As a seasoned analyst with over two decades of experience in the financial markets under my belt, I must say that the recent performance of Ethena (ENA) has caught my attention. The 96.6% surge in just one month is nothing short of impressive, and the 45.1% rise in the last seven days is simply astounding.

In the past week, ENA has emerged as the leading player, primarily due to significant advancements within its system and increased whale involvement.

Over the last month, Ethena (ENA) has experienced a significant increase, jumping by 96.6%. This surge has elevated its market capitalization from $420 million in mid-September to an impressive $1.14 billion. A large portion of these gains were made within the last week, with ENA witnessing a remarkable 45.1% rise during that timeframe.

A significant factor driving the surge in ENA’s pricing is the continuous growth of the Ethena ecosystem. Notably, Ethena Labs has successfully implemented a crucial decision to incorporate Ethereal, a decentralized trading platform based on the USDe stablecoin, into their reserve management system.

The integration aims to boost the flexibility and practicality of ENA tokens within the Ethena system, making it a more appealing investment choice for both regular users and potential investors.

Last week, I learned that the developers of Ethena plan to allocate $46 million from their reserve fund towards tokenized assets. This move not only expands their financial strategy but also adds a layer of diversity. Moreover, I’m thrilled to share that industry giants like BlackRock and Securitize have expressed support for our new stablecoin, UStb. Their involvement significantly boosts my confidence in the robustness of Ethena’s ecosystem.

Spike in whale activity

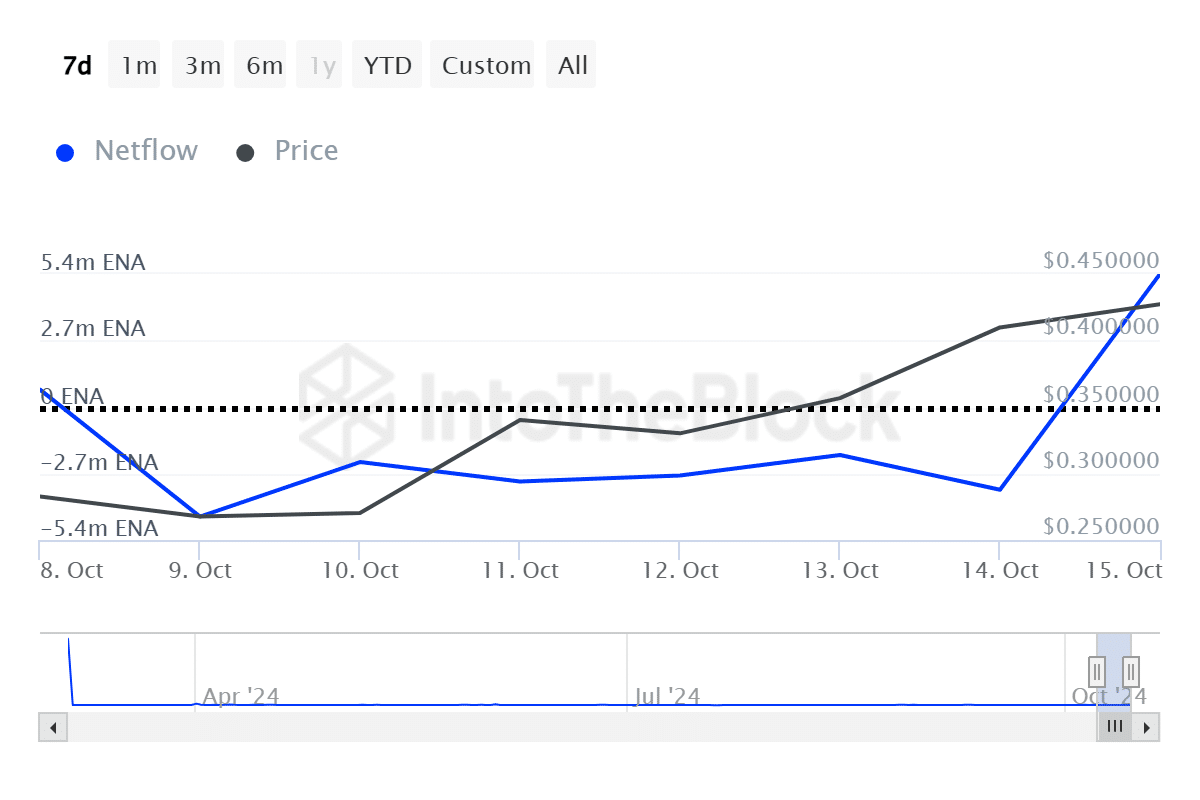

The behavior of whales has significantly influenced the current price fluctuations of ENA. As per IntoTheBlock’s data, substantial ENA holders amassed approximately 5.4 million tokens, equivalent to $2.3 billion, on October 15 – a significant rise from the $1.18 billion in outflows observed on October 9. Whale purchases typically indicate market assurance or accumulation, which could lead to price rises and enhance investor optimism.

Additionally, it has been reported that traders utilizing Smart Dex platforms, who are recognized for regularly making profitable transactions on decentralized exchange systems, have amassed 1.34 million ENA tokens during the last week. This accumulation equates to a total value of approximately $506,100, with each token costing an average price of around $0.32.

Price performance and future outlook

On Tuesday, ENA reached its highest point in two months at $0.455, thanks to a 45.1% increase over the last seven days. Yet, the token has experienced a slight decline since then, currently trading at $0.4179, representing a 7.5% drop over the last day. This decrease might be attributed to some long-term holders cashing out after ENA’s swift rise, which is usually seen following an extremely bullish day.

Despite this short-term correction, analysts remain optimistic about ENA’s price trajectory.

Based on ‘World of Charts’ analysis, ENA appears to have exited a widening downward channel formation, often indicating an impending bullish turnaround. The expert predicts that the token could potentially surge by approximately 150% within the short term.

Likewise, another expert, known as Altcoin Sherpa, predicts that ENA might climb up to $0.50 in the near future, assuming Bitcoin (BTC) maintains its current stability. Should the overall market conditions persist in being advantageous, ENA could potentially experience additional growth before experiencing a significant downturn.

As an analyst, I’ve observed a significant surge in the value of ENA, which has translated into more ENA token holders reaping profits. ITB data suggests that approximately 21% of active ENA holders are now in profit, marking a considerable increase from the 5.7% seen on October 8th. This enhanced profitability could potentially attract both retail and institutional investors, who might anticipate additional price increases and choose to hold onto ENA.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-10-16 12:22