The price of the Pax Dollar stablecoin (USDP) by Paxos Trust Company reached a peak of $1.28, leading to the automatic sale of $529,000 worth of USDC for a trader due to the coin’s value exceeding the usual dollar value.

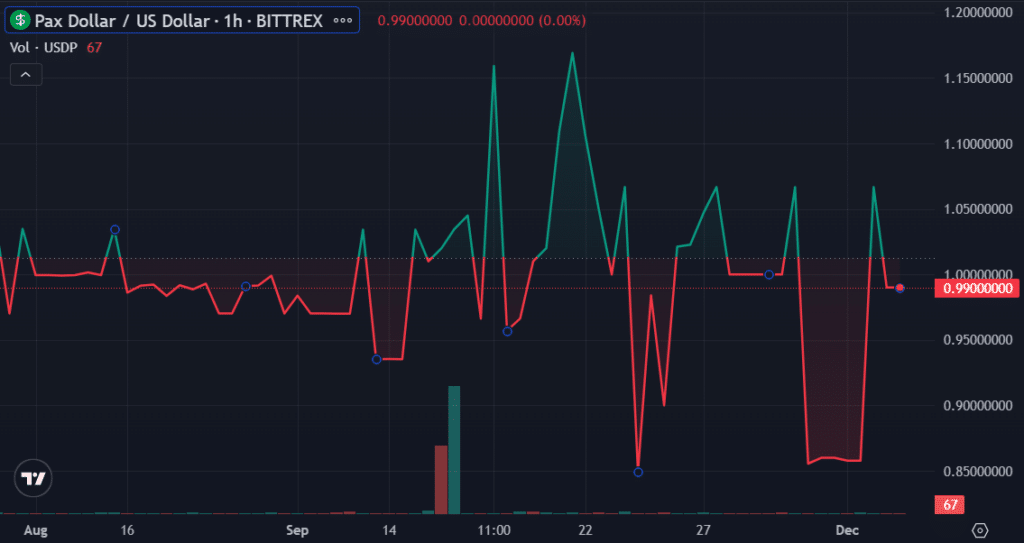

Just like standard stablecoins, USDP aims to keep its value constant at that of a U.S. dollar. This makes it an attractive option for traders looking for stability amidst the unpredictable price swings typical in cryptocurrencies. However, a sudden surge in USDP’s price, as reported by PeckShield, has sparked unease among some observers.

Five hundred twenty-nine thousand dollars worth of USDC were taken from an address (0x09a5…a87f) during a surge in the value of USDP (Pax Dollar), which reached $1.18.

— PeckShieldAlert (@PeckShieldAlert) April 17, 2024

Yesterday at 16:10 UTC, the value of the stablecoin unexpectedly rose to $1.2848, which was significantly higher than its typical value of $1. This brief spike went unnoticed by many, but it had significant consequences for traders with loan positions. As a result, these positions were liquidated due to the coin’s depeg from its intended value, causing far-reaching effects in the market.

On the decentralized finance (DEFi) platform Aave, a trader conducted a liquidation process using USDP as collateral to borrow USDC. In the DEFi world, loans are guaranteed by various assets, ensuring there are systems in place to handle market volatility.

On-chain data confirms that the trader lost the 529,000 USDC across sixteen uneven transactions from 16:16 to 20:09 UTC, coinciding with the period USDP lost its peg. The transaction label indicates that the liquidation process was automatically initiated by Aave’s built-in risk management algorithms.

During a surge in the USDP value, the platform may have anticipated a correction or a return to its regular pegged rate and issued a warning. This foresight could lead users to sell off assets ahead of time to prevent potential losses, especially if their loan-to-value ratios grew less advantageous.

According to a study published by SP Global in 2023, USDP, which was originally introduced on Paxos, has experienced some challenges in the past few months, with occasional deviations from the U.S. dollar value. The research indicated that among the major stablecoins, USDP showed the greatest variation from the U.S. dollar, with a total of 7,581 minor price discrepancies occurring between January 2022 and June 2023.

Read More

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- Silver Rate Forecast

- 10 Most Anticipated Anime of 2025

- Brent Oil Forecast

- USD MXN PREDICTION

- EUR CNY PREDICTION

- Hero Tale best builds – One for melee, one for ranged characters

- Capcom has revealed the full Monster Hunter Wilds version 1.011 update patch notes

2024-04-17 12:49