As a researcher with a background in cryptocurrencies and blockchain technology, I have closely followed the developments surrounding Binance’s NFT marketplace and the Ordinals project. The news that Binance ended support for Ordinals on its platform came as a surprise, given Binance’s previous bullish stance on Bitcoin and its potential use cases for NFTs.

The data indicates that Binance‘s NFT marketplace didn’t attract many traders for Ordinals in the first place, as there’s been a noticeable shift in focus towards Runes among the trading community recently.

The announcement from Binance in April that they would no longer support Ordinals sparked surprise among Bitcoin community members.

As a crypto investor, I’ve noticed that the exchange has been dealing with some legal challenges lately. They recently announced that they are making changes to “simplify” their line of products in response to these challenges.

Anyone possessing Bitcoin NFTs was advised to transfer them to another wallet to ensure their continued eligibility for upcoming airdrops.

This represents a surprising shift for Binance, the largest cryptocurrency exchange by trading volume.

Last year marked the emergence of technology that made it feasible to use ordinals for inscriptions on a satoshi, which is equal to one hundred- millionth of a Bitcoin.

“Recently, multimedia content such as images, videos, and more can be linked to Bitcoins. However, detractors argue that this enhancement might congest Bitcoin’s blockchain.”

Only last May, Binance’s head of product Mayur Kamat said:

As a researcher exploring the dynamic world of cryptocurrencies, I’m captivated by Bitcoin’s pioneering role as the first digital coin to gain widespread recognition. The excitement is palpable; we’re at the very beginning of something groundbreaking, and I can hardly contain my anticipation for what lies ahead in this innovative field.

Mayur Kamat

So why the dramatic reversal — and will this serve as a crushing blow to the future of Ordinals?

How are Ordinals holding up?

As a crypto investor, I’ve come to terms with the fact that Binance has formally discontinued its support for Ordinal tokens as of April 18. Consequently, these tokens can no longer be transacted or traded on their NFT marketplace.

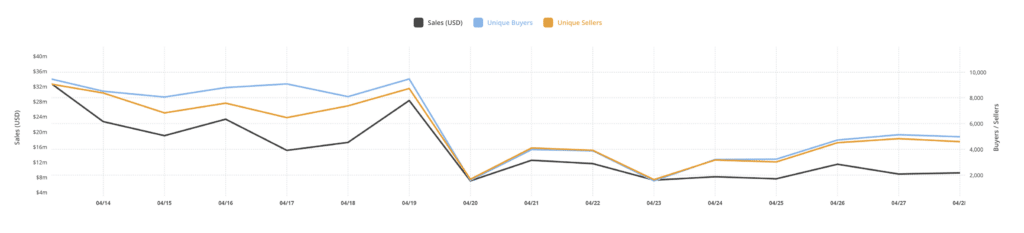

As an analyst examining data from CryptoSlam!, I’ve observed a significant decrease in both the sales volumes and the number of distinct buyers and sellers for Ordinals.

As a crypto investor, I’d interpret that report by saying: “On April 19th, the sales volume in the crypto market reached a total of $28.2 million. Among these transactions, there were 9,469 distinct buyers and 9,728 unique sellers involved.”

One week from now, on April 26, our revenues had dropped to $11.4 million. Simultaneously, the count of active buyers and sellers saw a significant decrease, with only 4,722 buyers and 4,515 sellers remaining.

Yet, it’s crucial to keep in mind that a correlation between two things doesn’t automatically mean one causes the other. Other influencing elements should also be taken into account.

As a bitcoin analyst, I’d like to point out that on April 19, we experienced the most recent Bitcoin halving event. This significant milestone led to a reduction in block rewards from 6.25 to 3.125 BTC per block. However, traders have been focusing their attention elsewhere in the market recently.

Additionally, the process of halving gave rise to the introduction of Runes. This innovation simplifies and streamlines the deployment of fungible tokens akin to ERC-20 on Ethereum within the Bitcoin network.

