As a seasoned investor who has weathered numerous market cycles and witnessed the rise and fall of various financial instruments, I find myself intrigued by the evolving landscape of stablecoins. Having experienced the turbulence of traditional banking systems and the volatility of cryptocurrencies firsthand, I can appreciate the allure of these digital assets that aim to provide stability in an otherwise chaotic market.

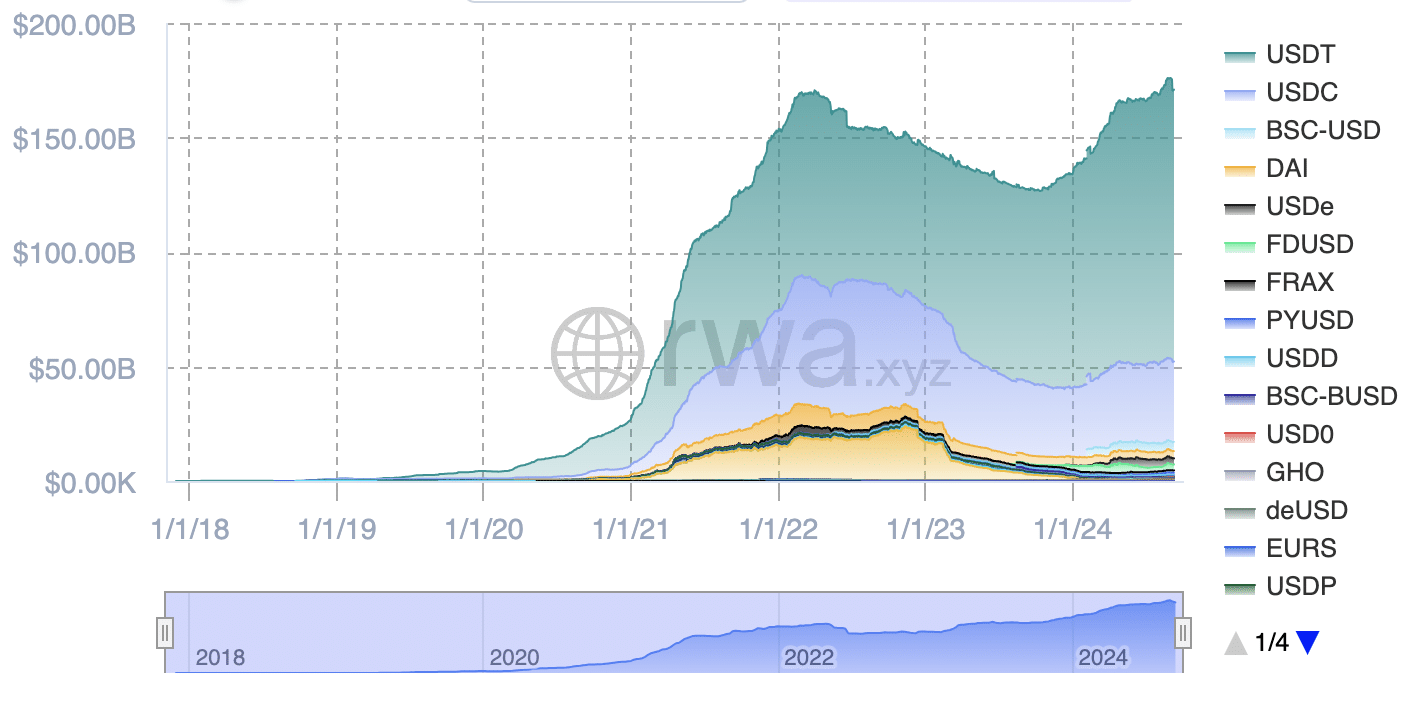

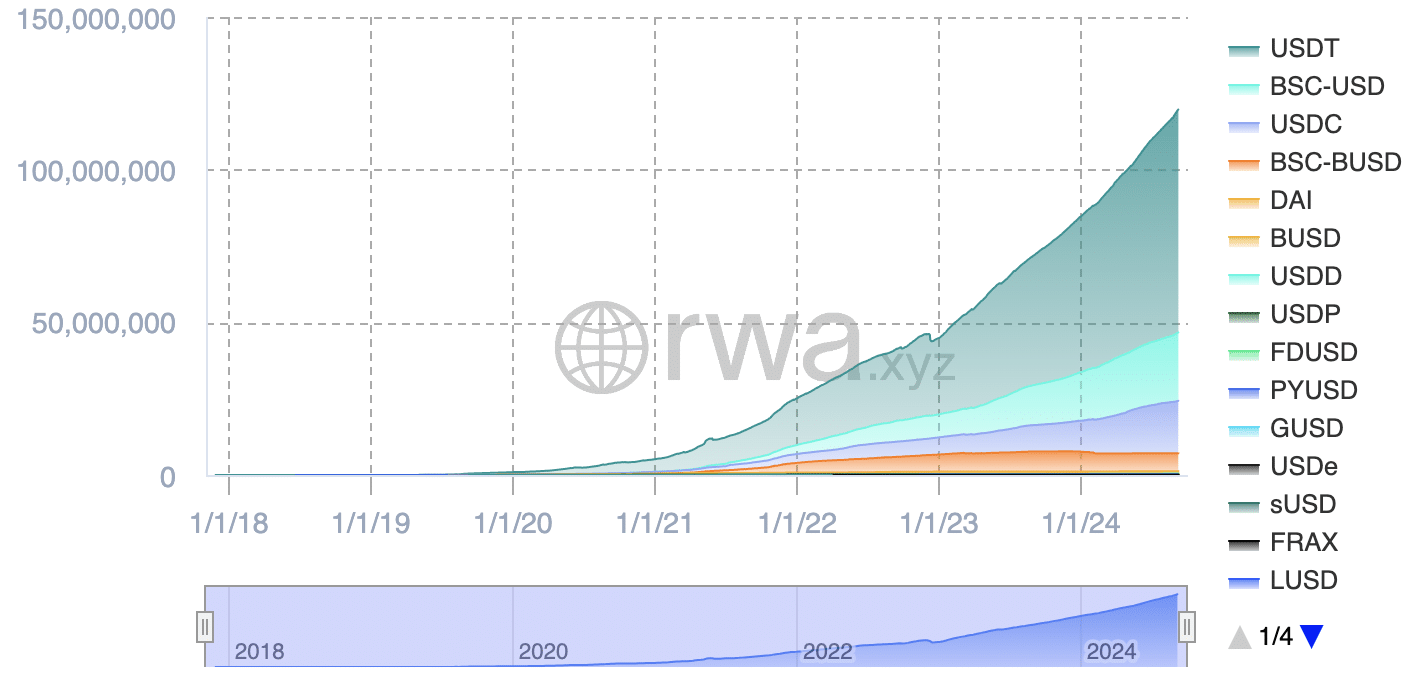

In the past four years, the market value of stablecoins has experienced an extraordinary surge, climbing from $17.6 billion to a massive $170.6 billion. Similarly, the number of people holding these digital assets has burgeoned significantly, rising from 3.78 million to an impressive 119.72 million. While this expansion is undeniably impressive, it raises several important concerns. Is it safe to hold stablecoins? Are the assets that support them truly secure? Could stablecoins potentially disrupt traditional banking systems, and what might be the government’s response to such competition?

Table of Contents

As a crypto investor, I’ve learned the hard way that crucial questions are too often overlooked. The crash of TerraUSD (UST) is a stark reminder, where just a handful of investors and analysts foresaw its impending doom. Many users placed their trust in the system, not delving into the true resilience of the underlying assets. Unfortunately, this blind faith led to substantial financial losses. To grasp the risks involved, it’s essential to delve deeper into the essence of money itself.

What is money?

