Amid the vast and often baffling digital wilderness, where rumors of demise and despair swirl like autumn leaves before the storm, a curious truth emerges from the obscurity: Bitwise, that towering colossus of crypto insight, whispers of a market quietly ablaze with life. Imagine a raging bull unseen, charging not through fields of gold but on the brittle ice of a ‘frustrating’ bear market.

It was the first quarter of 2025, a time when hope seemed on precarious footing, yet Matt Hougan, the sage guiding Bitwise’s vision, described this season not in despair, but rather with an odd mix of grudging respect and surprise—the sort of admiration reserved for a stubborn old horse that refuses to collapse despite the weight of years.

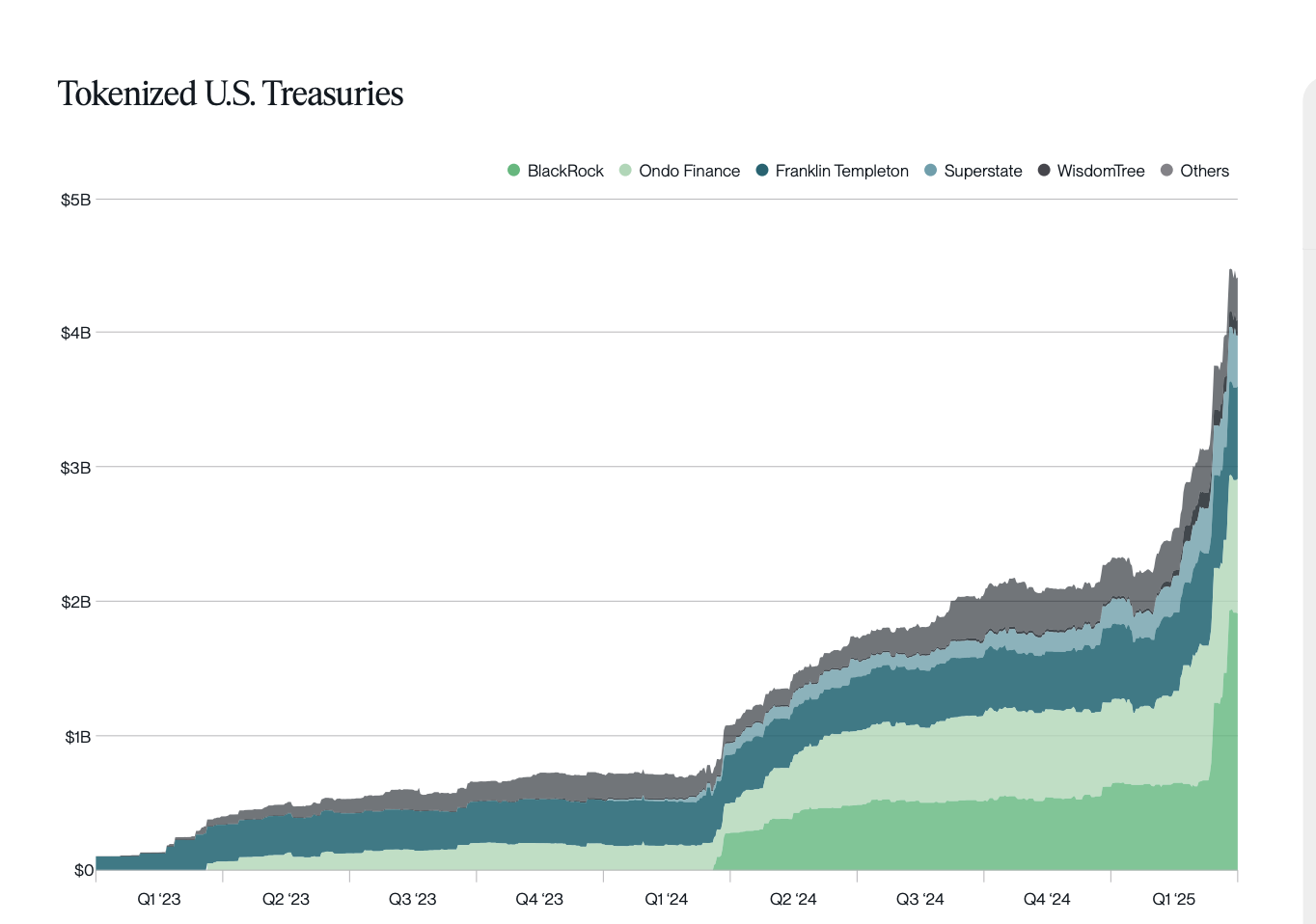

Among the flickering candles of digital fortune, the adoption of stablecoins swelled, like a river swelling after a calm spring thaw, while Bitcoin futures danced with renewed vigor, their volumes hinting at a quiet but stirring appetite among the learned institutions of finance. Yet the true marvel—so unexpected it could make the most stoic onlooker chuckle—was the parabolic ascent of tokenized real-world assets.

“Observe, if you will,” the report intones, “how, despite the merciless tug of market pullbacks, certain corners of this crypto realm roar with prosperity. Stablecoins have ballooned to an astronomical $218 billion of assets under management—a figure that grows quarter after quarter as if nourished by hidden springs beneath the frozen earth. Transactions have similarly surged, and tokenized real-world assets have ascended like Icarus—careful, now—increasing by over 37% to reach their austere new summit.”

Of course, this spectacle is not without its theater: regulators smile nervously, institutions murmur over their ledgers, and somewhere, a weary analyst sips his fourth cup of tea questioning his own sanity. Yet optimism carries itself forward, albeit with a tip of the hat to the day’s perplexities.

The narrative continues with Ondo Finance standing tall among titans, rivaling the venerable BlackRock itself in the realm of US Treasuries tokenization—a fanciful duel worthy of any high-society ball, outshining the likes of Franklin Templeton and WisdomTree as if they were but mere chess pieces on a vast, glittering board.

And as if guided by some capricious cosmic playwright, central banks worldwide gesture towards a loosening embrace of monetary expansion—a dance that, in history’s long and winding hall, has often signaled fortune’s favor for the bold, especially those who flirt with the intangible allure of digital assets.

Thus, the twisted tale of 2025’s Q1 market is scribed not as tragedy, but as a curious comedy—a testament to the strange persistence of life where one least expects it, or perhaps merely the stubbornness of numbers and charts, gambling on a stage set with jest and gravity in equal measure.

For those daring enough to dive into this curious unfolding, the full chronicle awaits here.

Read More

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- Gold Rate Forecast

- USD MXN PREDICTION

- USD JPY PREDICTION

- Brent Oil Forecast

- EUR CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

2025-04-16 21:22