On Tuesday, January 14th, Bitcoin surpassed $96,000 in trading. After dipping below $90,000 due to a sudden drop and economic concerns last week, Bitcoin has since rebounded. With potential large-scale selling ahead, Bitcoin could approach its key support areas on the weekly chart, which are close to the $70,000 mark.

Table of Contents

Bitcoin market movers and the Trump effect

The upcoming inauguration of President-elect Donald Trump on January 20 is a significant occasion that traders are closely monitoring. Trump’s influence extends to the realm of cryptocurrencies, as his appointments for positions like Securities and Exchange Commission Chair, AI & Crypto Czar suggest a pro-crypto stance, and there’s an expectation of favorable crypto regulations under his administration.

Over the last couple of weeks, I’ve noticed a strong correlation between the movements of Bitcoin (BTC) and U.S. economic developments. Given the high liquidity associated with BTC and other cryptocurrencies, it seems that macroeconomic updates play a significant role in determining their prices. In simpler terms, as an investor, I keep a close eye on global economic events to assess their potential impact on my crypto investments.

Initially, Bitcoin began the day slightly below the $94,000 mark. However, it managed to recover and peaked at $97,371 during the trading session today.

The newly elected President has made it known what he hopes to see from the Federal Reserve, and he’s also pledged to establish a strategic Bitcoin reserve for the United States. This proposal has sparked apprehension among crypto traders, as the central bank operates independently and the incoming President will not directly influence its decision-making process.

Senator Cynthia Lummis’ Bitcoin Act plans to create a U.S. Strategic Bitcoin Reserve, with the intention to acquire approximately 1,000,000 Bitcoins (around 4.76% of the total available supply) over the next five years, using U.S. dollars for debt financing.

Investors are closely monitoring how President-elect Trump might influence Bitcoin’s price movement as his inauguration approaches next week.

10X Research’s Bitcoin analysts express a degree of caution as they look towards President Trump’s term in office. They point out that current market forces appear to be lacking strength, suggesting that the price of Bitcoin may stay within a specific range up until mid-March.

Despite the waning post-election enthusiasm for cryptocurrencies, the crypto sector that contributed $238 million during the last election cycle has managed to put 298 pro-crypto representatives into Congress. It remains unclear if this relationship will be mutual and could potentially impact Bitcoin’s price over a longer period of time.