In simpler terms, money represents worth or value. When someone purchases a chocolate bar, they essentially swap their money (value) for the value of the chocolate bar. The seller, in turn, can utilize this money to acquire the value they require instead.

In earlier periods, people didn’t use paper money or digital transactions as we do now. Instead, they traded using livestock, hides, seashells, grains, and salt as a means to exchange goods. As time passed, societies adopted gold as a more consistent measure of value. However, consider a scenario where you purchase a chocolate bar for the equivalent of 0.0353 ounces (1 gram) of gold. This transaction would necessitate scales, knives, and is just not practical for everyday use.

Here’s a possible way to rephrase the given text:

The trust model

The transition from physical worth to paper money brought about an essential element: trust. At first, people trusted the intrinsic value of a commodity such as gold. Now, trust has been transferred from an item (gold) to a party (the government or central authority). Trust is the foundation of contemporary currency systems. Without trust, transactions would not be possible. For example, no one would trade a house for a bag of rocks because rocks lack universal trust and value.

Money, be it physical or electronic, derives its worth from the shared faith in the issuing authority, such as a government or central bank. Absent that trust, money would degrade into meaningless bits of cotton and cloth.

What is fiat money?

The term “fiat” means an official command or decision made by a power figure. Fiat currency, in essence, gains its worth not due to any inherent feature or commodity support, but simply because the government declares it valuable. Translated plainly, money is considered valuable solely based on the government’s assertion.

Cons of fiat money

fiat currency comes with some significant flaws. Primarily, it’s controlled centrally, implying that faith is required in the behavior and honesty of financial institutions and governing bodies.

- JPMorgan Chase data breach (2014): The data of 83 million accounts was compromised.

- Wells Fargo scandal (2016): Over 2 million fraudulent savings and checking accounts were created without clients’ consent.

- India’s demonetization (2016): Overnight, the government declared that 86% of the country’s currency circulation, 500 and 1000 rupee bills, was no longer valid.

Another problem with fiat money is excessive printing, which leads to inflation.

- Germany (Weimar Republic, 1923): Prices doubled every two days during hyperinflation.

- Brazil’s inflation (1985-1994): Prices increased by a staggering 184.9 billion percent during a decade-long crisis.

- Venezuela (2015-2022): The cumulative inflation rate from 2016 to April 2019 reached 53.8 million percent.

So, several problems plague traditional money systems. First, paper currency can become worthless overnight due to governmental decisions. Second, the stability of money varies widely between countries. Inflation affects all currencies, but some experience it more severely, leading to rapid devaluation and loss of purchasing power.

However, digitizing fiat currency presents certain challenges. Traditional banks work under a fractional reserve system where they keep only part of their customers’ deposits in reserves. Regulations like the Basel Accords and national banking laws allow them to loan out most of these funds. As a result, money becomes nothing more than figures on a ledger, essentially promises or IOUs, without full collateral behind it.

In the fractional reserve system, there’s a possibility of a bank rush, occurring when many customers withdraw their money simultaneously due to worries about the bank’s financial stability. Since banks don’t keep all deposits on hand, they may struggle to meet sudden cash demands, causing panic and potentially leading to the bank’s collapse.

Stablecoins operate on a different level from traditional fiat money but are not entirely immune to these issues either. Unlike fiat currencies, stablecoins like USDT, USDC, and DAI aim to maintain a stable value by being pegged to a fiat currency, usually the U.S. dollar.

