As a seasoned researcher with a knack for deciphering the cryptosphere’s intricacies, I must admit, the meteoric rise of VISTA has piqued my interest. The launch of Etherfun seems to have ignited a fire beneath this altcoin, propelling it from an obscure corner to challenging the mighty SushiSwap in trading volume.

Over the past day, VISTA experienced a significant surge of 74%, coinciding with the debut of the token deployer for the decentralized exchange, Ethervista, named Etherfun.

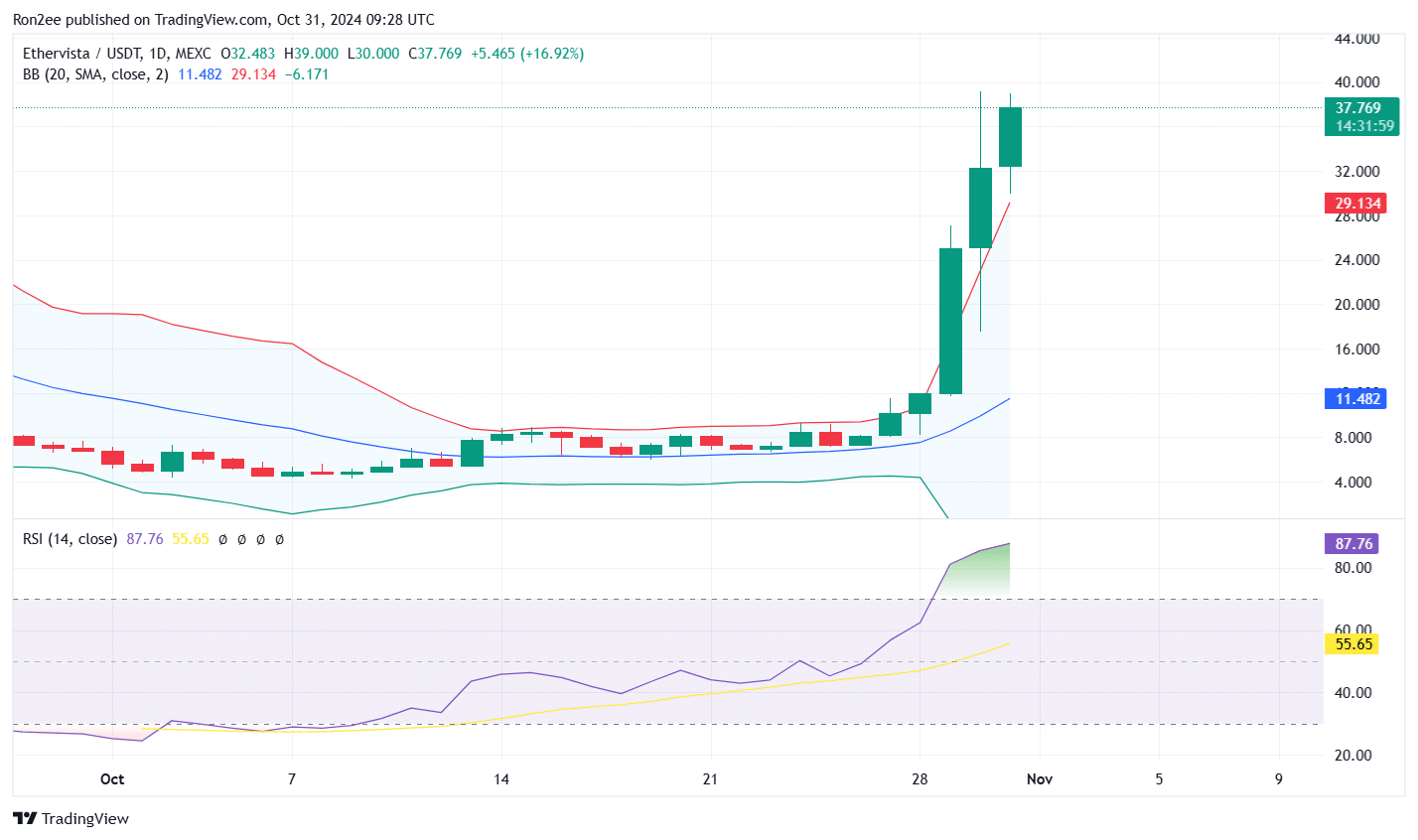

On October 28, VISTA began at $8.41, but by October 31, it reached a peak of $38.54 – a staggering increase of more than 350%. This dramatic price rise also significantly increased VISTA’s market capitalization, raising it from $8.9 million to $31.8 million as I write this.

The altcoin’s rally coincided with a jump in its trading volume hovering over $22.6 million up 63% over the past day.

Vista’s momentum started on October 28, spurred by the introduction of Etherfun – a tool for deploying Ethereum tokens. Etherfun aims to leverage the popularity of comparable platforms such as Solana’s Pump.fun and Tron’s Sun Pump, which have attracted substantial attention within the meme coin community.

As per the information provided by Ethervista, Etherfun is building upon what Pump.fun initiated, expanding its functionalities, and blending it with Ethervista’s advancements to offer a top-tier memecoin trading and launch platform, specifically designed to handle Ethereum’s elevated gas fees effectively.

The unique aspect of this platform lies in the fact that the liquidity derived from tokens released on Etherfun is perpetually secured within Ethervista. A portion of the fees generated is programmed to automatically acquire and destroy (burn) VISTA tokens on an ongoing basis.

Within a day following its launch, 100 tokens had been deployed on the platform.

The surge of enthusiasm for the latest platform significantly boosted Ethervista’s decentralized trading platform, surpassing SushiSwap in 24-hour trading volume. This additional push contributed to the current upward trend.

According to the most recent figures, Ethervista’s Decentralized Exchange (DEX) reached around 5.62 million dollars in trading activity, whereas SushiSwap’s trading volume slightly surpassed 3 million dollars.

Since late September, following the Etherfun launch, VISTA had been stuck within an accumulation phase, as noted by a member of the community. This phase ended with the launch, which typically indicates a positive or bullish trend, as VISTA began to break free from its accumulation zone.

Despite technical indicators showing cautionary signals, VISTA’s price has surpassed the upper boundary of the Bollinger Band at $29.13, indicating that it is significantly beyond overbought territory. This situation usually precedes a short-term price reversal.

As I’m observing the market trends, it’s worth noting that on October 28th, the Relative Strength Index surged beyond the overbought territory, reaching a level of 87. This upward trend suggests that a potential price reversal might be imminent in the coming days.

Yet, social sentiment around the altcoin remains bullish, with many traders on X expecting VISTA to hit a new all-time high. Despite bearish technical indicators, strong community hype and solid fundamentals could keep the token’s upward momentum alive, potentially pushing prices higher in the short term.

Read More

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- Gold Rate Forecast

- USD MXN PREDICTION

- USD JPY PREDICTION

- Brent Oil Forecast

- EUR CNY PREDICTION

- Castle Duels tier list – Best Legendary and Epic cards

2024-10-31 13:06