As a seasoned analyst with years of experience in the tumultuous world of cryptocurrencies, I find myself intrigued by the recent surge in stablecoin inflows into centralized exchanges. The data presented by IntoTheBlock is undeniably compelling, with Tether (USDT) and USD Coin’s (USDC) exchange net flows shifting dramatically within a few days, suggesting a potential buying spree that could ignite the crypto market.

There’s been an uptick in investments going into the top two stablecoins, which could indicate that a significant purchase might be imminent, as these funds are often deposited on centralized trading platforms.

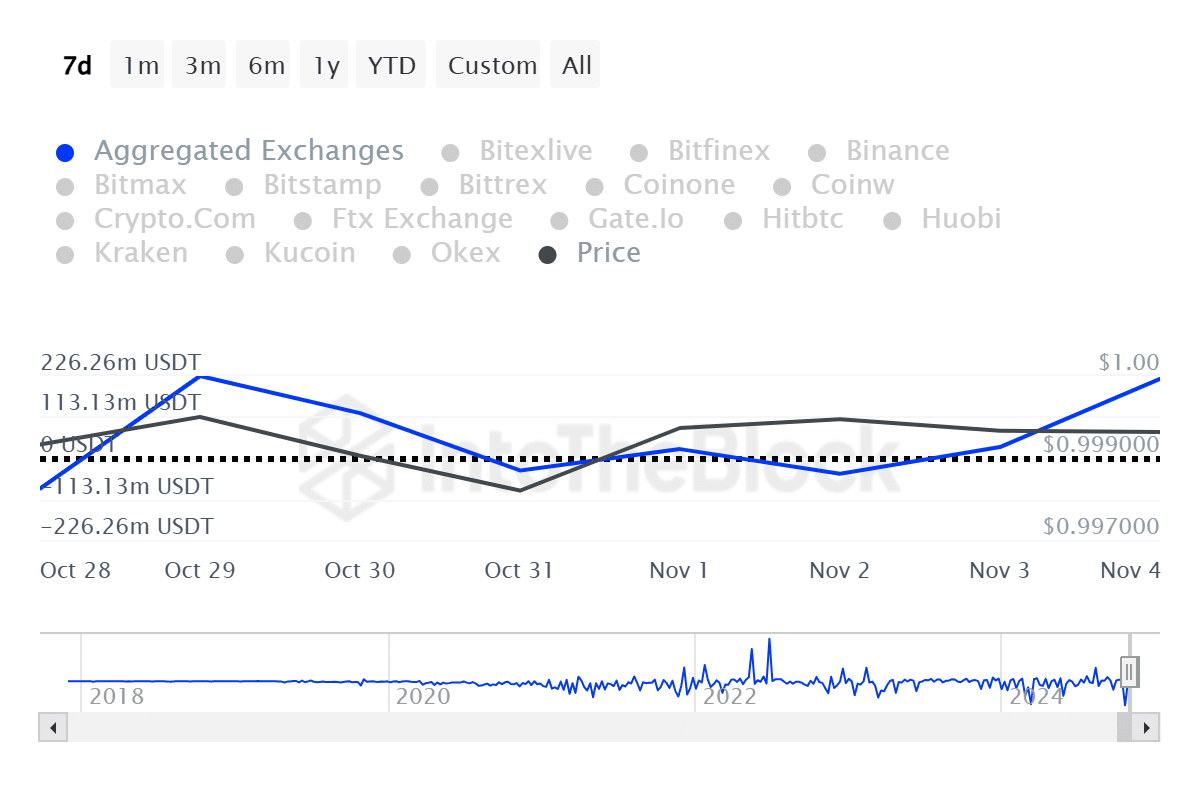

Based on information from IntoTheBlock, the exchange outflows for Tether (USDT) increased significantly. On November 2nd, there was an outflow of approximately $43 million, but by November 4th, this figure had flipped to a net inflow of around $218 million.