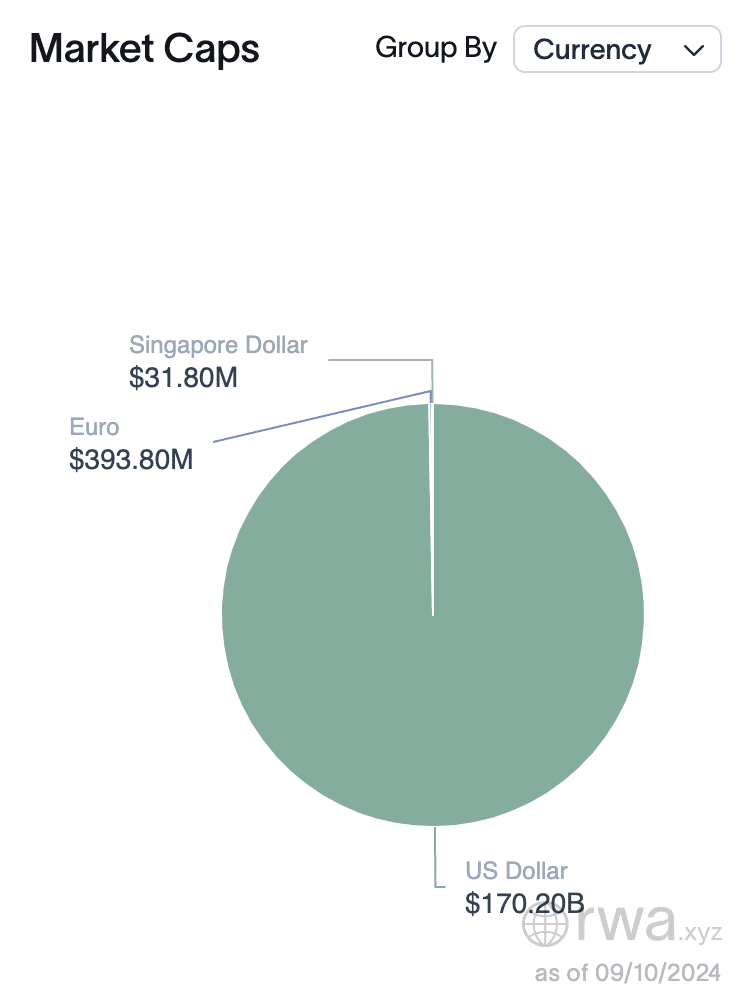

Why are the majority of stablecoins pegged to USD?

To grasp the differences between stablecoins and conventional fiat money, let’s delve into the reasons behind the U.S. dollar’s overwhelming influence. Why not the Swiss Franc or Japanese Yen? People might argue that the dollar is widely used, but the crucial question is what made it the world’s leading currency in its early days.

The reason for the U.S. dollar’s powerful position is often referred to as its “extraordinary advantage.” This advantage allows the United States to dodge financial crises related to international trade balances, as it continues to be the preferred currency in global reserves. Systems like the Petrodollar arrangement and compulsory acquisition of U.S. Treasury bonds by foreign central banks contribute to this situation, allowing the U.S. to borrow funds affordably and spend without facing immediate repercussions.

The system enables the United States to produce dollars and use them to purchase real items and services worldwide, effectively shifting the inflation they create to other countries. This is one explanation for why developing nations frequently experience higher inflation rates – they bear the brunt of the inflationary consequences of U.S. monetary policy. Essentially, the U.S. benefits from a distinct advantage in the global economy, as it can exchange printed money for tangible goods without experiencing immediate domestic inflationary pressures.

As a researcher studying monetary policy, I examine how the Federal Reserve manages the money supply in the economy. Specifically, when the Fed lowers interest rates or undertakes quantitative easing, it essentially pumps more dollars into the system. This expansion of the global dollar supply can be advantageous for U.S. entities such as governments, corporations, and banks, who can secure credit at reduced costs. Consequently, this increased access to capital fuels loan issuance, thereby creating additional dollars.

Foreign nations have a challenging decision to make when amassing dollars. They may opt to increase the value of their local currency compared to the dollar, but this move could hurt their export industries. Another option is to boost the supply of their own currency to preserve its parity with the dollar, yet this strategy frequently triggers domestic inflation. This ongoing inflation can result in a loop where central banks of these countries must manage the tension between maintaining their currency’s value and dealing with the consequences of inflation.

