As a seasoned crypto investor with a decade of experience navigating market volatility, I’ve learned to ride the waves and not fear the storm. This week was no exception – it started with a record inflow into U.S. spot Bitcoin ETFs, suggesting a strong demand for the digital gold even as its price dipped. However, the market sell-off triggered by Bitcoin’s drastic fall was inevitable, and I wasn’t surprised to see massive outflows from these funds.

This week, U.S.-listed Bitcoin exchange-traded funds (ETFs) exhibited varied patterns. Initially, they experienced a significant increase in investments at the start of the week, reaching new highs. However, as the week progressed, there was a substantial decrease in holdings.

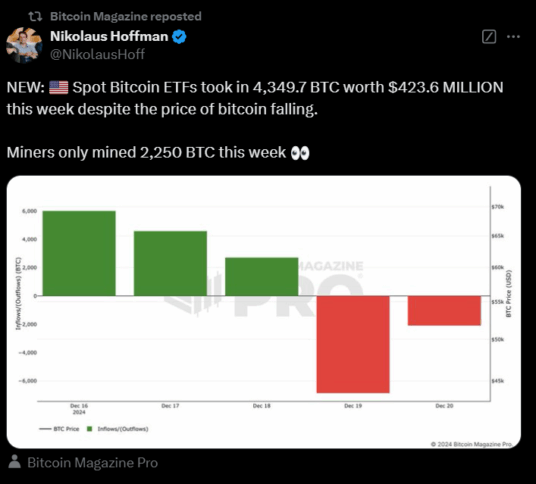

Based on information from Bitcoin Magazine, U.S. exchange-traded funds focusing on Bitcoin spots purchased approximately 4,349.7 Bitcoins worth about $423.6 million while the price was decreasing. At the same time, mining activities produced 2,250 Bitcoins, indicating a robust demand for this digital currency.

As a researcher studying the cryptocurrency market, I observed an upward trend for Bitcoin early in the week, reaching a peak of over $108,000 on December 17. This surge was likely fueled by investor optimism and anticipation of a rate cut from the Federal Reserve. However, by mid-week, Bitcoin reached its all-time high, and then began a steep descent. On December 19, the price dropped to $93,145.17, representing a 9.2% decrease within a single day. This sudden fall triggered a market sell-off and resulted in approximately $1 billion in liquidations within the cryptocurrency market.

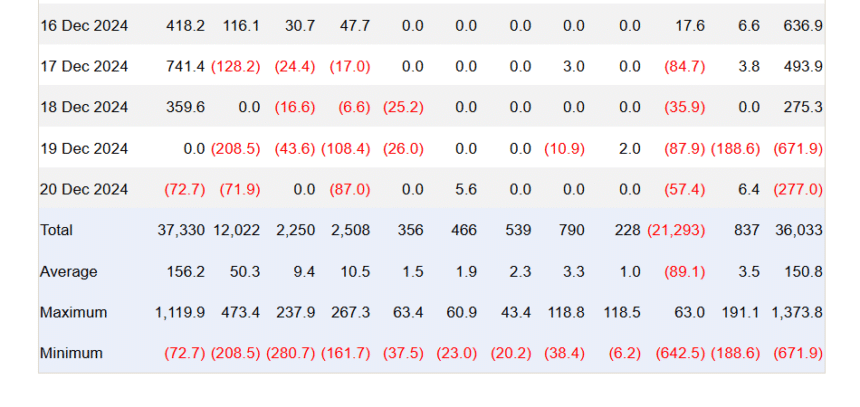

On December 19th, Bitcoin ETFs experienced their largest collective decline, amounting to a loss of approximately $671.9 million in total assets as reported by Farside Investors. Among these, Grayscale’s GBTC recorded the highest losses with an outflow of around $208.6 million, while ARK Invest’s ARKB also saw a substantial decrease of about $108.4 million.

During the specified timeframe, BlackRock’s iShares Bitcoin Trust (IBIT) saw no changes in its holdings, as there were neither additions nor withdrawals. Data from Sosovalue showed that the collective value of Bitcoin ETFs reached $109.7 billion on December 20, marking a decrease from $121.7 billion just three days earlier.

Despite the sell-off, Bitcoin rebounded on Dec. 20, briefly crossing $99,000 before stabilizing at $98,500.

On December 20th, Ethereum spot ETFs experienced withdrawals amounting to $75.12 million, as per data from Wublockchain on X. Interestingly, the price of Ethereum picked up mid-week, surpassing $3,500 after a dip to approximately $3,300 earlier. Furthermore, the broader cryptocurrency market seems to be on the mend, with coins like Binance Coin (BNB), Solana (SOL), and Cardano (ADA) experiencing gains between 5% and 6% over the past day.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- USD CNY PREDICTION

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD JPY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-12-21 23:16