The ever-dramatic Bitcoin finds itself in a rather unfortunate predicament, a delightful plunge below the noble price of $80,000—a bitter pill for cryptocurrency enthusiasts to swallow on a dreary Sunday, reminiscent of a Tolstoy novel where everyone just seems to be suffering for no reason.

Ah, but wait! Like a phoenix—or perhaps a particularly stubborn cockroach—Bitcoin managed to claw its way back to the lofty heights of $79,825, sparking glimmers of hope like the sun peeking through dark clouds. This recovery, a mere 4.1%, does pose the poignant question: can a cryptocurrency really fall 26% and still reside in the realm of speculation and dreams?

Bitcoin Open Interest: A Resounding Whisper

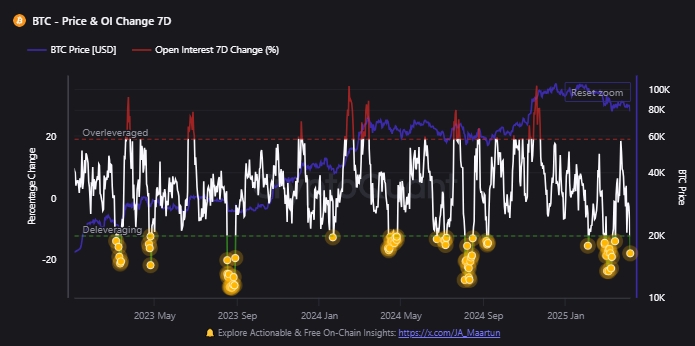

There we find our dear Bitcoin, revealing—quite embarrassingly—its open interest metric, akin to a shy youth declining a date. CryptoQuant’s Maartunn illuminates a rather alarming 17.8% decline among our leveraged traders over the week.

This disheartening statistic suggests a reduction in brave souls willing to gamble on derivatives, possibly due to trepidation following our beloved currency’s recent chaotic escapades. But let’s not write a eulogy just yet! Such drops have historically precluded stunning market rebounds, like the spring unfurling after a long winter’s nap.

With the leverage reset, it seems our bolder investors may once again feel the urge to re-enter the fray—particularly, of course, if a chubby whale shows a penchant for acquisitions, eyes sparkling with bullish anticipation. Who doesn’t love a good plot twist?

Bitcoin Open Interest has taken a nosedive of 17.8%. Truly, it’s shedding billions like a snake shedding its skin—only a bit more dramatic.

Just a week, and billions vanish into thin air. Oh, the transient nature of wealth! How delightful!

These flush-outs, some might say, form the very groundwork for golden opportunities that make one swoon with delight.

— Maartunn (@JA_Maartun) April 8, 2025

A Tidal Wave of Accumulation: A Comedic Coincidence?

Meanwhile, one cannot overlook the peculiar behavior of our long-term holders, or as I like to call them, the “whale whisperers.” According to the insightful observations of CryptoQuant, certain addresses are engaging in what can only be described as a buying frenzy—an impulsive splurge of Bitcoin even amidst its dizzy heights!

Imagine, rising from a modicum of $20 billion in 2023 to a staggering $160 billion in just a couple of years. It’s as if our whales decided to throw a lavish party, inviting all their friends to join, and they’ve collectively amassed a treasure trove swelling from 800,000 to 3 million BTC! One must ponder: how much does a whale eat, anyway?

The newfound fortitude of these accumulating addresses baffles the mind; despite soaring prices, they threw caution to the wind, resembling characters in a novel whose moral compass has become dislodged in the fervor of investment. An analyst mused:

Indeed, the average price at which these addresses acquired their BTC has ascended significantly, yet they chose to ramp up their buying instead of retreating. A curious manifestation of high conviction amid rising costs!

One could say a generational divide in realized capital has sprouted, akin to a theater divided between well-to-do patrons and the hopeful masses awaiting a glimpse of glory. The whales, undisturbed by the fluttering whims of the market, are steadily amassing BTC, placing them into the vaults of inaction, much like a squirrel hoarding acorns for a winter that seems endlessly distant.

Onchained’s analysis further teases out three tantalizing implications—growing supply-side pressure as more BTC nears dormancy, steadfast conviction from those investors through each tremor of market caprice, and, of course, the delightful potential for supply shocks as the long-term holdout becomes ever more pronounced.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- USD MXN PREDICTION

- USD CNY PREDICTION

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD JPY PREDICTION

- Grimguard Tactics tier list – Ranking the main classes

2025-04-09 09:09