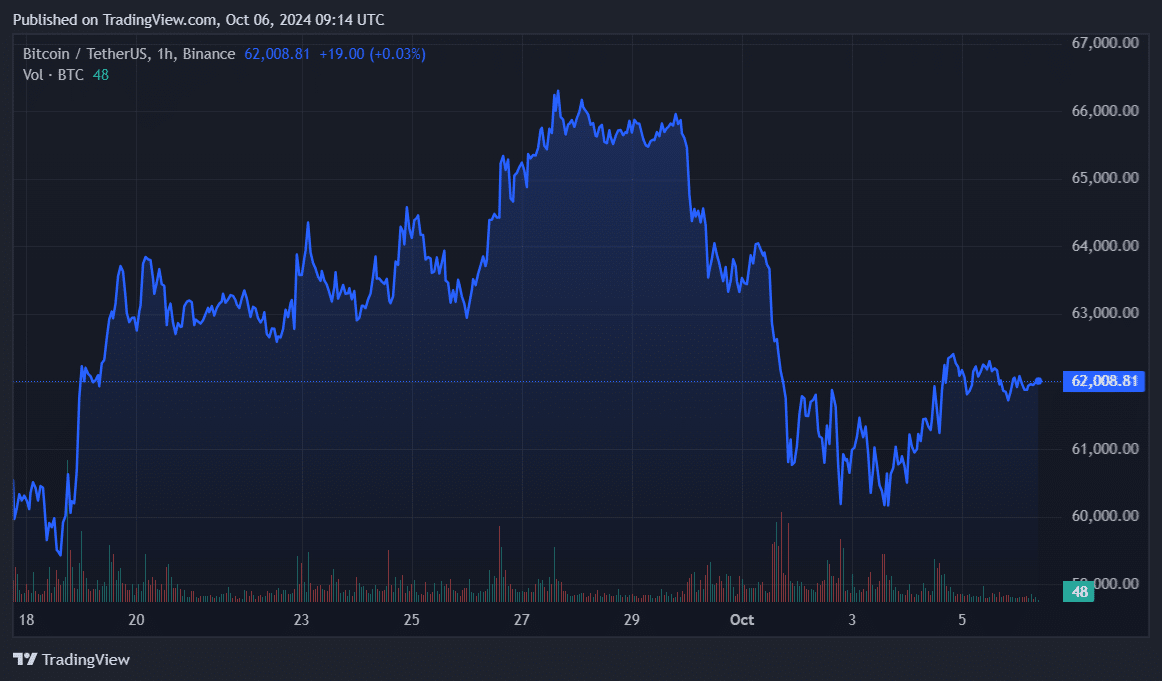

As a seasoned analyst with over two decades of experience in the financial markets, I have seen my fair share of market corrections and bull runs. The recent correction in Bitcoin after it surpassed the $62,000 mark on Oct. 2 is not uncommon, especially considering the volatility that characterizes the crypto market.

After reaching over $62,000 on October 2nd, Bitcoin has experienced a dip once more, but interestingly, the data indicates that the ‘whales’ (large-scale investors) have not contributed to this recent wave of selling.

During the period from October 1st to 4th, the price of Bitcoin (BTC) stabilized near the $60,000 mark, amid escalating political tensions between Iran and Israel.

On October 5th, following the release of the U.S. employment data, Bitcoin, the leading cryptocurrency, hit a new local peak at $62,370, while the overall crypto market experienced a surge in positive energy.

In simple terms, over the last day, the value of Bitcoin dropped by about 0.2%, now standing at approximately $61,950. Furthermore, its daily transaction volume has significantly decreased by around 53%, settling at a level of roughly $12.2 billion at this moment.