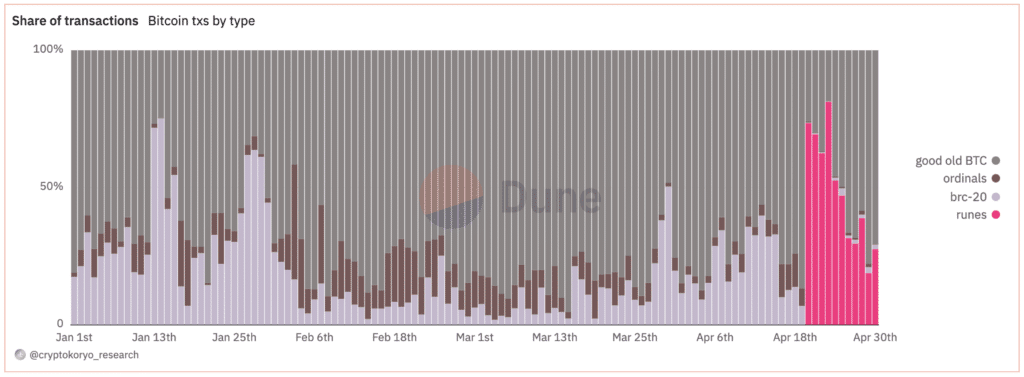

Data from Dune Analytics powerfully explains what happened during the second half of April:

On April 19, Ordinals had a 6.5% share of transactions on the Bitcoin blockchain.

The day after Runes were introduced, I observed that Ordinals accounted for only a 0.4% market share. However, the excitement for memecoins surged dramatically, causing demand to skyrocket.

As a crypto investor, I’d describe it like this: The vibrant hot pink bar in the graph signifies the significant portion of daily Runes transactions, reaching an astounding 73.5% during the coin’s launch.

Instead of placing all the blame on Binance, it’s important to consider that the decreasing interest in Ordinals may be due to Runes taking a significant portion of the demand.

What next for Ordinals?

Ordinal collectors are unlikely to be greatly concerned by Binance’s exit from the market given that the exchange has faced bans or severe restrictions in around 20 countries. Among these countries are Canada, China, Japan, Italy, Australia, the United Kingdom, and the United States.

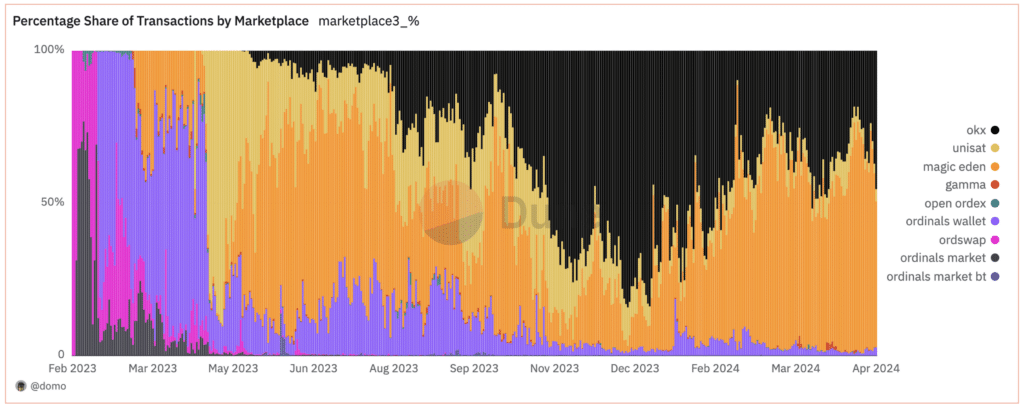

As an analyst, I’ve examined Dune Analytics’ latest data, and my findings suggest that Binance’s NFT platform didn’t experience significant traffic from Ordinal users.

On April 29, two marketplaces — OKX and Magic Eden — handled 94% of transactions between them.

Binance may be strategically investing its resources in areas that will help increase its market dominance.

The bigger question now is this: will Binance be rolling out support for Runes any time soon?

Binance hints at adding Rune to its platform, but previously took a lengthy time before listing BRC-20 tokens. However, once listed, the trading volume reached hundreds of millions of dollars, subsequently propelling Ordinalis (($ORDI)) to surpass a $1 billion valuation.— trevor.btc (@TO) April 22, 2024

With the escalating trading activity surrounding freshly minted memecoins on the Bitcoin blockchain, it’s only logical that Binance would seek to capitalize on this trend.

As a researcher studying the dynamics of the trading platform market, I’ve observed that in order to maintain competitiveness in terms of transaction fees, these platforms frequently explore methods for expanding their sources of income. This can involve introducing new services or offerings that cater to different user needs and preferences, thereby broadening their revenue base and reducing reliance on transaction fees alone.

The number of requests for ordinal rankings might have decreased lately, yet Bitcoin retains its position as the second-largest platform for NFT (Non-Fungible Token) sales volume. It significantly outperforms Solana in this regard. Notably, Ethereum has regained the lead in NFT sales volume.

If the demand for Bitcoin NFTs on Binance’s marketplace recovers, Binance’s decision to not support Ordinals might be regretted later on.

Read More

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Gold Rate Forecast

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-04-30 18:52