So, long-term U.S. Treasury yields are practically throwing a party at 18-year highs. Who knew global sovereign debt could be so… entertaining? 🎉

Investors Flee Long-Dated Bonds Like They’re on Fire 🔥

This week, U.S. Treasury yields decided to flirt with danger: The 30-year bond just hit 5% for the first time in 16 years. Thanks, Moody’s, for the downgrade to Aa1! Nothing like a little panic to spice things up, right? 😅 The 10-year yield is hanging around 4.483%, while shorter-term notes are like that friend who shows up late to the party—nobody’s really interested.

Analysts are waving off liquidity alarms like they’re pesky flies, but come on! This downgrade is like a bad haircut—everyone notices. Moody’s is just following the crowd, echoing S&P’s 2011 cut and Fitch’s 2023 adjustment. They call it “political brinkmanship.” I call it “let’s all panic together!” 🤷♂️ Mizuho Securities’ Vishnu Varathan said it’s “dire but inconsequential.” Sounds like a classic Larry David line, doesn’t it?

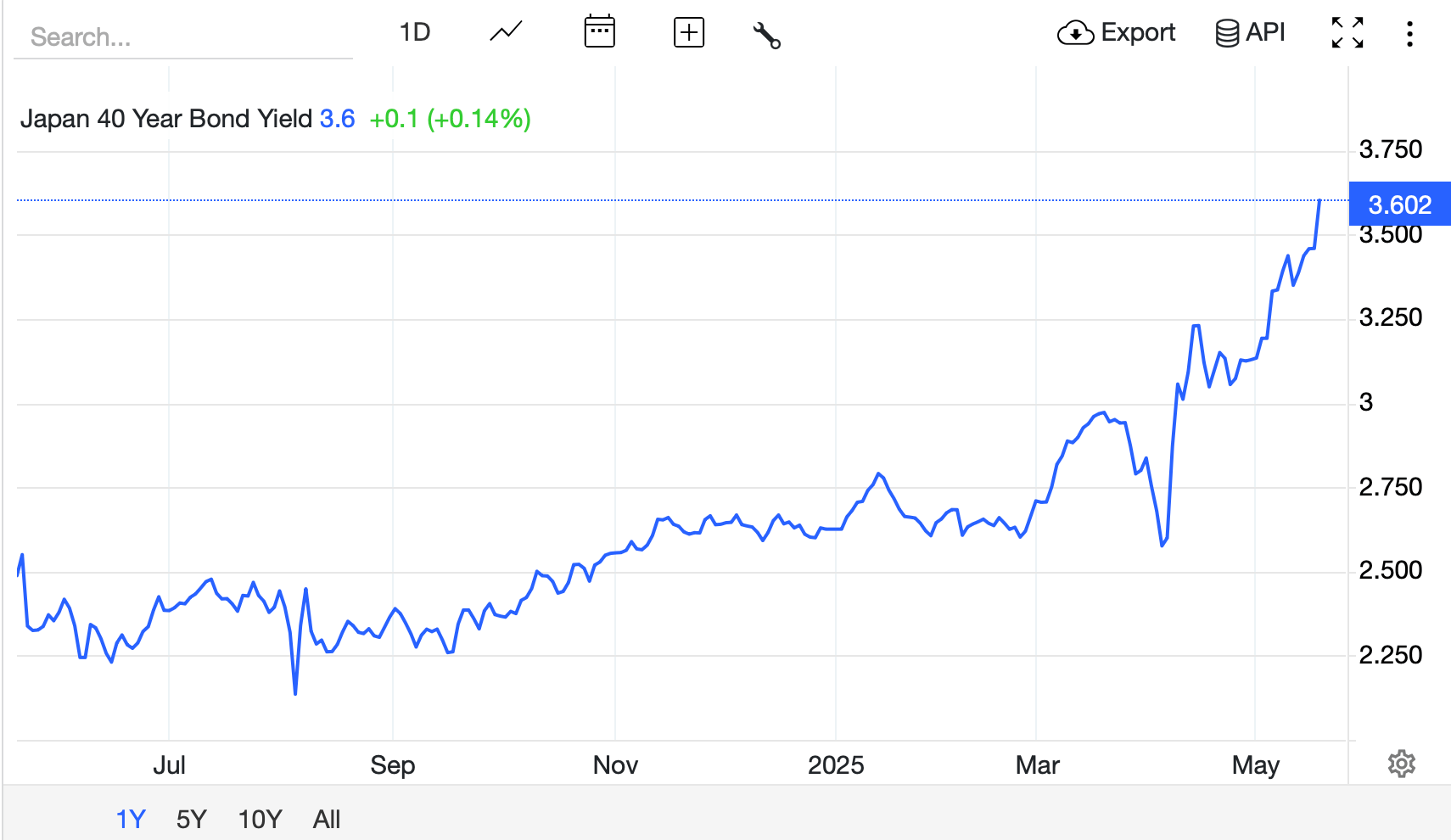

Remember October 2023? A 5% 10-year yield and then—boom!—equity downturn. Traders are sweating bullets over that déjà vu. And look at Japan! Their 40-year government bond yield is at its highest since 2007. Officials are comparing fiscal strains to “Greece in 2011.” What a time to be alive! 🌍

Apparently, capital is running to 3- to 6-month Treasuries like it’s a safe haven. Who knew short-term could be so appealing? Regulators are throwing liquidity buffers around like confetti, but doubts are still lurking. Risk-free assets? More like risk-what-are-you-talking-about? Investors are eyeing gold, bitcoin ( BTC), and some equities. The classic 60/40 portfolio is looking more like a 50/50 at best. 😬

Skeptics are saying fiscal solutions are as elusive as a good parking spot in New York. April’s yield spike was like a bad date—awkward and full of surprises. With faith in sovereign collateral fading, markets are looking for something outside the system. It’s like a bad breakup; nobody wants to go back! 💔

As the 10-year yield flirts with 4.5%, it’s time to get defensive. Bonds are sending a clear message: this isn’t just chaos; it’s a full-on recalibration of debt-fueled growth models. Remember when U.S. banking giants hoarded long-term debt during Covid-19? Now they’re haunted by colossal paper deficits. Talk about a bad investment! 😱

If interest rates keep climbing, these institutions might find themselves in a fiscal straitjacket. Unless, of course, the Federal Reserve swoops in for a rescue. But let’s be honest, who’s really coming to save the day? 🤔

Read More

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- Grimguard Tactics tier list – Ranking the main classes

- USD MXN PREDICTION

- Castle Duels tier list – Best Legendary and Epic cards

- PUBG Mobile heads back to Riyadh for EWC 2025

- Silver Rate Forecast

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD CNY PREDICTION

2025-05-21 01:29