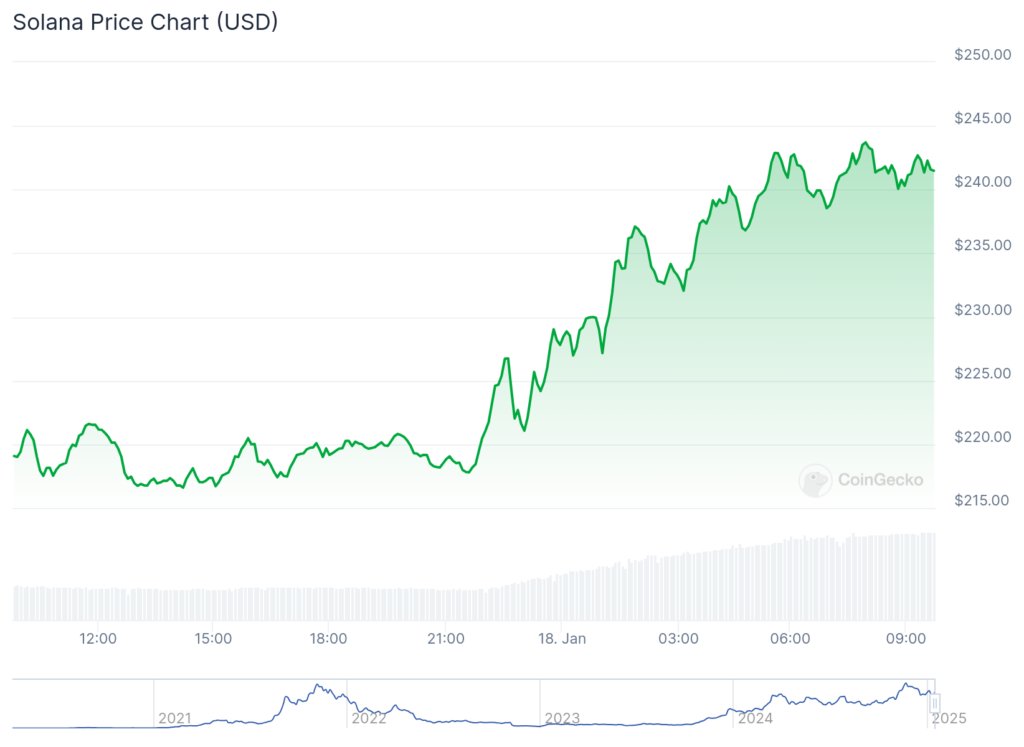

In the past five days, the price of Solana has picked up speed again and hit a new high not seen since December 6th.

On Saturday, Solana (SOL) reached a peak of $245, marking a 42% increase from its lowest point this month. This surge in value elevated its market capitalization to an impressive $117 billion. As a result, Solana now ranks fifth among all cryptocurrencies, following Bitcoin, Ethereum, Ripple, and Tether.

Here are some top reasons why SOL spiked and why that rally will likely continue.

Solana’s ecosystem growth

As a researcher, I’ve observed an upward trend in Solana’s performance, largely due to the expansion of its ecosystem. Notably, the market capitalization of its meme coins has surged beyond the impressive figure of $22 billion. Moreover, the Official Trump (TRUMP) project, introduced by President-elect Donald Trump on January 17, currently boasts a valuation of approximately $4.4 billion.

Additionally, among the well-known meme coins in the same environment are Bonk (Bonk), Dogwhisker (Dogwifhat), and Plump Penguins (Pudgy Penguins).

Solana is equally significant in the realm of non-fungible tokens (NFTs). As reported by CryptoSlam, Solana’s NFT sales amounted to more than $81 million within the past month, placing it as the third-largest player following Ethereum and Bitcoin.

As a crypto investor, I’m excited about Solana’s potential for growth due to its lightning-fast transaction speeds, affordable costs, and booming Decentralized Exchange (DEX) networks. Interestingly, statistics reveal that Solana’s DEX networks processed an impressive $32.2 billion over the past week, surpassing Ethereum’s $9.2 billion. This trend suggests a promising future for Solana in the crypto market.

