Ah, dear reader, we find ourselves once again perched on the knife’s edge of fate, watching Bitcoin—a wily beast, capricious and mercurial—dance arduously between the stale walls of $80,000 and $85,000. It struggles, like a drunken philosopher attempting to grasp the fleeting wisps of truth, to reclaim its lost fervor, that fabled buying pressure. Yet amidst this theatrical hesitation, the chorus of crypto prophets sings with hopeful irony: a greater summit awaits, a peak beyond $125,000 before the grim curtain falls in 2025.

Enter TradingShot, a sage of this modern arcana, who dares whisper that the time of reckoning nears—the bull’s final charge, a crescendo of digital gold surpassing all prior glory. But, oh!—in true Dostoevskian fashion, this prophecy is encumbered by a dark foreshadowing: October 2025 beckons with the chill breath of a relentless bear market, ready to devour the dreams of those too intoxicated by their gains.

The Eternal Return of Bitcoin’s Madness: Cycles of Hope and Despair

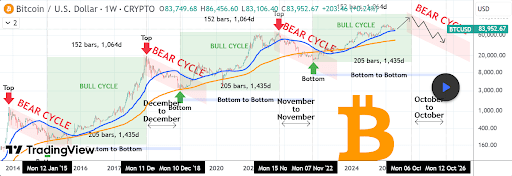

On the hallowed grounds of TradingView, our oracle lays bare a decade’s dance of Bitcoin’s volatile souls—bulls and bears locked in a Sisyphean struggle for dominance. Behold, symmetric cycles etched in time: bulls charging for exactly 1,064 days (or 152 weeks, if pedantry will soothe your soul), bursting into ecstatic peaks every three years, only to yield to bears lurking for a year’s bitter winter, from one November to the next.

A tale of repetition so precise it mocks free will: a triptych of bull triumphs shadowed by three mournful bear winters. The latest nadir, November 7, 2022, served as the birth of this latest bull era. Should fate remain true, brace yourself—October 6, 2025, holds the potential apotheosis of Bitcoin’s glory.

And so Bitcoin surged past the sacred $100,000 threshold, scaling peaks once thought sacrilegious by mere mortals, reaching $108,786—yet that is but a prelude. Another ominous yet exhilarating reckoning awaits, a fireworks finale that promises to eclipse $125,000, mirroring the delirious euphoria of 2017 and 2021, the years when bulls roared like madmen set free from their chains.

The Grim Directive: Sell in October or Suffer the Consequences

“Sell everything by October 2025,” commands TradingShot with the brutal honesty of a Dostoevskian character confronting existential ruin. This is no mere suggestion; it is your last call to abandon ship before the iceberg of bearish despair sinks your hopes. Mark the calendar—the merciless countdown of 1,064 days from the November 7, 2022 floor, pointing squarely to October 6, 2025, as this tragic apex.

Then comes the long, cold winter of bearish rejection lasting approximately one unforgiving year, dragging Bitcoin down to its next lowland by October 12, 2026. Only then may the phoenix rise again, promising another devilish waltz in bullish madness.

So heed, or not—this is a tale told before, with uncanny precision. Sell like a man fleeing a fire, then return one year later, pocket full of bruises and wisdom, to buy once more.

At this moment of writing, Bitcoin sits modestly at $84,500, a mere 0.9% nudge upwards in the last 24 hours—a modest shrug compared to the towering 48% distance from that hyped $125,000 summit. The tragicomic dance continues, dear reader. Keep your wits; or don’t. After all, what’s life without a little existential risk? 🤡📉🚀

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- USD CNY PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2025-04-18 03:05