As a seasoned analyst with years of experience navigating the turbulent seas of the cryptocurrency market, I find myself intrigued by the latest developments that have transpired over the past few days. The surge in large transactions across leading cryptocurrencies, particularly Bitcoin (BTC), Toncoin (TON), Cardano (ADA), Wrapped Ether (WETH), and Ethereum (ETH), is a clear indication of whales jockeying for positions amidst the market correction.

There has been a substantial rise in the frequency of major transactions involving prominent cryptocurrencies, coinciding with a significant market downturn.

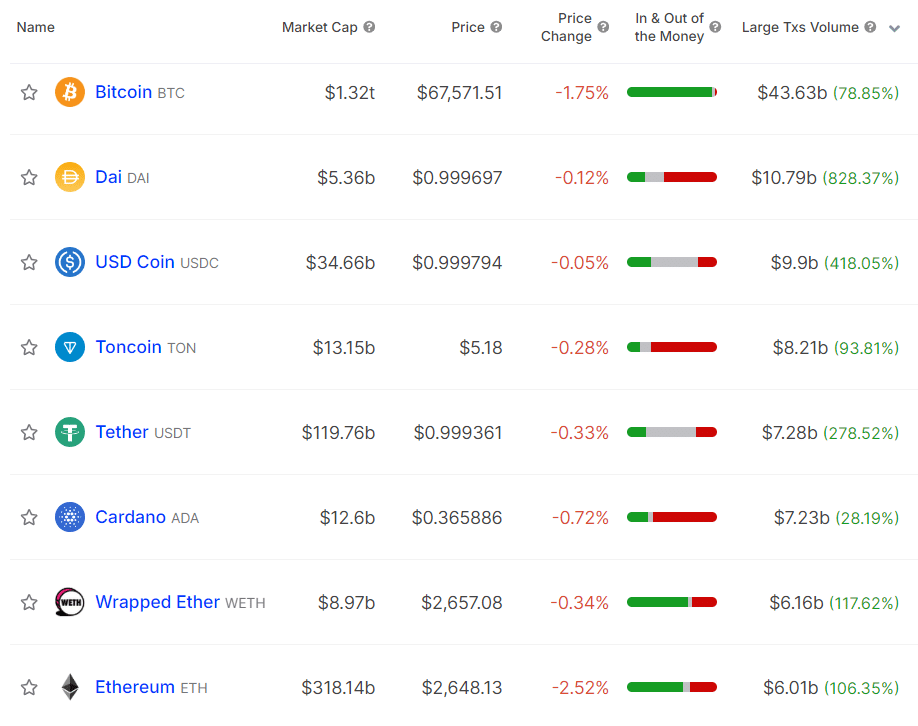

On October 21st, as reported by IntoTheBlock, Bitcoin (BTC) dominates with a substantial transaction volume of around $43.63 billion. Despite this, the foremost cryptocurrency saw a drop of 2.2%, currently valued at approximately $67,500 during this writing.

Despite the drop in Bitcoin’s price, the amount of Bitcoin held for more than a year saw a modest growth of 0.05%, totaling approximately $856.23 billion in value.

Yesterday, there was a significant increase of 93% in large-scale transactions involving Toncoin (TON), totalling approximately $8.21 billion. Given Toncoin’s market capitalization of around $13 billion, this high volume of whale activity might suggest apprehension and unease among investors.

1) The number of large Cardano (ADA) transactions has risen by 28%, totalling approximately $7.23 billion. Similarly, large transactions for Wrapped Ether (WETH) have seen a surge of 117%, amounting to about $6.16 billion. Both ADA and WETH investors are currently grappling with uncertainty due to the ongoing market-wide selloff.

The whale activity around Ethereum (ETH) also doubled to $6 billion. ETH, quite similar to BTC, witnessed a 0.04% hike in its long-term holder balance—currently at $288 billion.

It’s been noticed, based on ITB’s data, that there’s been a noticeable surge in the activity of large stablecoin holders, often referred to as “whales.” Particularly, USDC and DAI are experiencing more outflows from exchanges. This trend typically suggests a market that’s becoming overheated, prompting these whales to pause and seek potential buying opportunities.

Based on figures from CoinGecko, it appears that the overall crypto market value dropped by approximately 3.1% over the last day, now standing at around $2.44 trillion. Contrastingly, the daily trading volume significantly increased from $90 billion to $118 billion within this time period.

The recent market-wide correction would be considered natural since the bullish momentum was majorly triggered by the “Uptober” trend and greedy traders.

Read More

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- Gold Rate Forecast

- USD MXN PREDICTION

- Brent Oil Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

2024-10-22 10:42