Institutional appetite for Bitcoin cools down, sentiment deteriorates

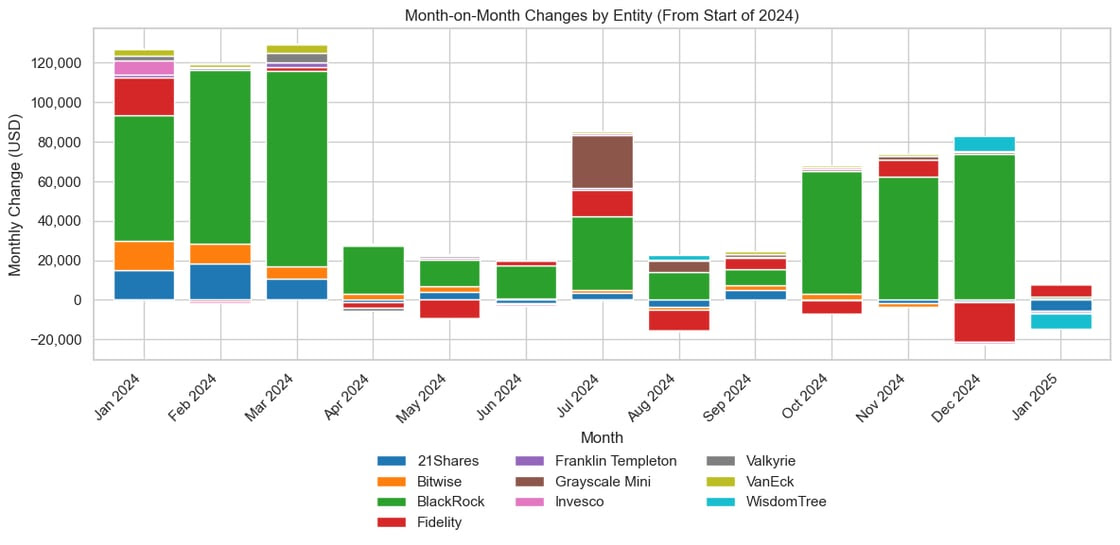

According to AmberData’s findings, institutional investors appear to be reducing their investments in U.S.-based Spot Bitcoin ETFs and may have halted further allocations due to the recent drop in Bitcoin prices. This action suggests that these institutional investors are adopting a more cautious approach towards investing, possibly due to perceived risks.

Bitcoin traders’ temporary hesitation may soon transform into renewed optimism as Bitcoin approaches its significant milestone of $100,000. With Bitcoin’s price holding steady above $95,000, it has the potential to influence the flow of investments into Spot Bitcoin Exchange-Traded Funds (ETFs).

As an analyst, I find it intriguing that consistent investments from industry giants like BlackRock could indicate renewed confidence, while persistent withdrawals by firms such as 21Shares and Franklin Templeton might strengthen a risk-averse narrative. Therefore, it is crucial to keep a close eye on ETF distribution patterns to forecast Bitcoin’s price fluctuations, so we can discern whether the asset will stabilize or push towards new price points in the upcoming weeks.

