As a seasoned crypto investor with battle-tested nerves, I’ve seen my fair share of market ups and downs. The recent performance of dogwifhat (WIF) has piqued my interest due to its unique pattern. Despite the 24% price rally, WIF is still grappling with a 40.6% decline over the past week, trading at $1.42 with a market cap of $1.417 billion.

As a new entrant in the meme coin market, I’ve noticed a significant drop in the open interest of Dogewhatch (DOGW) recently, coinciding with heightened price volatility.

Despite a 24% surge in the past day, the data indicates that DogWhatever (WIF) has dropped by 40.6% over the last seven days. At the moment of writing, WIF is being traded at $1.42 and holds a market capitalization of approximately $1.417 billion.

On August 5th, the meme coin dropped down to a five-month minimum of $1.08, reflecting a period of market instability and doubt.

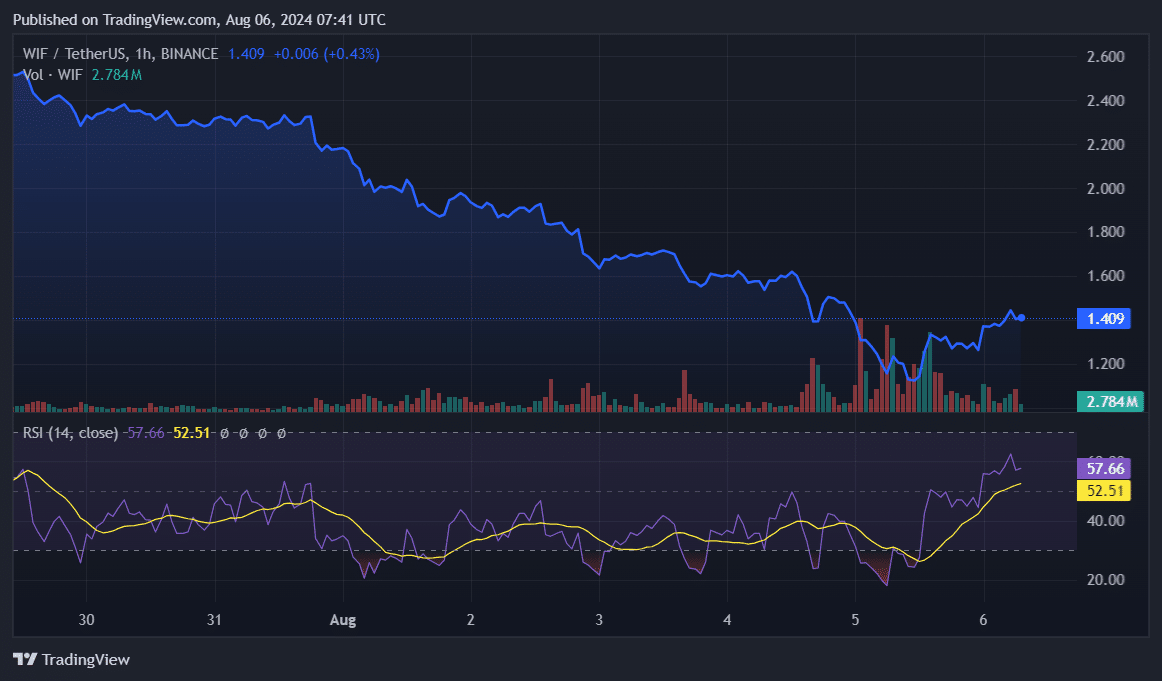

Over the past day, the Relative Strength Index (RSI) of WIF significantly increased, moving from a low in the oversold zone (26) to the neutral zone (52), following the recent price rise.

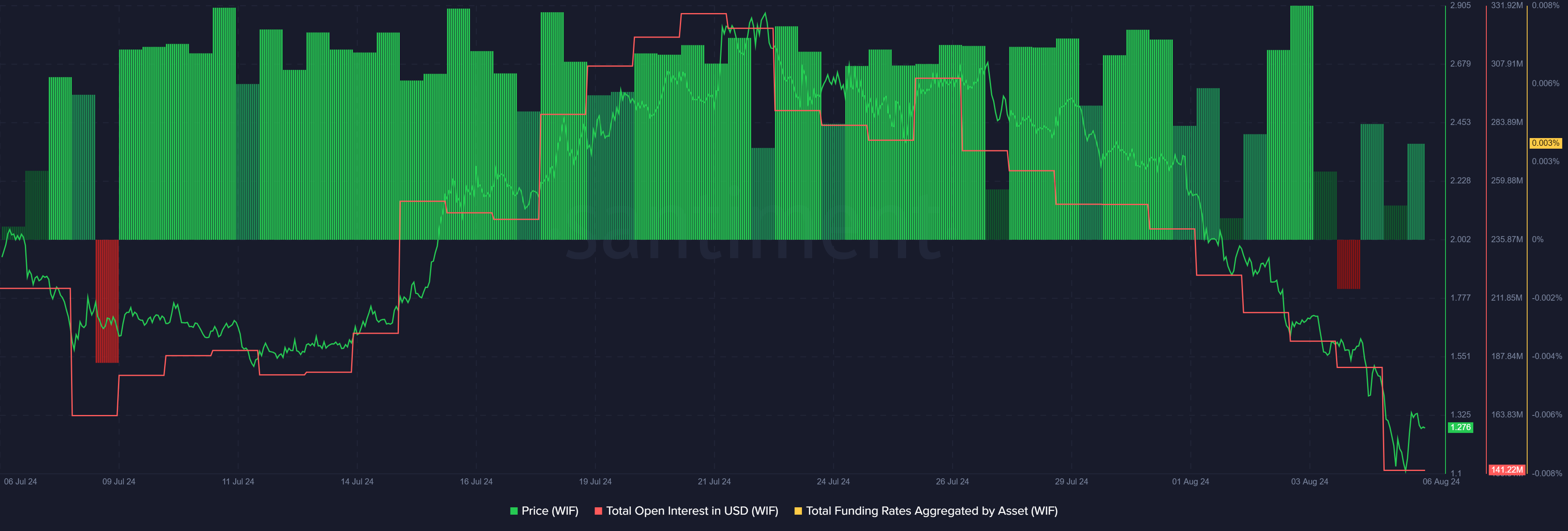

Based on information from Santiment, the total open interest of WIF has decreased from approximately $183.4 million to $141.2 million within the last two days. This low figure was last observed in March.

Reduced open interest in the meme coin suggests that traders are adopting a less risky strategy, given the broader market instability. Consequently, this could mean decreased price swings as fewer forced sales (liquidations) may occur.

As an analyst, I’ve observed a significant increase in the funding rate related to WIF across all exchanges. Over the past 24 hours, this rate has climbed from 0.001% to 0.003%. This trend suggests that traders are positioning themselves for a potential price surge of WIF.

As a crypto investor, I’ve noticed some promising technical and on-chain signals, but I always keep in mind that significant global economic shifts can alter the trajectory of the cryptocurrency market. So, while I’m optimistic about the current trends, I remain vigilant and prepared for any unexpected changes that might stem from macroeconomic events.

As an analyst, I found one significant factor contributing to the widespread market decline on August 4 was the escalating geopolitical tensions between Iran and Israel, coupled with anticipation of a possible conflict.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- USD CNY PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-08-06 12:06