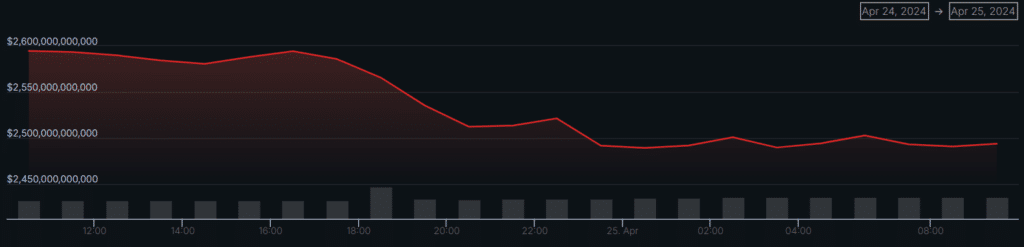

The world’s cryptocurrency markets experienced a significant drop, but according to Santiment’s data, most crypto tokens presently reside in a favorable investment range.

Based on information from CoinGecko, the overall value of the crypto market dropped by 4.1% within the last 24 hours and is now at approximately $2.49 trillion. In contrast, the daily trading volume experienced a rise of 16%, amounting to $99.1 billion.

The increased trading volume usually brings higher volatility to the market.

In addition, Bitcoin (BTC) and Ethereum (ETH), two of the most popular cryptocurrencies, saw declines of 3.5% and 2.6% respectively.

BTC is trading at $64,250 and ETH is hovering around $3,150 at the time of writing.

According to Farside Investors’ data, Bitcoin ETFs collectively saw an outflow of approximately $120.6 million in the previous day. Notably, the BlackRock IBIT Bitcoin ETF experienced no inflows for the first time since its launch in the US.

Additionally, the Grayscale Bitcoin Trust (GBTC) experienced a net withdrawal of approximately $130.4 million on April 24. This action could be contributing to the prevailing pessimistic attitude in the crypto market.

According to Santiment’s data, over 85% of the assets on their platform are currently situated in the potential growth area.

Based on our analysis, the average investor’s mid-term profits and losses suggest significant realized losses for most alternative coins based on their current market values versus the value of their previous transactions (MVRV). Over 85% of the assets we monitor are currently in a historically high opportunity zone when considering this ratio.

— Santiment (@santimentfeed) April 25, 2024

Based on the data from the market intelligence platform’s analysis, if we compare the current market values of assets to their realizations over the past one month, three months, and six months, these ratios have signaled a buying opportunity.

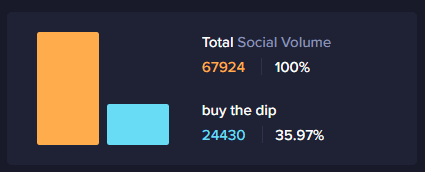

Despite the increasing apprehension among the crowd as a result of recent market dips, according to Santiment, “buy the dip” messages have surged in popularity on social media, comprising 35.97% of all crypto-related discussions.

According to Santiment’s analysis, a significant proportion of social engagement originates from Reddit and X, whereas Telegram and Bitcointalk contribute less.

Read More

- USD MXN PREDICTION

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- USD JPY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD CNY PREDICTION

- Brent Oil Forecast

- Gold Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-04-25 10:04