So, here we are in the United States, where policymakers have been studying, debating, and issuing reports on whether the Federal Reserve Bank should create a central bank digital currency—a “digital dollar.” Spoiler alert: they still haven’t decided! It’s like watching a soap opera, but with fewer plot twists and more spreadsheets. 📊

CBDCs, or Central Bank Digital Currencies, are basically the digital versions of our beloved paper money, but with a government stamp of approval. They’re supposed to promote economic inclusion and give everyone access to financial services—because who doesn’t want to pay their bills with a fancy token? 💸 They’re like the cool kids in the payment system playground, improving monetary policy while cash is slowly being pushed to the sidelines. But let’s be real, they also help keep the financial chaos at bay, especially with all those meme coins floating around. 🐶

Now, there are two types of CBDCs: retail and wholesale. Retail is for the everyday Joe, while wholesale is for the big boys in interbank payments. Think of it as the difference between buying a candy bar and buying a whole candy store. 🍬

Vivek Raman, the CEO of Etherealize.io, told me, “We don’t believe a CBDC will happen in the US under the new administration. A CBDC goes against the principles of decentralization and freedom, and it is better to have a marketplace of stablecoins and tokenized assets.” Sounds like someone’s been reading too many conspiracy theories! 🤔

The US CBDC Ban

On January 16, President Trump’s Treasury nominee, Scott Bessent, who has since been confirmed as the 79th Secretary of the Treasury, testified before the Senate Finance Committee. He was like, “I see no reason for the US to have a CBDC,” citing privacy and economic concerns. Well, that’s one way to kill the party! 🎉

Then, on January 23, Trump signed an executive order officially banning CBDCs in the US. Rhett Shipp, CEO of Avant, chimed in, “In my opinion, CBDC would end up hurting the US since it would reduce USD utility by increasing censorability and reducing privacy. Embracing stablecoins is the better path.” So, basically, let’s stick to our good old dollars and avoid the digital drama! 🙄

CBDC Development Around the World

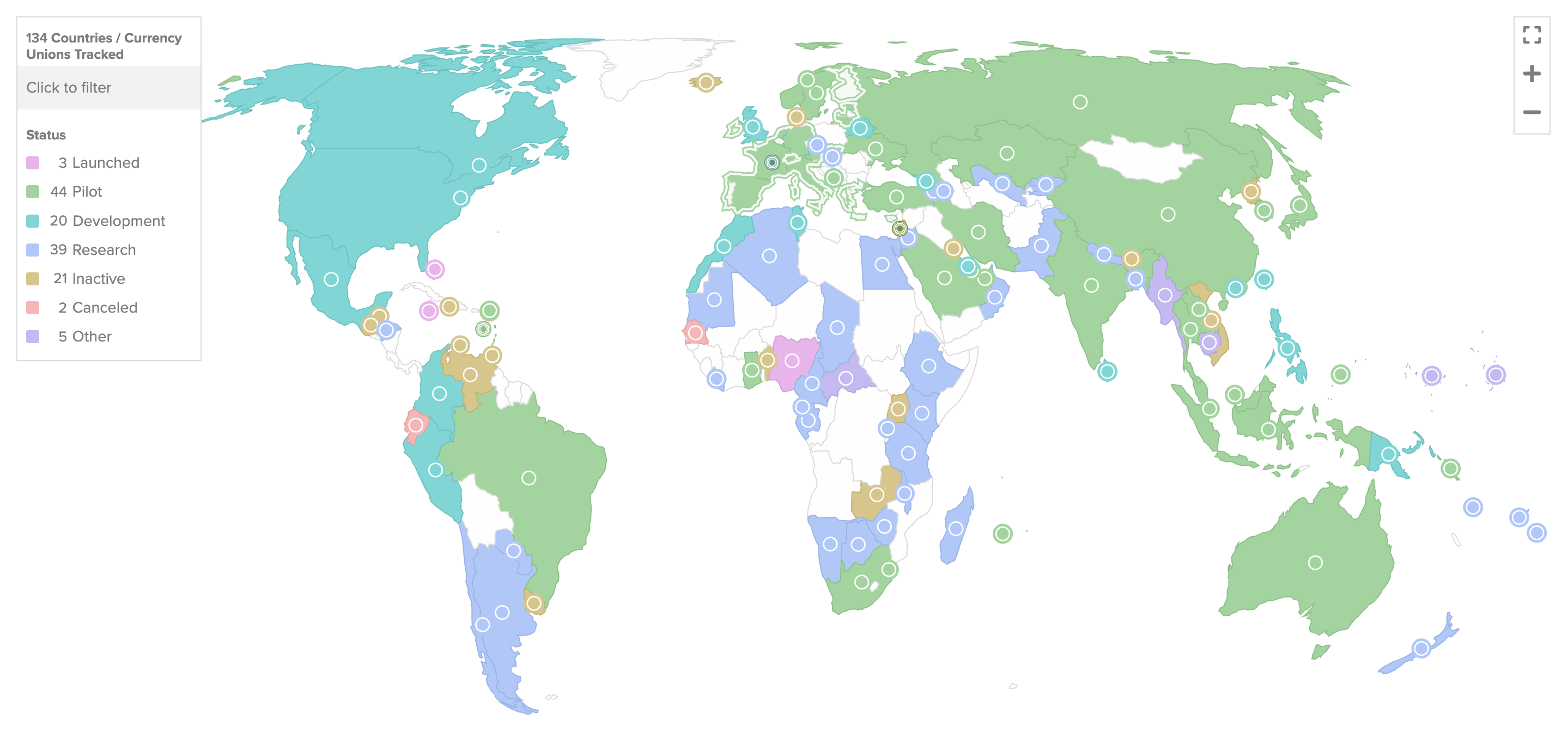

Meanwhile, the rest of the world is moving on without us. The Atlantic Council’s tracker shows that 66 countries are exploring CBDCs, with China leading the charge. Only three countries—Nigeria, Jamaica, and the Bahamas—have actually issued them. Talk about a slow dance! 💃

These countries are working on coordinated legislation to regulate CBDCs, while the IMF points out that the whole CBDC ecosystem is facing cybersecurity challenges. It’s like trying to build a sandcastle while the tide is coming in! 🌊

World’s Most Used CBDC—The e-CNY

China is strutting its stuff with the e-CNY, which has 260 million wallet users. They’ve done transactions totaling 7 trillion yuan ($982 billion). That’s nearly four times what they had last year! Talk about a glow-up! 💥

But wait, there’s more! The e-CNY is being used for everything from public transport to tax payments. It’s like the Swiss Army knife of currencies! 🛠️

And while the US is busy banning CBDCs, central banks in Asia and the Pacific are already piloting their own. Kanni Wignaraja from the UN said, “In Asia and the Pacific, central banks are already piloting CBDCs.” So, while we’re stuck in neutral, they’re zooming ahead! 🚀

Yifan He, founder of Red Date Technology, said that Trump’s ban will impact retail CBDC projects for the next four years. But he doesn’t think any country will develop a real retail CBDC in the next decade. So, we’re basically in a digital currency limbo! ⏳

Red Date Technology is leading the charge with two companies focused on global CBDC pilot programs. They’re like the Avengers of the digital currency world! 🦸♂️

- China’s Blockchain-Based Service Network (BSN) connects different payment networks.

- The Universal

Read More

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- USD JPY PREDICTION

- USD CNY PREDICTION

- Brent Oil Forecast

- Pi Network (PI) Price Prediction for 2025

- How to Watch 2025 NBA Draft Live Online Without Cable

- Silver Rate Forecast

- Gold Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

2025-03-09 15:21