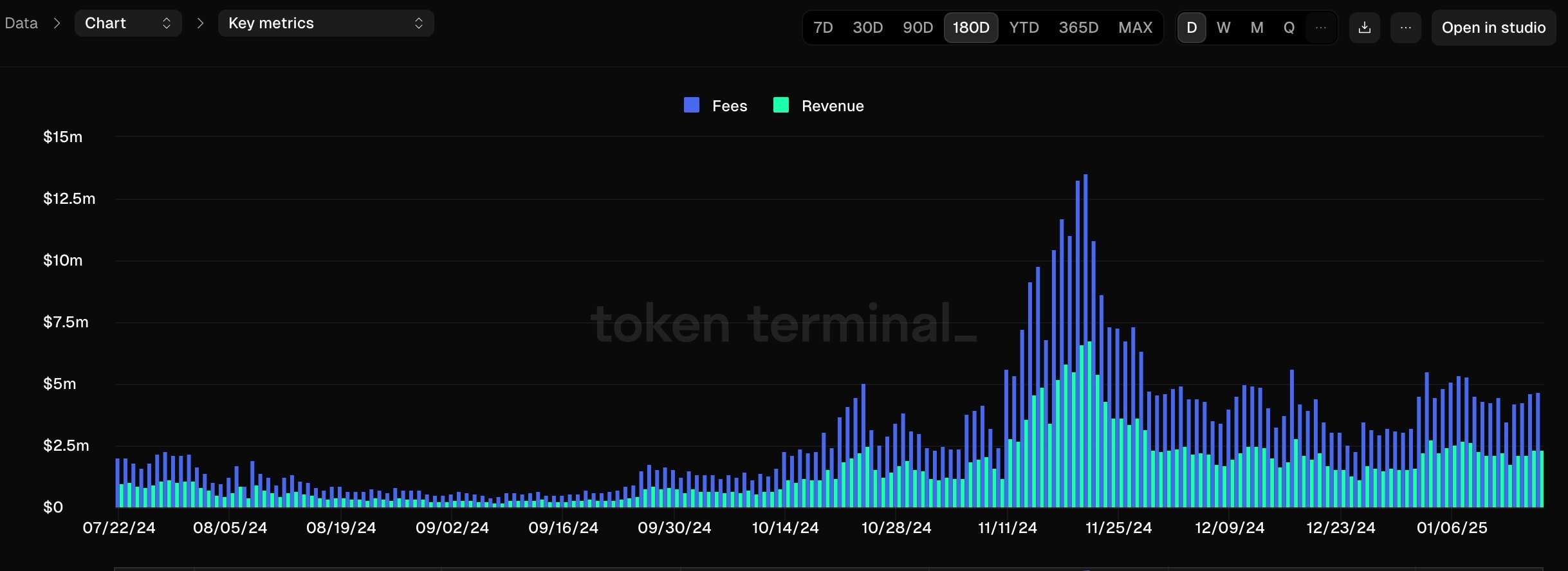

Due to this expansion, network fees have significantly increased, amounting to approximately $820 million over the past 365 days and $77 million so far in the current year. A portion of these charges are distributed to Solana stakers, who currently enjoy a return of around 7%.

SOL ETF hopes are steady

The cost of Solana has surged as well, with investors hopeful about the prospect of an ETF getting approved by the Securities and Exchange Commission. According to a Polymarket survey, there’s a 77% likelihood of this happening, suggesting that the commission led by Paul Atkins might be more inclined to grant approval.

An Exchange-Traded Fund (ETF) based on Solana could generate increased interest from institutional investors due to its nature. If this ETF allows for token staking, the demand might even escalate further. In a recent report, JPMorgan predicts that such an ETF could draw investments between $3 billion and $6 billion within the first year.

Solana price technicals are supportive

Based on the day-to-day graph, it’s apparent that the SOL token recovered following the formation of a double-bottom pattern at $175.42. Now, it has surpassed the pattern’s neckline at $222.95 – marking its highest peak seen on January 6th.

Solana, established in 2020 by engineer Anatoly Yakovenko, continues to hover above a rising trendline that links its lowest points since January 23 of last year. It has consistently stayed above its 50-day moving average, and the Relative Strength Index shows an upward shift.

Given this trend, it’s expected that the Solana price will probably keep increasing. This prediction would be reinforced if the token manages to break through the significant barrier at approximately $264.15, a level it reached in 2024, marking its highest point during that year.

Solana up until now

As an analyst, I envisioned the creation of a blockchain that could handle millions of transactions per second, addressing concerns about slow transaction speeds and high fees often criticized in Ethereum. This network is engineered to sustain decentralized applications (dApps) and cryptocurrency transactions.

Solana touts faster transaction processing and a higher throughput than many of its competitors.

Following its mainnet debut in 2020, Solana garnered significant interest due to its fast transaction speed and low costs, drawing in both developers and investors. Throughout the year 2021, the network expanded substantially, hosting a variety of decentralized finance (DeFi) projects and non-fungible tokens on its system.

Solana, supported by prominent venture capitalists such as Andreessen Horowitz, is consistently advancing at a fast pace by providing efficient blockchain technologies within the rapidly expanding cryptocurrency sector.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2025-01-18 18:32