As an analyst, I find it advantageous for the United States to be part of the global financial system. Foreign countries often choose to invest the dollars they accrue in our U.S. Treasuries, essentially lending money to our government at relatively low-interest rates. This financing mechanism allows us to cover our budget deficits, which are utilized for expenses like military expenditures, infrastructure development, and social welfare programs. The reason foreign nations continue to purchase our debt is twofold: firstly, they require dollars for international trade, and secondly, holding U.S. debt provides them with a sense of financial stability.

Most stablecoins are tied to the U.S. dollar because that’s where their stability primarily lies, and the U.S. dollar serves as the foundation for nearly all activity in the stablecoin market.

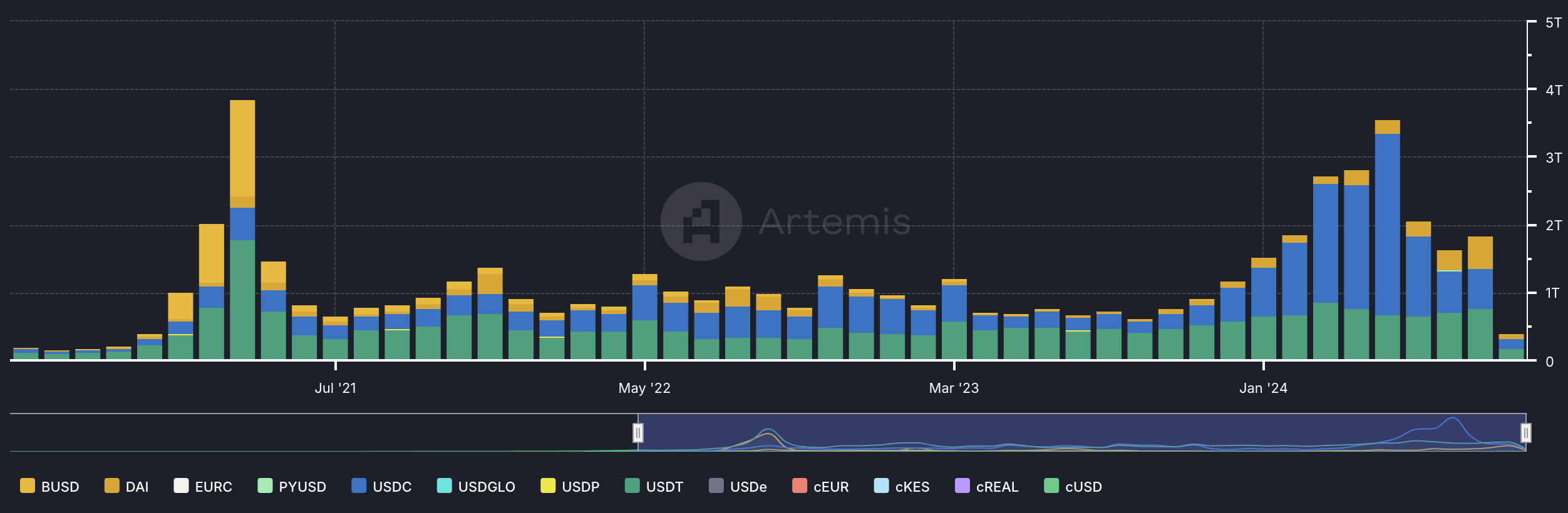

Over a span of four years, the amount of stablecoins transferred each month has skyrocketed from an impressive $202 billion to a staggering $3.6 trillion.

Compared to conventional finance, the foreign exchange trading of U.S. dollars in 2022 amounted to a staggering $2,739 trillion, as reported by the Progressive Policy Institute. By 2024, it’s projected that this figure will swell to $3 trillion, which equates to around $250 trillion traded every month. Remarkably, stablecoins currently account for close to 1.5% of this dollar trade.

How do stablecoins maintain their peg?

Most of the trading activity and value in the stablecoin market is dominated by just three major players: Tether (USDT), USD Coin (USDC), and Dai (DAI). While each of these coins has a different approach to keeping their value tied to the U.S. dollar.