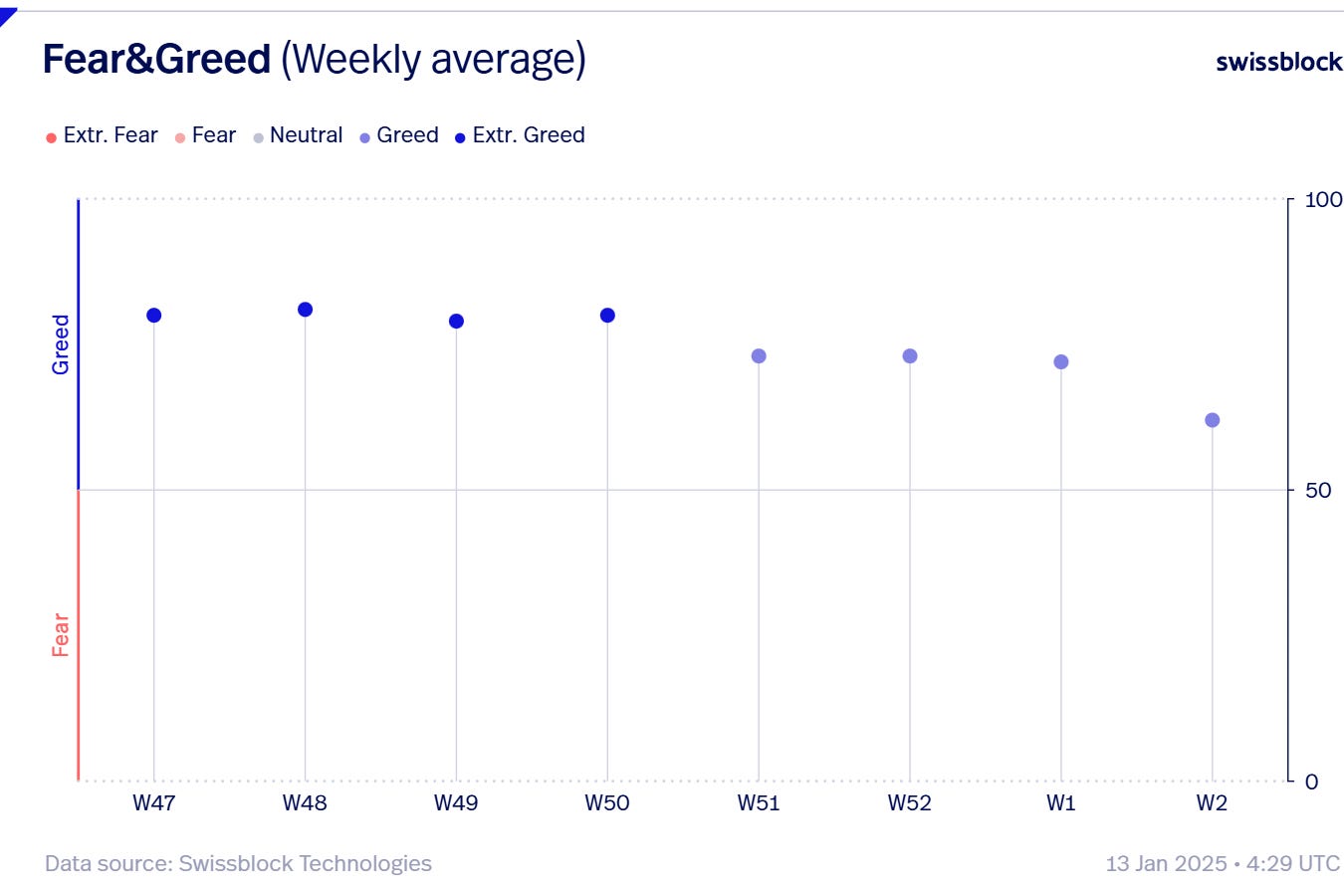

I, as a researcher, have analyzed data from Swissblock Insights that highlights a downward trend in Bitcoin (BTC) sentiment during the initial fortnight of January. As Bitcoin plummeted to its $90,000 lowest point, this development sparked apprehension among traders and consequently dipped the Fear and Greed Index.

Bitcoin on-chain and derivatives data analysis

In the last 24 hours, data from Coinglass indicates an increase in open interest and options trading volume. As derivatives traders prepare for potential further gains before Trump’s inauguration, swift changes in Bitcoin price might cause numerous long positions to be liquidated, potentially exposing traders to adverse effects on their investment portfolios.

The excessive optimism shown by derivatives traders, as indicated by the long/short ratio being greater than 1 on platforms such as Binance and OKX, could be due to anticipation of a crypto-friendly administration under President Trump.