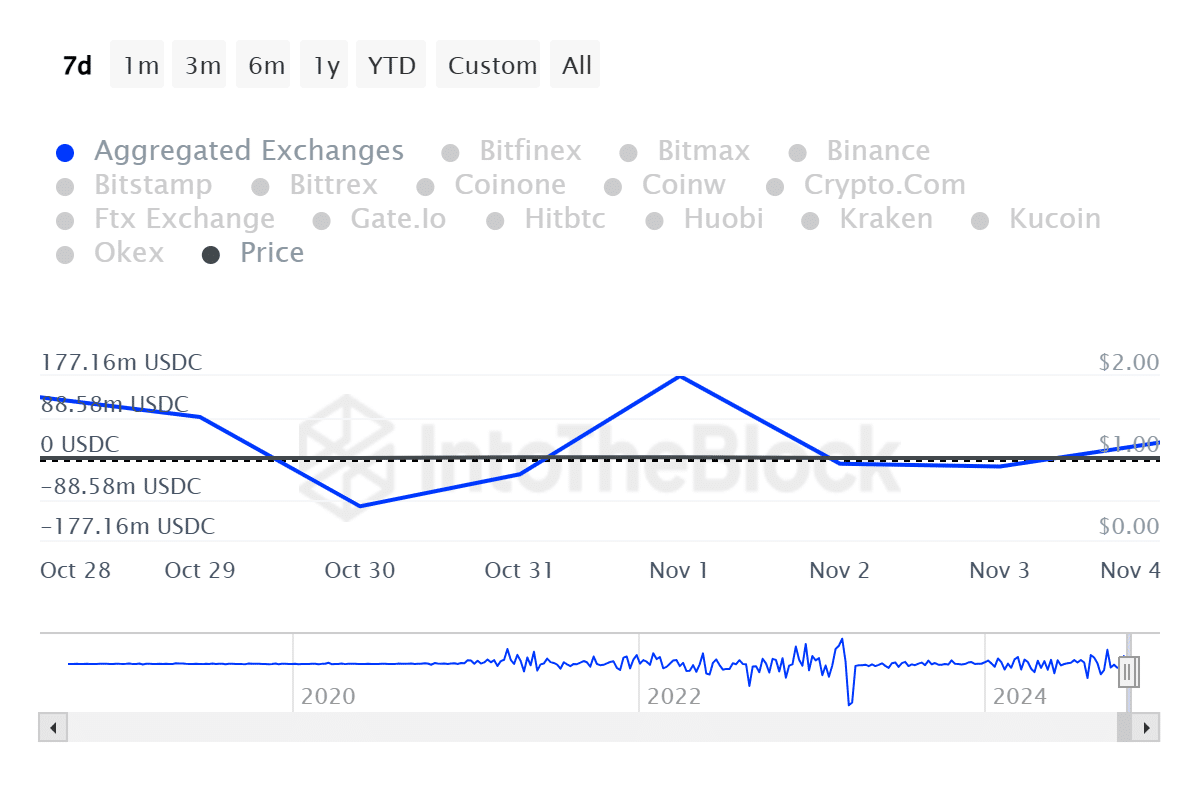

Yesterday, there was a net influx of $33.6 million for USD Coin’s (USDC) CEX, which contrasts with the net outflow of $18.5 million on November 3rd.

On November 4th, the cumulative value of stablecoins flowing into crypto exchanges exceeded $250 million, according to ITB’s data.

The bullish case

As a researcher studying cryptocurrency trends, I’ve noticed that an increase in stablecoin inflows often indicates investors are eager to amass Bitcoin (BTC) and other digital assets. Recently, data from CoinGecko shows the global crypto market capitalization has begun to climb back up from its local low of $2.33 trillion, now reaching $2.39 trillion—a surge of approximately $60 billion in under a day.

Large whale trades involving at least 100,000 USDT and USDC units have seen a significant surge – growing by approximately 187% for USDT and 190% for USDC. These transactions now account for an impressive total of around $6.62 billion (USD) and $8.93 billion (USD), as reported by ITB data.

Boosting whale activity might spark feelings of apprehension over not being part of it (FOMO) in market players. Additionally, this could indicate a possible market recuperation following the general correction.

Based on ITB’s data, the overall market capitalization of stablecoins dropped from approximately $172 billion to around $169 billion in the last month.

As a researcher delving into market trends, I’ve noticed that one significant contributor to the recent market correction was the outflows from Bitcoin exchange-traded funds (ETFs) this month. According to a report by crypto.news, Monday saw the second-largest outflow from U.S. spot Bitcoin ETFs, amounting to $541.1 million. These outflows followed a net inflow of over $5 billion last month into these investment products.

Read More

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Gold Rate Forecast

- Silver Rate Forecast

- USD MXN PREDICTION

- Brent Oil Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

2024-11-05 14:55