. The bankruptcy of Mt. Gox, the rejection of Bitcoin ETF proposals, the upcoming bitcoin halving event, and regulatory actions in Germany are among the key contributors. For a comprehensive understanding of these elements and their impact on BTC’s price dynamics, please find my detailed analysis below 🧵👇— Gargoyle (@degargoyle) July 4, 2024

At the point when these cryptocurrencies face competition from other risks, this trend is expected to emerge. The price of Bitcoin has dipped beneath the support level of its double-top chart configuration, suggesting further declines.

As an analyst, I’ve observed some noteworthy developments in the Bitcoin market recently. Specifically, Germany has initiated the process of selling off its Bitcoins, resulting in a surge of these digital assets flowing into exchanges for liquidation. Moreover, wallets linked to Mt.Gox have also become active once again, transferring their coins to various destinations.

Additionally, the political landscape in the United States is shifting, as speculation grows that Joe Biden may withdraw from the presidential race. In such a scenario, a more youthful contender might emerge as the favored choice to challenge Donald Trump. It’s worth noting that Trump has gained popularity within the crypto community, making him a formidable opponent in this regard.

Given the current state of cryptocurrencies, marked by weak technical indicators and questionable fundamentals, it’s plausible that they may experience further declines in the short term.

Read More

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Gold Rate Forecast

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-07-05 16:24