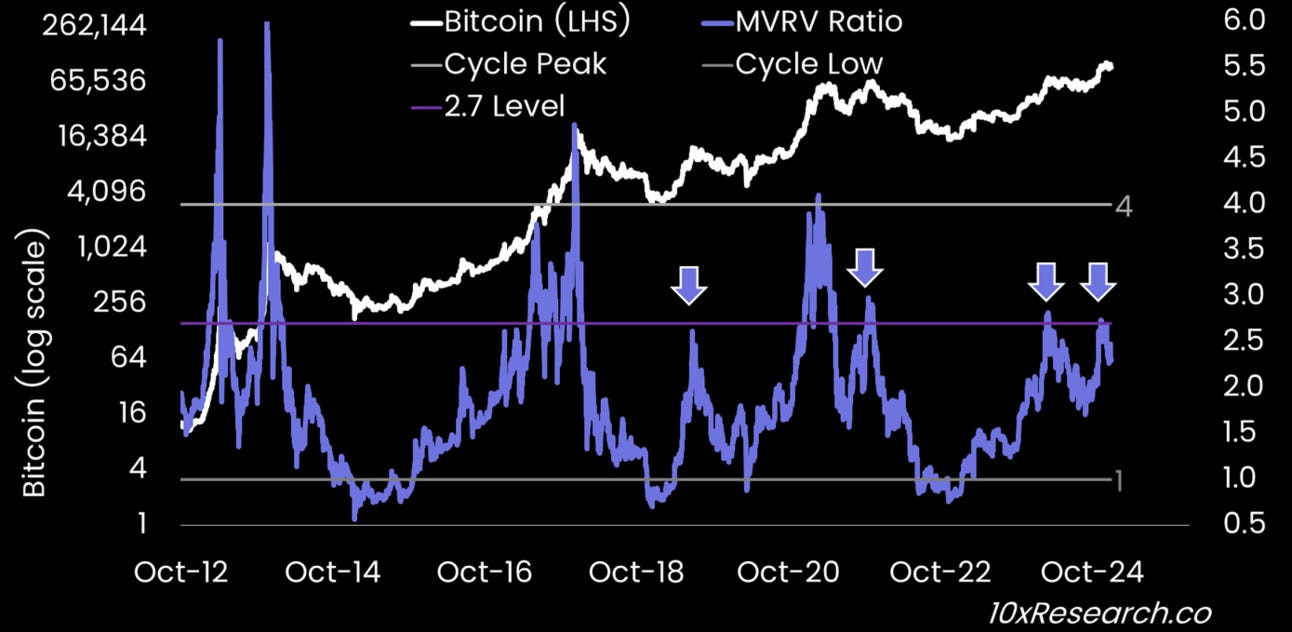

10X Research’s analysis of the Bitcoin log chart and Market Value to Realized Value (MVRV) ratio suggests that the token is approaching historical levels linked with “smart money” actions, such as those by large investors and institutions. Notably, the MVRV ratio has surpassed 2.7 times, a level often preceding profit-taking among BTC holders, as indicated in past occurrences.

historically, when the MVRV (Market Value to Realized Value) ratio reaches 4 or 6 times its usual value, it often signals a significant drop in Bitcoin’s market price.

If on-chain analysis is paired with a projected aggressive monetary policy by the Federal Reserve for an extended period, there’s a high likelihood that Bitcoin’s price could touch or even drop below the support levels of $76,000 and possibly $69,000, given that it might dip below the $70,000 threshold.