USDT

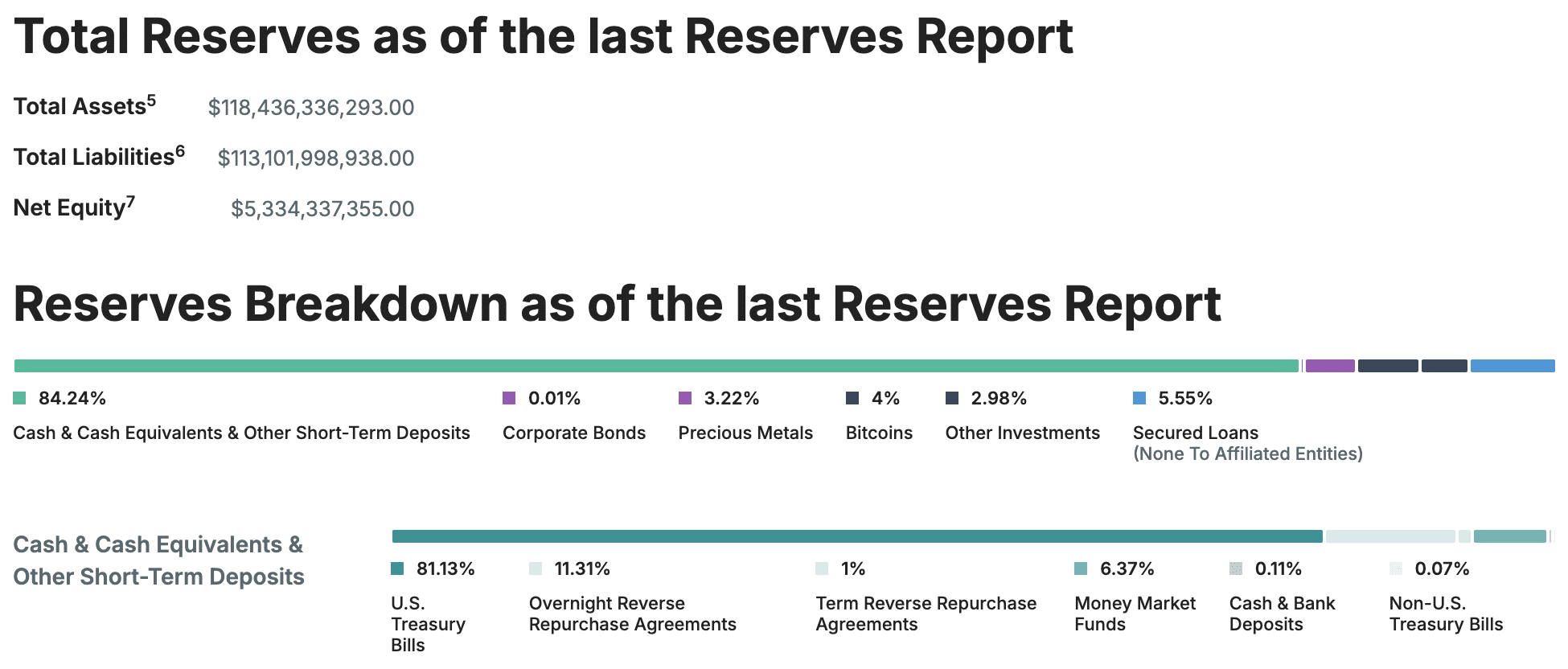

USDT (Tether) maintains its connection to the U.S. dollar by utilizing a combination of reserve assets and stringent issuance guidelines. For every USDT token circulating, an equivalent value is kept in reserve, often in the form of cash, short-term investments, or U.S. government bonds. These reserves are intended to guarantee that each USDT can be swapped for one USD.

As the need for USDT increases, Tether adds new tokens and ensures they are backed by the appropriate reserve assets. Conversely, when users trade USDT for USD, those tokens are removed from circulation to maintain the supply in balance with the reserves.

