As a researcher with a background in finance and experience following the meme stock phenomenon, I am thrilled to see Roaring Kitty’s return after three long years. The trader from Massachusetts, who goes by the online alias “Roaring Kitty,” gained notoriety for his role in the GameStop short squeeze that occurred in early 2021.

The reemergence of Roaring Kitty, a trader from Massachusetts, after a three-year absence has sparked enthusiasm in the crypto world and meme coin market. What information is available regarding this figure?

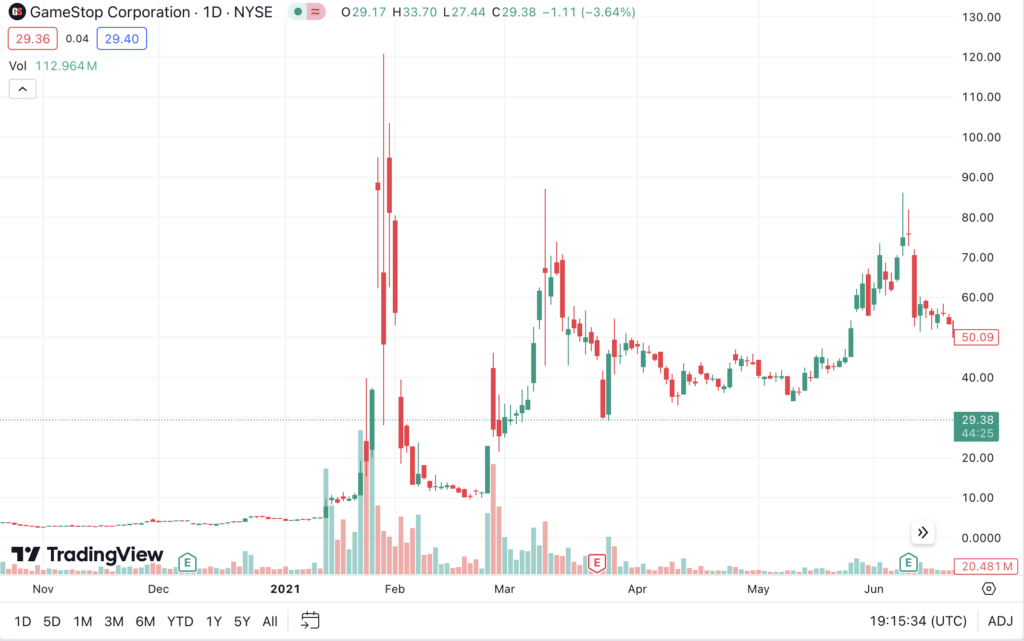

I, as an analyst, would describe it as follows: In May, both the meme coin market and GameStop shares saw a surge in growth once again due to the reemergence of a significant figure in the financial world – Roaring Kitty. This trader, known as “Kitty,” gained notoriety earlier in 2021 for his role in the unprecedented price increase of GameStop stocks. His actions served as an inspiration and a call to action for many traders looking to challenge traditional Wall Street norms.

Table of Contents

A kitty that believed in GameStop

Around the middle of 2019, Reddit user Keith Gill, previously a financial planner for Massachusetts-based insurance firm Roaring Kitty, made a public investment of $53,000 in GameStop. This post garnered minimal interest, with only a few individuals mocking his choice in the faltering corporation. However, this didn’t deter him.

During the course of the year, he frequently engaged in conversations about GameStop on Twitter and shared insights into his investments through videos on YouTube and TikTok. His financial theories gained traction among Reddit users, leading them to pay close attention.

A GameStop short squeeze

Keith Gill, also known as Roaring Kitty, gained significant recognition for his contribution to the dramatic increase in GameStop’s stock price in January 2021. This phenomenon is referred to as a “short squeeze” in financial markets.

As a researcher closely following the stock market scene during the global pandemic, I strongly advocated for the appreciation of GameStop shares based on my analysis. Despite the economic downturn causing consumer spending to decrease and historically low interest rates putting more cash in investors’ hands, I believed these shares were undervalued. Some investors, fueled by their resentment towards Wall Street hedge funds, saw an opportunity to express their discontent and jumped at the chance to invest in GameStop as a form of protest.

Mimicking Gill’s influence, internet traders initiated a frenzy over GameStop shares through the acquisition of options contracts. These contracts afforded them an affordable means to wager on the stock’s potential price increase.

In less affluent surroundings, Gill and his team engaged in discourse on Reddit and YouTube, leveraging complimentary online trading tools. Devoted traders immersed themselves in lengthy discussions beneath Gill’s videos, meticulously examining GameStop’s financial reports and deciphering intricate data regarding cash flow and gaming consoles.

The rise of GameStop

Prior to the series of recent events, I, as an analyst, would have advised GameStop to take corrective measures to improve its financial standing. The perception among institutional investors and hedge funds was that GME stock was overpriced, leading them to frequently engage in short selling, wagering on a decrease in the company’s share value.

On January 4, 2021, a single share of GME was valued around $4.56. Conversely, by January 27, the stock price peaked at an astounding $347.51 per share based on TradingView’s records.

The surge in this jump can be attributed to the active members of the r/WallStreetBets forum, among them Keith Gill. Observing a significant rise in the quantity of short bets placed on GME, they orchestrated a short squeeze, thereby igniting widespread enthusiasm for GameStop.

As a researcher studying online communities, I’ve observed an intriguing development regarding r/WallStreetBets. The short squeeze event led to a remarkable surge in viewership, with approximately 73 million people tuning in within a single day. Simultaneously, the subreddit experienced significant growth in its user base, expanding from around one and a half million members to roughly six million individuals.

Once the cost of GME surpassed previous highs, hedge funds holding short positions on GameStop were forced to buy up shares rapidly to limit their losses.

In reaction to the series of occurrences, Robinhood imposed a buying restriction for GameStop shares on January 28, 2021. The stock’s value peaked at $492 that day, only to plummet down to $193 shortly afterwards.

As a proactive crypto investor, I keep a close eye on market trends and adjust my portfolio accordingly. Given the current volatile conditions, I’ve decided to limit transactions for specific cryptocurrencies to only closing positions.

Robinhood statement

In 2021, the intensified regulatory clampdown on meme stocks triggered congressional inquiries, with Gill testifying among others, focusing on brokerage procedures and the addictive nature of retail stock trading. Simultaneously, Gill encountered multiple class-action lawsuits, one of which accused him of misrepresenting himself as a budding trader despite holding a professional license.

Return of Roaring Kitty

In the spring of 2024, after a three-year absence from social media, Roaring Kitty resurfaced. His initial post was a simple drawing: a man engrossed in a video game while seated in a chair. Remarkably, this image garnered over 24 million views within a day of its publication.

— Roaring Kitty (@TheRoaringKitty) May 13, 2024

As an analyst, I observed a noteworthy development when Roaring Kitty reemerged on social media platforms. Intrigued by the potential implications, I noticed a surge in buying activity among community members, leading to a significant increase in GameStop share purchases and meme coin momentum.

Market reaction

As a crypto investor, I was thrilled to witness the remarkable surge in GameStop’s share price, which soared by an astounding 75% instantly, reaching a new peak at $53. Furthermore, one of the most trending meme coins, Pepe (PEPE), broke its all-time high, leaving me and many others feeling elated about our investments in this space. The collective market capitalization of the entire meme coin sector experienced a significant boost, exceeding expectations with an impressive increase of over 6%.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- USD MXN PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

- Silver Rate Forecast

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD CNY PREDICTION

2024-06-12 22:24