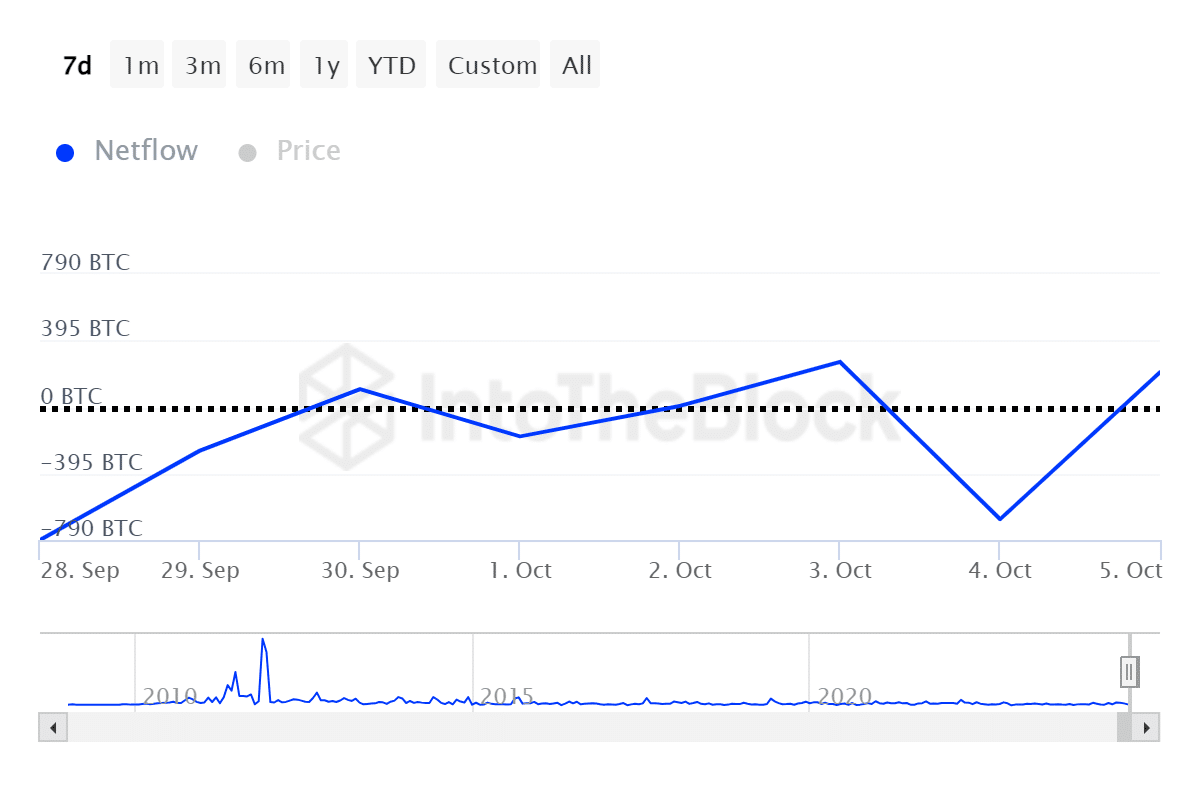

Based on information from IntoTheBlock, there was a net inflow of approximately 205 Bitcoins to large Bitcoin holders on October 5th. This influx occurred while outflows stayed steady, suggesting that big Bitcoin owners didn’t offload their coins as the price of Bitcoin exceeded $62,000. The on-chain indicator indicates that these whales chose not to sell Bitcoin at this price level.

On October 5th, the amount of Bitcoin transactions made by large holders (whales) dropped by nearly half – decreasing from a value of approximately $48 billion to $25 billion in Bitcoin. This decrease in trading and transaction volumes often suggests periods of price stabilization and reduced volatility.

According to data from ITB, there was a withdrawal of approximately $153 million in Bitcoin from centralized platforms during the last week. This surge in withdrawals might indicate that people are stockpiling Bitcoin, as optimistic predictions about October’s market performance grow.

Keep in mind that unexpected shifts in global economies and international political climate might abruptly alter the trajectory of financial markets, encompassing cryptocurrencies as well.

Read More

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- Gold Rate Forecast

- USD MXN PREDICTION

- USD JPY PREDICTION

- Brent Oil Forecast

- EUR CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

2024-10-06 19:02