As a seasoned analyst with over two decades of experience in the financial markets under my belt, I must admit that the recent surge in Velodrome Finance (VELO) price has piqued my interest. Having witnessed numerous market cycles and trends, I’ve learned to read between the lines when it comes to crypto listings on major exchanges like Binance.

Velodrome Finance price surged and reached the year-to-date high after getting listed by Binance.

Velodrome Finance, a major participant in the Optimism network, experienced a significant surge and peaked at $0.0335, which represents an impressive 810% increase from its lowest point this year. This upward trend has elevated the total market capitalization of Velodrome Finance above $282 million.

Following Binance, the leading cryptocurrency exchange, adding VELO’s token with a seed tag to their platform, the jump in VELO occurred. This listing provides VELO with increased visibility to millions of users who regularly engage on the Binance trading platform.

According to statistics from CoinGecko, it appears that a significant number of VELO tokens are being traded on platforms like MEXC, OKX, Gate, and XT. Given Binance’s size, there’s a good chance we might see an increase in the volume of VELO on Binance within the coming days.

Historically, it’s common for the value of cryptocurrencies to increase when they are added to major trading platforms. Yet, these increases in value tend not to last long as the initial excitement subsides.

The Velodrome platform has emerged as a key player within the world of decentralized finance, with its total value locked surpassing $100 million. Over the last week, its daily exchange volume reached more than $700 million, which is significantly higher compared to other well-known DEX networks on Optimism such as Uniswap (UNI), WOOFI, Beethoven, and Curve Finance.

Velodrome Finance has handled over $20 billion in assets cumulatively, a trend that may continue as the crypto bull run accelerates. Most DEX networks, led by Raydium and Uniswap, have seen a sharp increase in volume this year, with their November volume rising to over $371 billion.

Velodrome Finance price has more gains to go

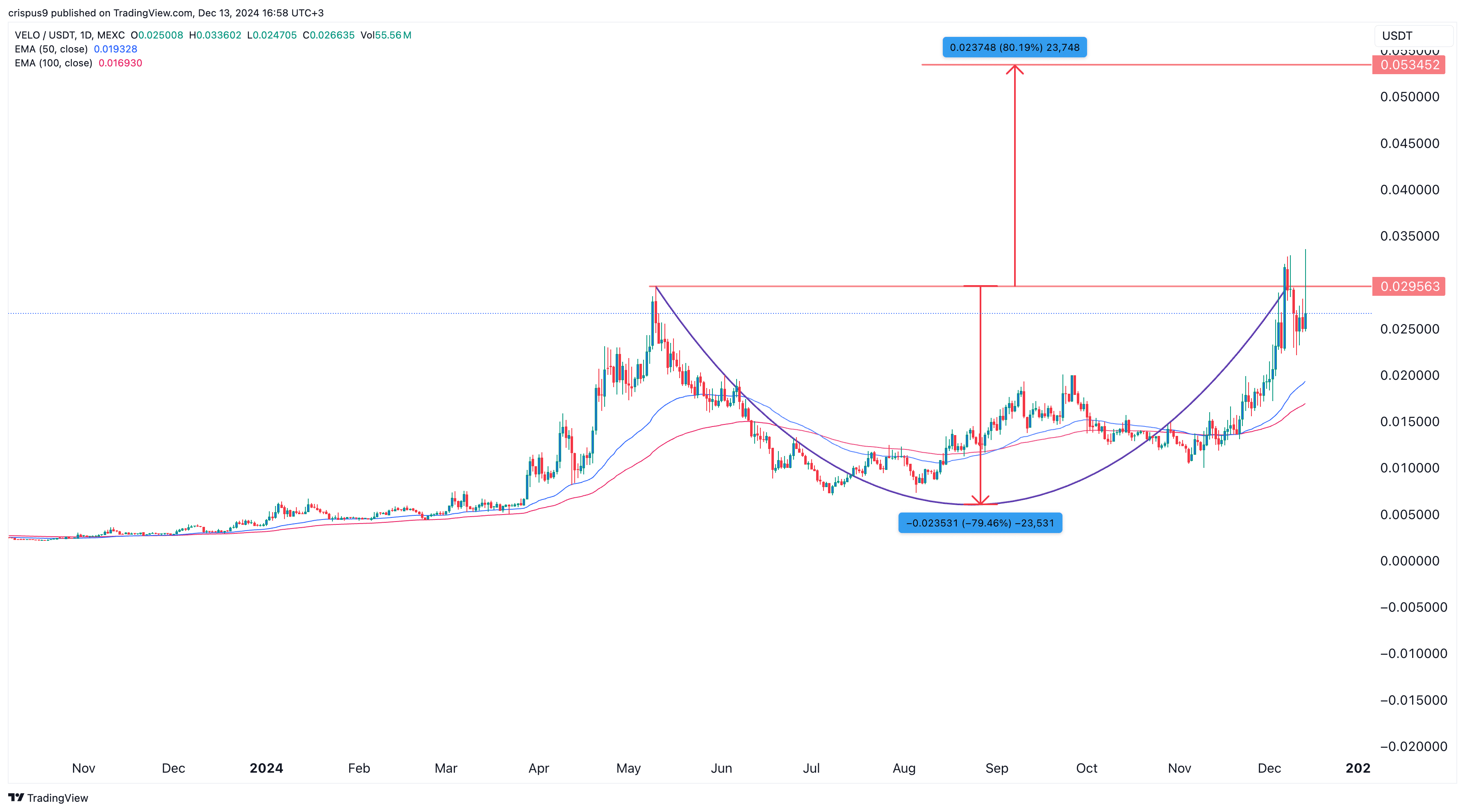

Over the past few months, the graph depicting the VELO price demonstrates a robust upward trajectory. Lately, it has touched upon a significant resistance barrier at around $0.030, which happens to be its peak from May 10.

At this point, we’ve reached a significant stage because it marks the top part of the cup and handle formation. This formation has now fully developed its handle component. The cup and handle (C&H) pattern is widely recognized as a bullish continuation signal.

The Velodrome’s price has surpassed both its short-term (50 days) and long-term (100 days) average prices. This suggests that the token might keep increasing in the future. By analyzing the depth of the cup, we predict that the Velodrome price could reach approximately $0.054, which is nearly 110% higher than its current value.

Read More

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- USD MXN PREDICTION

- USD CNY PREDICTION

- USD JPY PREDICTION

- Gold Rate Forecast

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- Castle Duels tier list – Best Legendary and Epic cards

2024-12-13 17:20