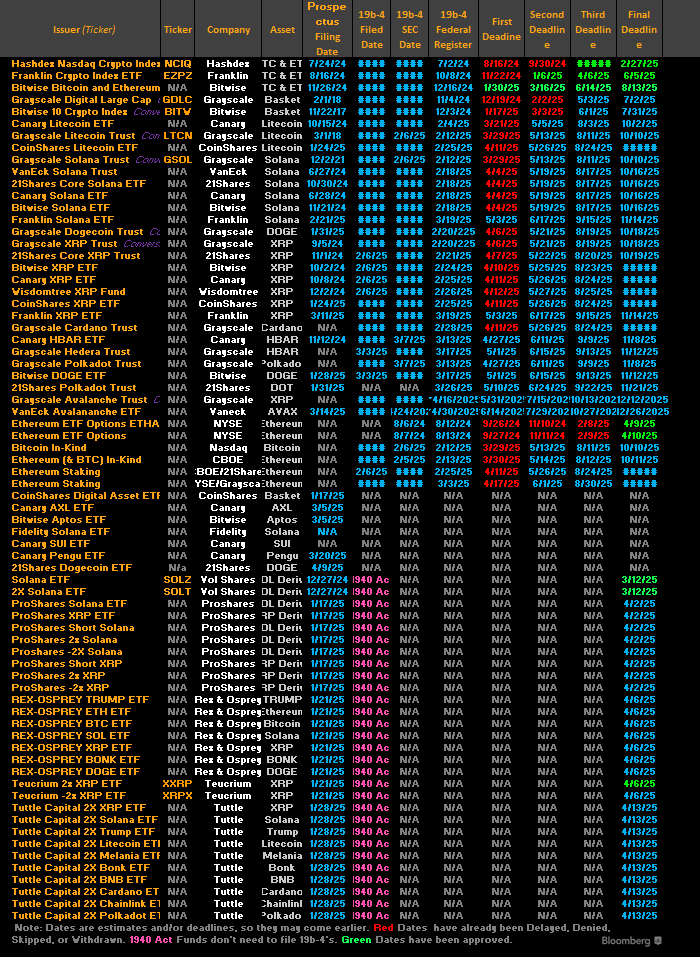

Imagine, if you will, the august U.S. Securities and Exchange Commission—our nation’s self-appointed gatekeepers of fiscal fantasy—taking an extended intermission in the theatrical production of crypto ETFs, with a well-practiced shrug and a polite “More time, please.” Bitwise’s Bitcoin and Ethereum ETFs, along with Canary Capital’s Hedera proposal, find themselves caught in this bureaucratic ballet, their fate postponed to the far-flung days of June 10 and 11, as though these dates might magically unravel the Gordian knot of regulatory mystery.

One might picture the SEC, perched behind a fortress of paperwork, eyes bleary from sifting through a deluge of crypto promises, token fantasies, and the odd pet penguin bundled in a memecoin—because why not? With public commentary notes piling higher, the “thorough review” is less a slow dance and more a relentless waltz with procrastination.

Meanwhile, Grayscale’s valiant yet beleaguered effort to transform its Polkadot Trust into an ETF joins the waiting chorus, also serenaded by a June tune, as if synchronization in delay provides some secret comfort.

Enter Paul Atkins, crypto’s new best friend at the SEC helm, like the unexpected plot twist in a novel you thought was a dull procedural—perhaps a harbinger that approval might bloom someday, somewhere, in the tangled garden of digital assets, or at least that’s the hope whispered by those who dream of “crypto-friendly” days.

Our dear Bloomberg analyst, James Seyffart, documents the growing menagerie of applicants: Solana, Ripple, Sui, Litecoin, Axelar—think of it as the United Nations of altcoins, plus a few oddball guests like Bonk and a Trump-branded token, because the circus must go on. The SEC’s answer? More time, obviously.

Not just lone wolves but bundled cryptic beasts in index funds also await the SEC’s scrutinizing gaze, while Bitcoin, that ancient digital titan, stands tall, reigning supreme over 90% of crypto fund assets and seemingly immune to the seductive allure of its flashy altcoin cousins.

“… Bitcoin ETFs command 90% of all the crypto fund assets globally. While a TON of alt/meme coin ETFs are likely going to hit market this year, they will only make minor dent, bitcoin likely to retain at least 80-85% share long-term,” he mused on X, where brevity meets the eternal dance of market optimism and regulatory patience.

Read More

- 10 Most Anticipated Anime of 2025

- Brent Oil Forecast

- Silver Rate Forecast

- USD MXN PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

- Gold Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- Pi Network (PI) Price Prediction for 2025

- How to Watch 2025 NBA Draft Live Online Without Cable

- Castle Duels tier list – Best Legendary and Epic cards

2025-04-25 14:48