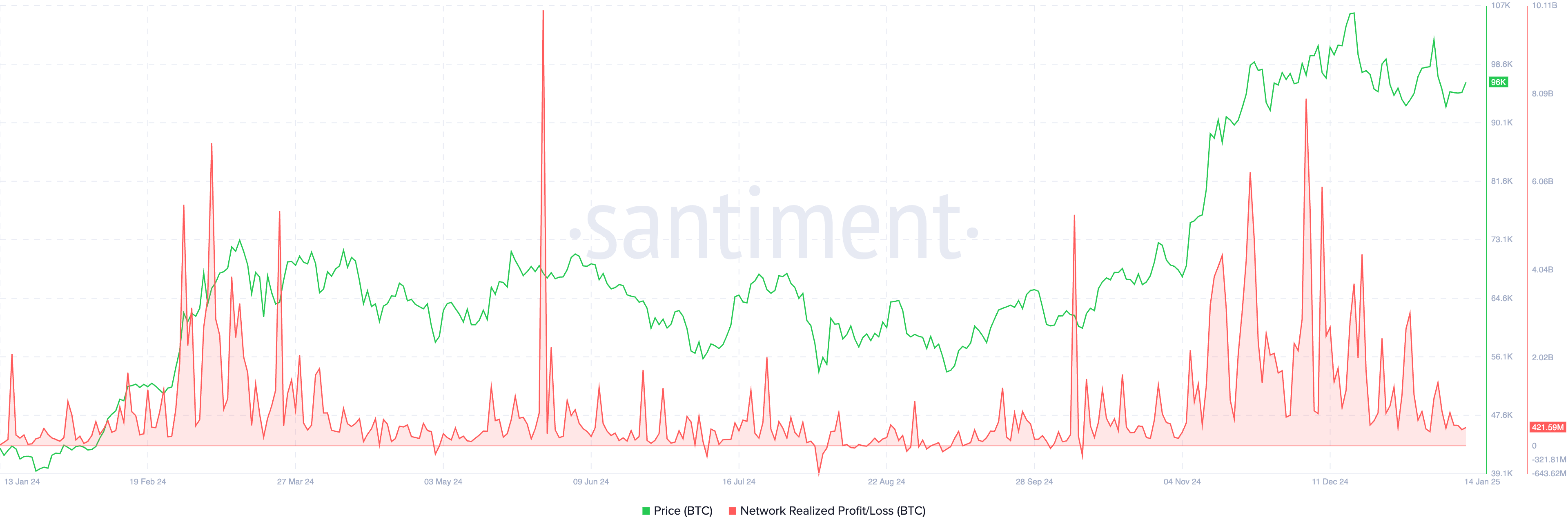

According to the Network, the profit/loss measurement aligned with the MVRV ratio and the worsening feelings among traders on Santiment nodes. Over prolonged durations, frequent instances of profit-taking have been linked to a downturn in the Bitcoin market price.

Expert commentary on where Bitcoin is headed

In a tweet regarding X, Keith Alan (co-founder of Material Indicators) issued a caution to crypto traders about a possible drop in Bitcoin’s 2021 peak price of $69,000. According to Alan, $86,000 represents a crucial support point, with $76,000 serving as the secondary backup.

If Bitcoin experiences a significant drop and can’t recover from the two designated safety nets, it might fall below the $70,000 mark.

I’ve been anticipating a more substantial correction, and there are signs it might be happening as we speak. However, I think there could still be another market surge related to Inauguration Day. It’s important to keep an eye on the situation to determine if it will serve as a catalyst for a bullish rally or simply a “sell-the-news” event.

I believe we might see a significant drop in prices soon, but there could also be another price increase around Inauguration Day. We need to watch closely to decide if it will lead to a market surge or just cause people to sell their stocks quickly.

— Keith Alan (@KAProductions) January 13, 2025

Sergei Gorev, head of risk, YouHodler, told Crypto.news in an exclusive interview:

The prices of cryptocurrencies are currently exhibiting a downward trend along with shrinking trade volumes in cryptocurrency markets. Traders find it challenging to predict the mid-term direction, as the situation is rapidly evolving.

Bitcoin’s prices have surpassed the resistance at $92,000, potentially causing a drop towards $73,000. This area is reinforced by the 200 Simple Moving Average (SMA), providing significant support at the moment.

Matteo Bottacini and his team from Crypto Finance observe that Bitcoin has swiftly rebounded after falling below $90,000. The initial significant level indicating an upward trend is $96,800, and currently, Bitcoin is maintaining its position above the support level at $92,000.

Technical analysis and Bitcoin price forecast

As an analyst, I’m observing that at present, Bitcoin appears to be stabilizing around the $96,600 mark. Upon examining the BTC/USDT daily price chart, it seems we’ve got two potential support zones or areas where Bitcoin might find stability. The first one is roughly between $81,500 and $85,072, while the second is positioned around $76,900 to $80,216.

The important line for Bitcoin price is around $70,000, which may act as a safety net if Bitcoin doesn’t recover after dipping below its two supporting regions and instead keeps falling.

As a researcher examining Bitcoin trends, I’ve observed that a potential 27% decrease from the current price might lead to a test of the $70,000 level as a potential support. This significant dip could undo all the gains Bitcoin has made since November 5, 2024, effectively erasing the post-election BTC rally.

As an analyst, I’m observing that the Moving Average Convergence Divergence (MACD) indicator for Bitcoin is displaying red bars below the neutral line, suggesting a negative momentum in the Bitcoin price trend. Additionally, the Relative Strength Index (RSI) is hovering around 51, which is quite close to the neutral level of 50. This could indicate a potential pause or reversal in the Bitcoin market dynamics.

Read More

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- Grimguard Tactics tier list – Ranking the main classes

- USD MXN PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

- Castle Duels tier list – Best Legendary and Epic cards

- Silver Rate Forecast

- Brent Oil Forecast

- USD CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

2025-01-15 15:10