As a seasoned crypto investor who’s seen more than a few market cycles, I’ve learned to read between the lines of such data points. The whale accumulation of Aave tokens is indeed intriguing, especially considering its recent price surge. However, as we all know, the crypto market can be as unpredictable as a game of dice in a casino.

Over the last seven days, I’ve observed an intriguing trend with Aave – whales seem to be amassing this cryptocurrency as its value ascended. However, it appears that we have now moved into the overbought territory for the token.

As reported by IntoTheBlock, entities possessing more than 1% of Aave’s (AAVE) existing token pool have amassed approximately 9.74 million AAVE tokens collectively. This accumulation represents a staggering 60% or more of the entire AAVE supply.

The number of significant investors holding AAVE has risen significantly over the past day, according to ITB data, with a total of 291,000 tokens now in their possession. This suggests that whales are growing increasingly interested in AAVE as its price surges by an impressive 44% in the last month.

As a crypto investor, I’ve noticed that data indicates a significant withdrawal of Aave tokens by larger holders, amounting to approximately 271,000 units. However, this trend shouldn’t be mistaken for selling pressure from whales, given the current rising price. Instead, it might signal increased withdrawals from exchanges, potentially hinting at a shift in strategy or increased holding among these investors.

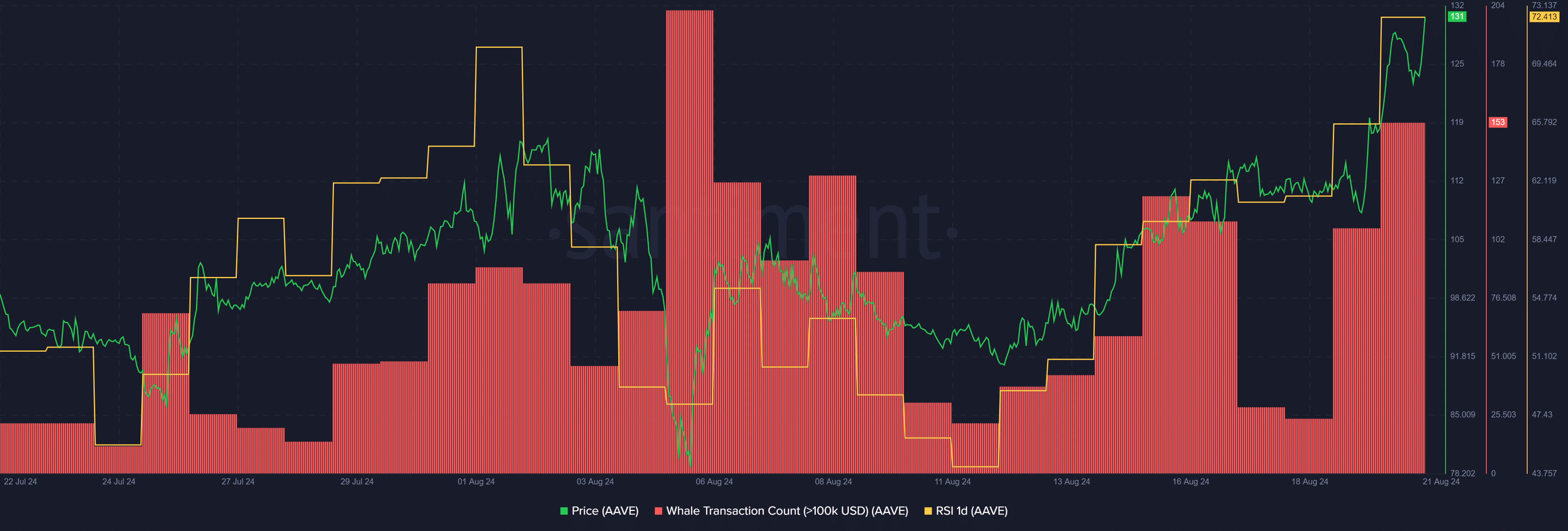

Over the last 24 hours, there has been a significant surge in the number of whale transactions involving at least $100,000 worth of AAVE, as reported by Santiment. This increase is more than sixfold since Aug. 18, with a total of 153 unique transactions taking place in this timeframe.

With a rising price of AAVE and increased whale accumulation, the Relative Strength Index (RSI) has reached 70, as reported by Santiment data. This suggests that the asset is currently overbought, meaning it might be normal for both smaller and larger token holders to take short-term profits.

In the past 24 hours, AAVE has risen by 7%, and it’s now being traded at approximately $137.2. However, even with this recent surge, AAVE is currently falling short by about 79% compared to its all-time high of $666, which was reached in May 2021. As of writing, the native token of the Aave protocol holds the 44th position among cryptocurrencies, boasting a market cap exceeding $2 billion.

Read More

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- Gold Rate Forecast

- USD MXN PREDICTION

- USD JPY PREDICTION

- Brent Oil Forecast

- EUR CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

2024-08-21 11:54