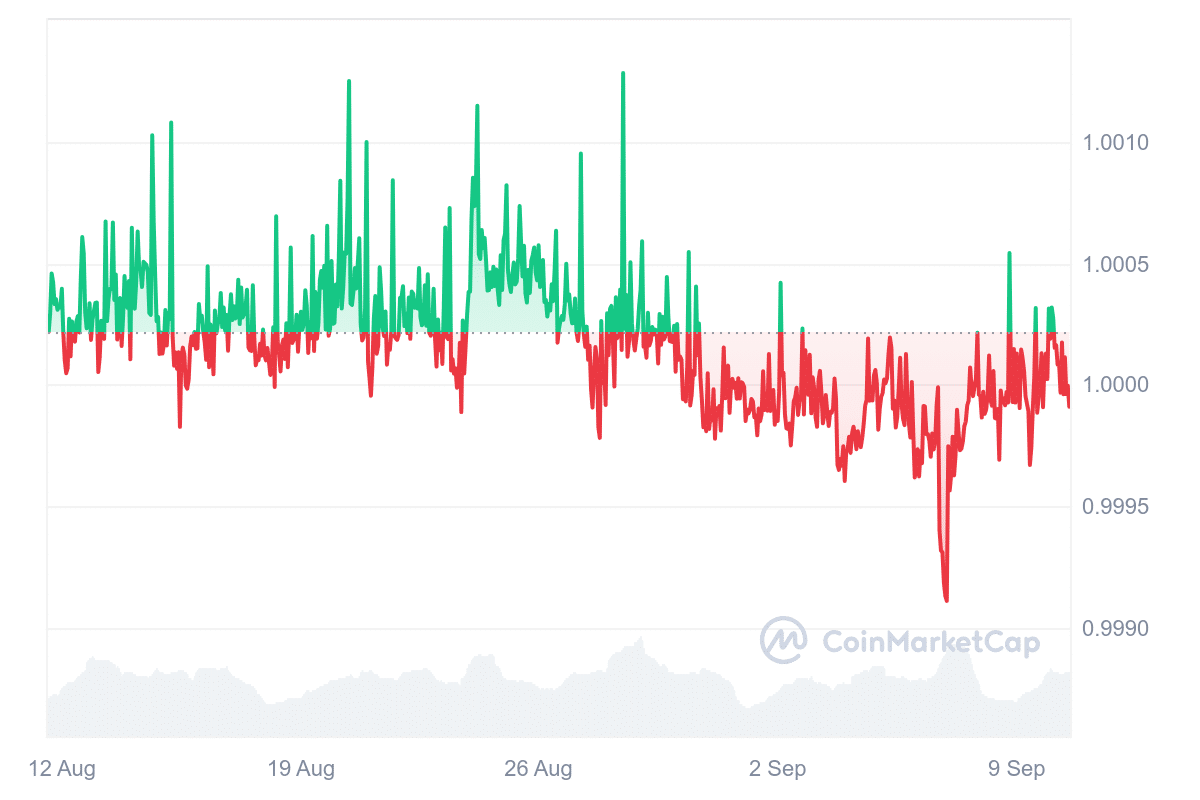

The peg always deviates slightly due to liquidity imbalances or shifts in supply and demand on exchanges.

For example, when market conditions are particularly active or tense, an unexpected increase in the need for USDT might cause its price to go over $1. This could happen because traders are willing to pay more to immediately obtain a stable asset. On the flip side, a quick sale of USDT may momentarily push its price below $1, as the supply outpaces demand for a short period.

As a crypto investor, I’ve found that only verified entities with a Tether account can swap USDT for USD directly. These tend to be institutional clients, large-scale traders, or established exchanges. In contrast, retail investors like myself typically don’t have the ability to redeem USDT directly from Tether. Instead, we usually convert our USDT to USD on cryptocurrency exchanges.

For quite some time now, Tether has been embroiled in controversy, and its reputation remains tarnished. A major issue at hand is the clarity regarding Tether’s reserve holdings, with critics doubting whether USDT tokens have consistently been fully backed by U.S. dollars. In 2021, Tether reached a settlement with the New York Attorney General’s office following an investigation that uncovered discrepancies in their past reserve declarations.

As a crypto investor, I’ve noticed that one area where Tether could improve is by undergoing full audits from renowned global accounting firms. While they have begun releasing transparency reports on a quarterly basis, some remain skeptical due to the absence of thorough audits by top-tier firms in the industry.

Despite the controversies and skepticism, Tether remains extremely profitable due to its widespread use. In the first half of 2024 alone, Tether reported a profit of $5.2 billion.

USDC

USDC and USDT function similarly, but USDC prioritizes compliance with regulations and transparency. To assure users that each USDC token is tied to one real asset, USDC conducts regular audits by top-notch accounting firms every month. This audit procedure offers a stronger sense of security compared to Tether’s quarterly assurances since it follows guidelines closer to those in traditional finance.

Although USDT and USDC vary in terms of transparency and regulatory alignment, they both possess a significant common trait: they are centralized. This means that their issuers have the ability to freeze or restrict access to tokens in certain accounts, in accordance with legal mandates. Both stablecoins have demonstrated a pattern of blocking specific addresses when requested by law enforcement or government bodies, thereby introducing an element of control that clashes with the decentralized ethos typically associated with cryptocurrency.

DAI

Unlike USDT and USDC, DAI (Decentralized Autonomous Internet currency) operates differently as it’s a decentralized, overcollateralized stablecoin. Instead of being issued by a centralized organization, DAI is produced by users who pledge cryptocurrencies like Ethereum as collateral. This system ensures that the value of the pledged assets consistently surpasses the value of the generated DAI. Even when the value of the collateral fluctuates, the value of DAI remains stable due to this overcollateralization. In case the collateral’s value significantly decreases, it is automatically liquidated to preserve the parity with other currencies. A significant advantage of DAI is its resistance to freezing, blocking, or blacklisting specific addresses.

The future of stablecoins and government action

Currently, stablecoins make up about 1.5% of global U.S. dollar trading. However, it’s when this percentage significantly increases, falling somewhere between 5% and 15%, that a significant shift will occur. When stablecoins become a major player in the market, governments may find it necessary to collaborate closely with issuers, establishing a regulated environment that combines traditional finance with the burgeoning cryptocurrency sector. Governments could choose to view stablecoins as a means to strengthen the global influence of the U.S. dollar or they might respond with stringent regulations.

It’s not very probable that governments would outlaw stablecoins, particularly those tied to the U.S. dollar, because they help strengthen the global influence of the U.S. currency. This is beneficial for national interests rather than causing conflict. By using stablecoins in international transactions, governments might find it advantageous as it supports the dominance of the U.S. dollar on a global scale.

But the rise of stablecoins also raises questions about security and reliability. Holding traditional paper money presents its own risks, including inflation and devaluation. Digital money in banks is also vulnerable, as seen with events like bank runs or systemic failures. And stablecoins carry big risks as well.

Even though TerraUSD has a unique structure compared to coins like USDT, USDC, and DAI, its collapse, coupled with Silicon Valley Bank’s troubles and USDC’s temporary de-pegging in 2023, the ongoing debates about USDT’s transparency, underscores that stablecoins are not entirely shielded from market turmoil and liquidity problems. Although they provide some benefits, they should not be considered completely dependable for long-term wealth preservation.

In light of the TerraUSD crash, it’s evident that relying excessively on any single stablecoin can be hazardous. A more prudent strategy might entail owning assets that increase in value, like stocks, bonds, Bitcoin, Ethereum, Solana, or real estate, while keeping a modest amount of cash or stablecoins for liquidity reasons. Preferably, this reserve should cover between 3 to 24 months of expenditures based on one’s risk tolerance and could be stored in high-yield savings accounts or reputable decentralized finance platforms.

Read More

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Gold Rate Forecast

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-09-18 00:43